The Failure of Tenaga Nasional Berhad acquiring UK renewable energy assets by paying RM 14billion in cash

investingiscommonsen

Publish date: Tue, 31 Oct 2023, 10:31 PM

Hi, I am investingiscommonsense. I am going to discuss with you about Tenaga Nasional Berhad, especially the failure of Tenaga Nasional Berhad acquiring UK renewable energy assets by paying RM14bilion in cash.

Tenaga Nasional Berhad is a monopoly in transmitting and distributing all of the electricity used in Malaysia, serving 33million Malaysians. Theoretically and Practicality Tenaga Nasional Berhad owned by everyone of us , Malaysians because sovereign wealth funds owned around 70% shareholding in Tenaga Nasional Berhad. Sovereign wealth fund is a government owned investment fund. Who is the boss of government? We, Malaysians are the boss of the Malaysian government. As at 31 December 2022, Khazanah Nasional Berhad had a 25.5% of shareholding. Other government-related agencies cumulatively held 43.2%, with Permodalan Nasional Berhad at 18.3%,the Employees Provident Fund at 15.8%, Kumpulan Wang Persaraan at 7.3% and others at 1.8%. It is also the largest power generator with the market share of 66% as at June 2023. Tenaga Nasional Berhad is using fossil fuel sources to generate electricity, predominantly gas and coal.In 2022, coal accounted for 41.8%, followed by gas at 34.4%, hydro at 17.8%, solar wind and biomass at 4.6%, oil and mini hydro at 1.4%

To avert the worst impacts of climate change and preserve a livable planet, global temperature increase needs to be limited to 1.5°C above pre-industrial levels. Currently, the Earth is already about 1.1°C warmer than it was in the late 1800s, and emissions continue to rise. To keep global warming to no more than 1.5°C ,carbon emissions need to be reduced by 45% by 2030 and reach net zero by 2050. What are the consequences of exceeding the target of 1.5 degrees? Extreme flooding, wildfires and food shortages and others. Malaysia is a member of the global village and aims to achieve its net zero carbon emission by 2050 under Twelfth Malaysia Plan 2021-2025. As a corporate citizen, Tenaga Nasional Berhad is growing its RE portfolio in existing as well as adjacent markets across Asia Pacific and Europe. It aims to achieve the overall target of 8,300MW of RE capacity by 2025 and over 14 GW of RE capacity by 2050.

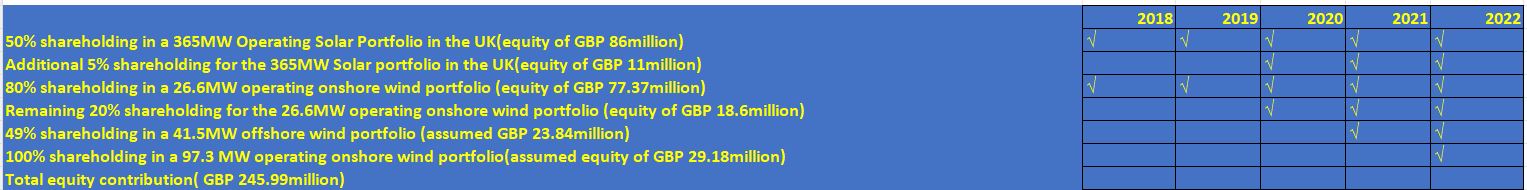

In 2017,Tenaga Nasional Berhad ventured into the Europe’s renewable energy market by acquiring of a 50% interest in one of the UK's largest portfolios of operating solar power assets, with a combined capacity of 365 MW. The transaction was valued at an enterprise value of GBP 470million and an equity value of around GBP 86 million, the shareholding increased to 55% by contributing GBP11million equity. In 2018, Tenaga Nasional Berhad acquired other renewable energy assets by purchasing a 80% stake in 2 operational onshore wind portfolios with an equity value of GBP77.37million, in 2020 the shareholding increased to 100% by contributing GBP18.6million in cash. In 2021, Tenaga Nasional Bhd (TNB) has acquired a 49% stake in Blyth Offshore Demonstrator Ltd (BODL), an offshore wind farm company in the UK with an enterprise value of GBP119.2million. If we assume 20% of the transaction was financed by cash, Tenaga Nasional Berhad contributed GBP 23.84milion equity.The assets include five turbines with a total installed capacity of 41.5MW (Blyth 1) and further development rights for a floating offshore wind project of up to 58.4MW (Blyth 2) located off the Northumberland coast. In 2022, Tenaga acquired a 97.3 MW operating onshore wind portfolio in the UK on 1 April 2022 with an enterprise value of GBP145.9 million. If we assume 20% of this transaction was financed by cash, the company contributed GBP 29.18million equity. The total equity contribution by Tenaga Nasional Berhad amounting to GBP 245.99million or around RM14.37billion at the exchange rate of 5.84ringgit per Pound at 24 Oct 2023 。All these assets are parked under Vantage RE ltd.

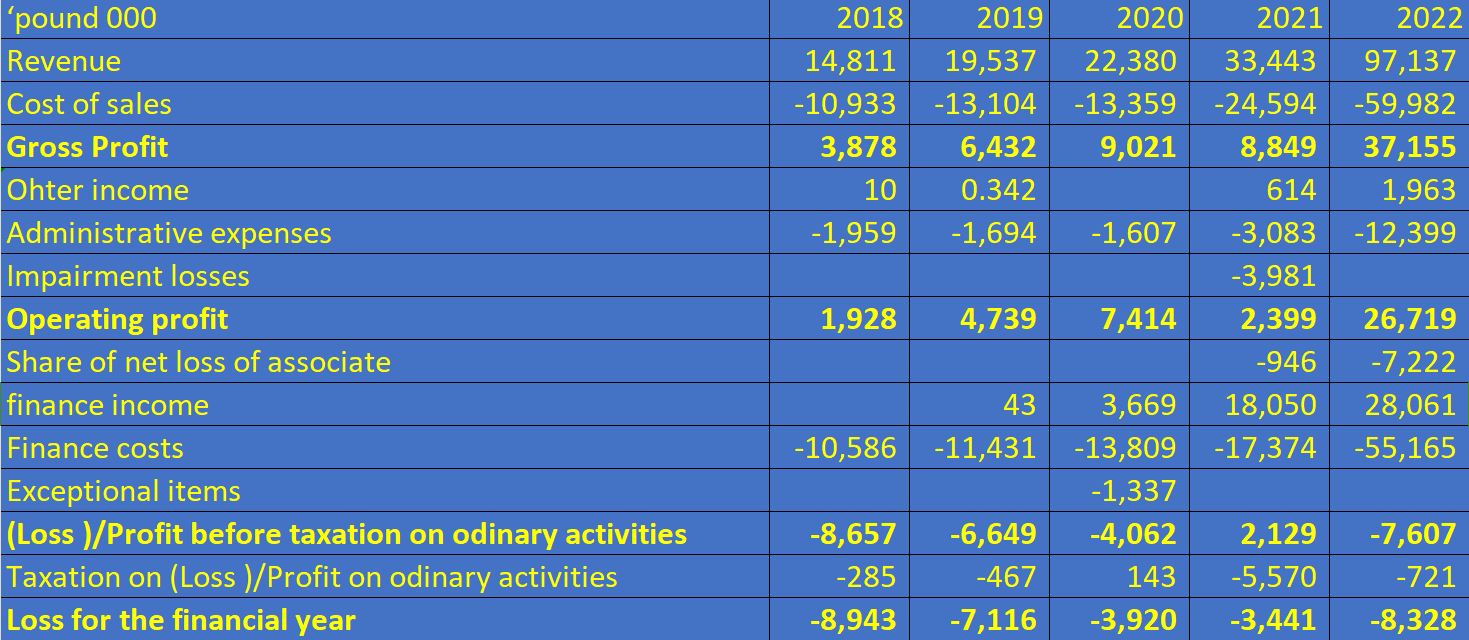

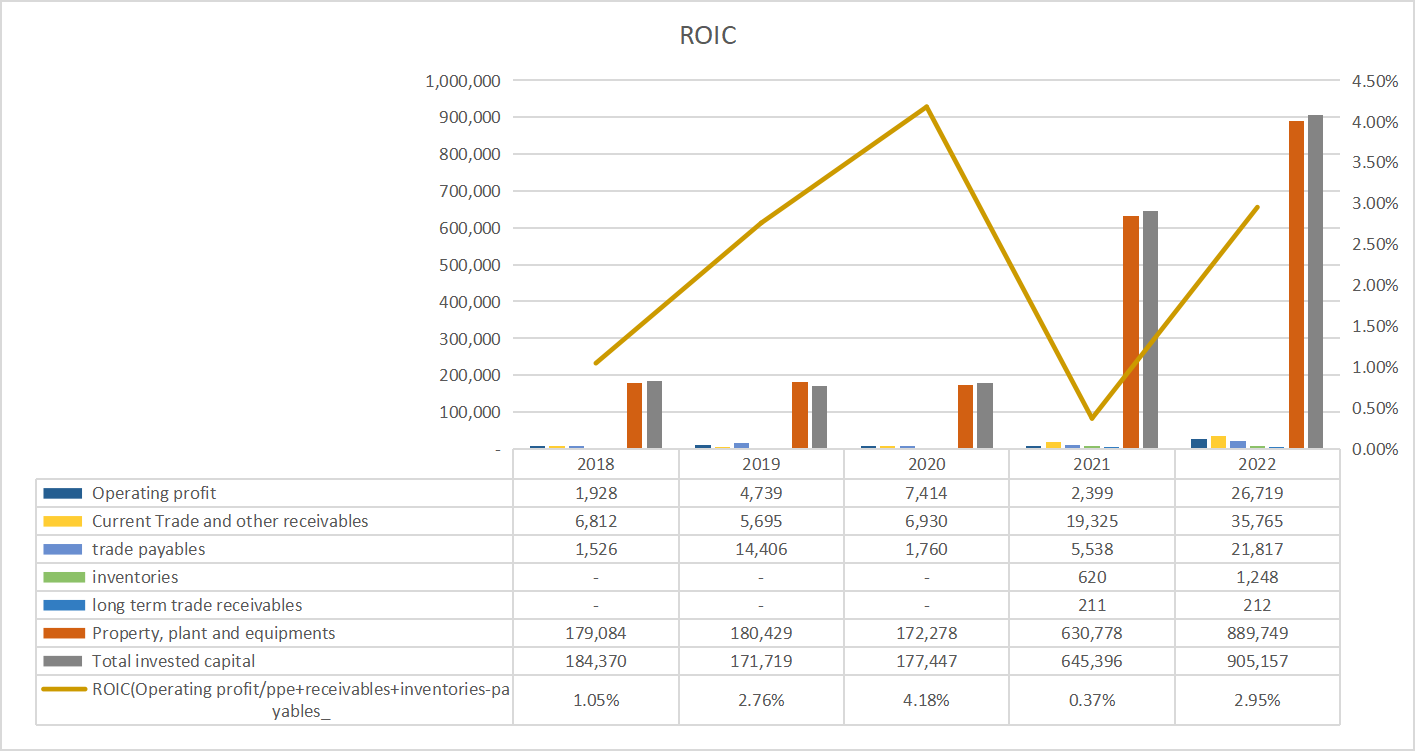

I don’t see any dividend paid by Vantage RE ltd to Tenaga Nasional Berhad in the 5 year period from 2018 to 2022 . Can I ask you, Tenaga Nasional Berhad, do you recoup any investment return from the GBP245.99million equity investment or you use the cash flows from operating activities for other purposes , like further expanding the business? Secondly, the investment assets are not performing well using return on invested capital measurement. The 5 year period financial statement from 2018 to 2022 shows that Vantage RE Ltd incurred net losses for these financial years owing to high cost of sales and finance costs. On average, cost of sales and finance costs account for 67% and 60% of revenue respectively, therefore the company were making losses. For example, in 2018, the company’s cost of sales and finance cost were GBP10.93milion and GBP10.57million compared with revenue of GBP14.8million, resulting in net loss of GBP8.9million.

If you use the return on invested capital to judge the performance of the investment activities carried out by the company, they are not performing well. I define return on invested capital by dividing operating profit by invested capital. Invested capital is defined as property , plant and equipment+ net working capital( account receivables+ inventories- account payables).The number ranged from 0.37% and 4.18%. what is the meaning of 4.18%? It means that the company only earns a 4.18% return on the investment activities in the UK. What is today Fixed Deposit rate? Around 3%? Fixed Deposit is risk free, that means the return is guaranteed. Tenanga Nasional Berhad needs to bear the risk like underperformance of the renewable energy assets such as low electricity outputs due to volatile weathers and force majeure events like infrastructure failures. However, in order to have more accurate details on the investment performance generated by the renewable energy assets in the UK, we can use IRR to determine the investment result of each asset. Currently, I do not have the details on each asset, and hence I cannot build the financial model to determine the result. If anyone is from Tenaga Nasional Berhad, I hope you can share with us the electricity output, tariff, operation and maintenance, tax rate, debt to equity ratio, loan tenure, loan repayment moratorium period, duration of the REPPA of each investment activity in the UK that you carried out, therefore we can have a clear understanding on the investment performance.

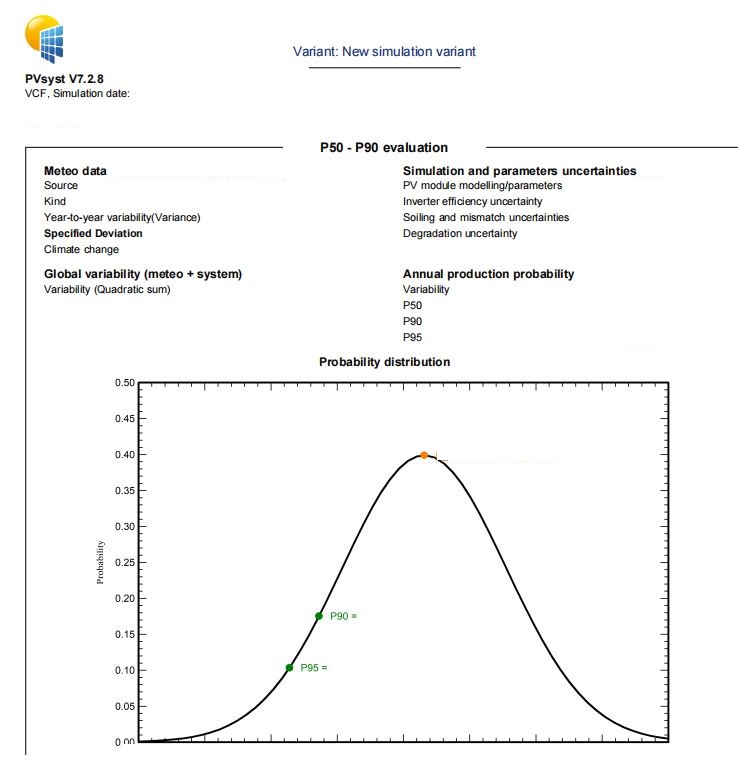

For my audience understanding, when it comes to due diligence, the process is lengthy. You need to have technical reports like pvsyst report to determine the electricity output, normally there is probability of electricity output in the pvsyst report.

For example, P50, P90,P95 in the pvsyst report. P50 means 50% chance the electricity output will be produced in this amount.

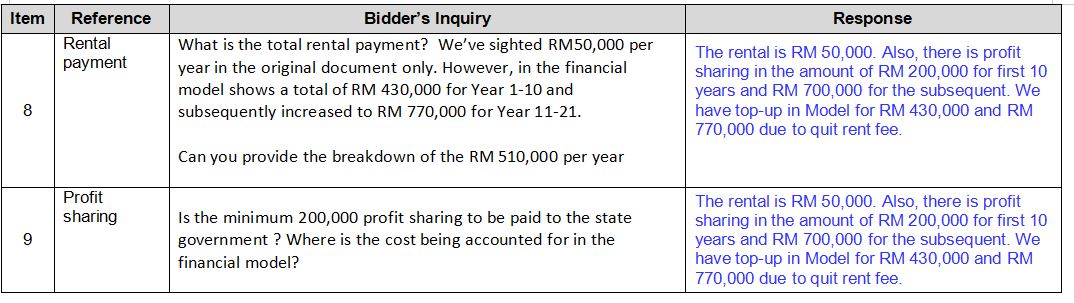

If there is any doubt, you need to ask questions to the counterparty. For each due diligence, I could ask more than 100 questions for clarifications when I was working as a financial analyst. In the following example , you can see that I asked about rental payment and profit sharing to the state government. The answer was “The rental is RM 50,000. Also, there is profit sharing in the amount of RM 200,000 for first 10 years and RM 700,000 for the subsequent. We have top-up in Model for RM 430,000 and RM 770,000 due to quit rent fee.”

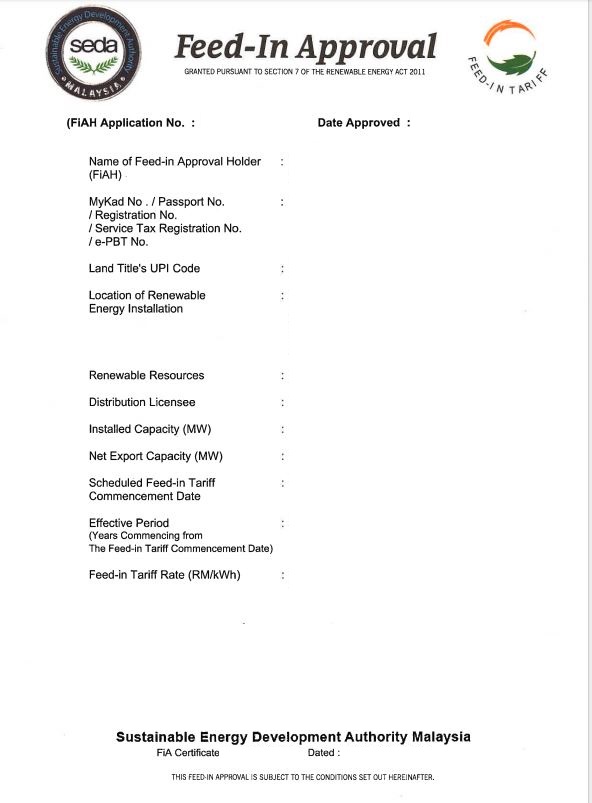

You can see REPPA(renewable energy power purchase agreement) which contains tariff, duration of the agreement, installed capacity ,export capacity, name of the holders.

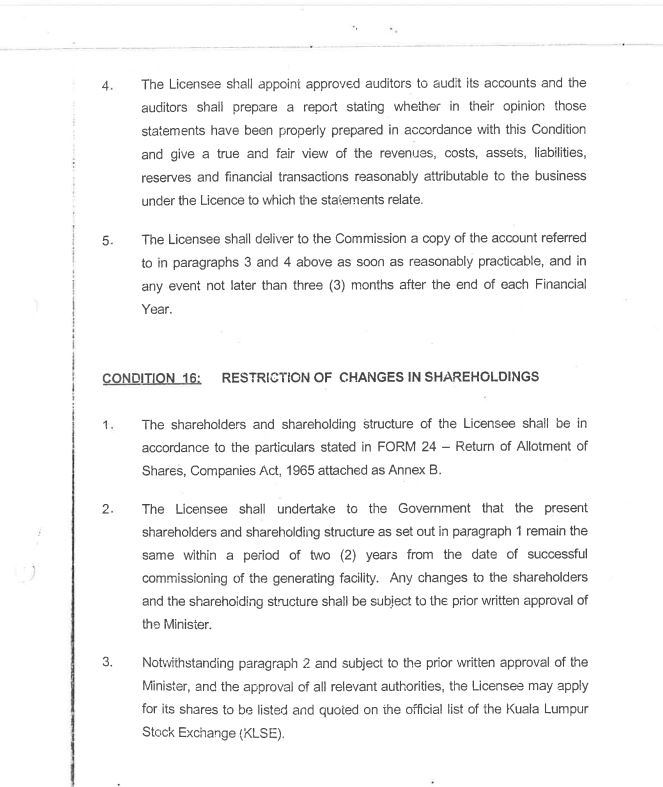

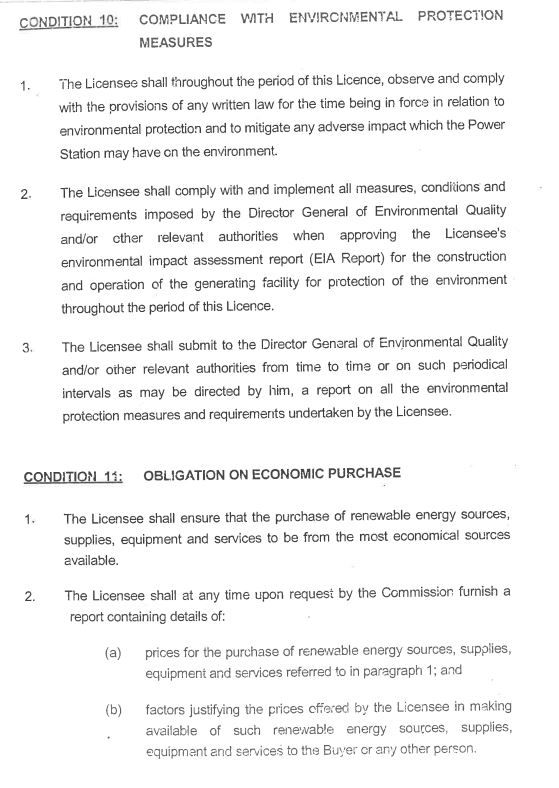

You also need to apply licenses from Energy commission with the terms and conditions. The licensee needs to protect the environment, to have the EIA(Environmental Impact Assessment) report, to buy the resources at the most economical way, the shareholding structure will be the same in the first 2 years after COD( commercial operation date), and any change in shareholding structure requires the approval from the Ministry.

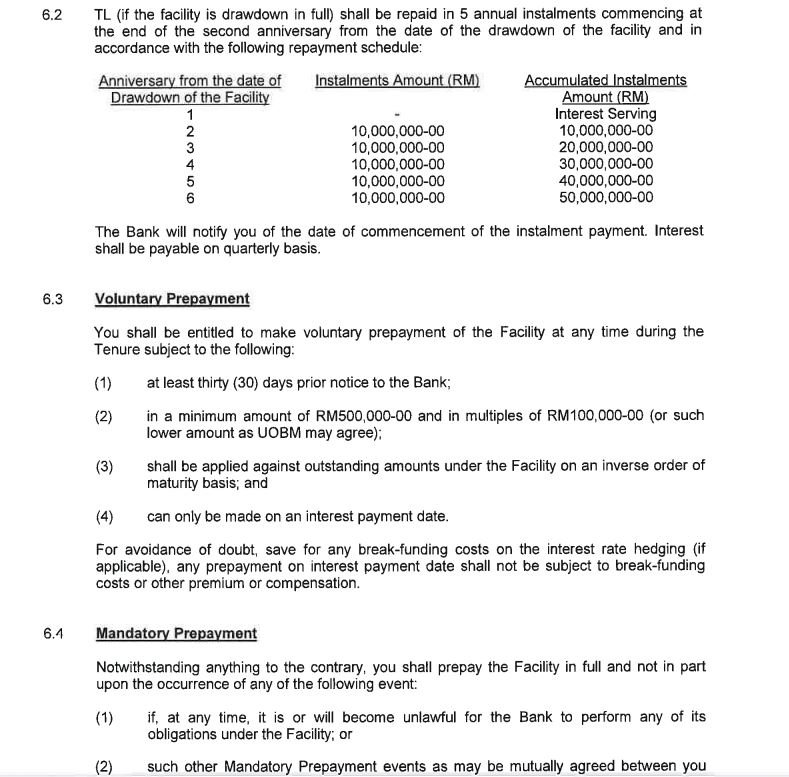

The terms and conditions of the loan are different for each project. For the following example, there is a principal moratorium period of 1 year but interest has to be paid in the beginning. In the end of the second year the principal repayment is RM10,000,000 for each year until RM50,000,000 has to be fully settled. IRR or Internal Rate of Return is indicating the annualized return of an investment project with the expected future cash flows.

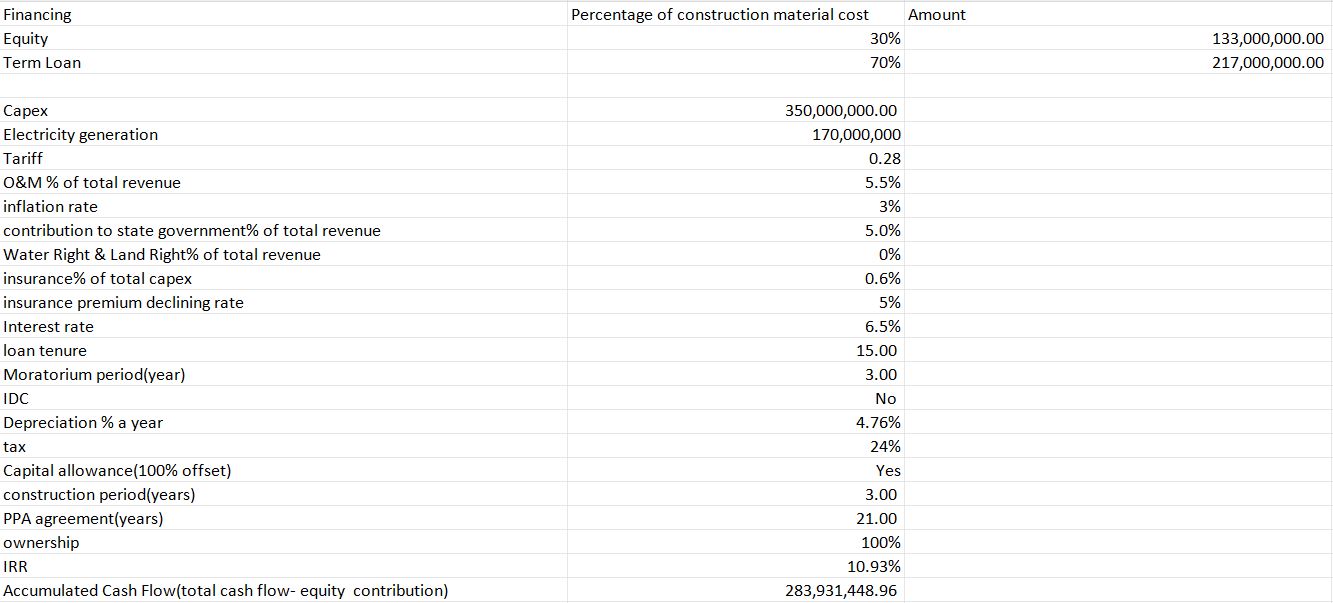

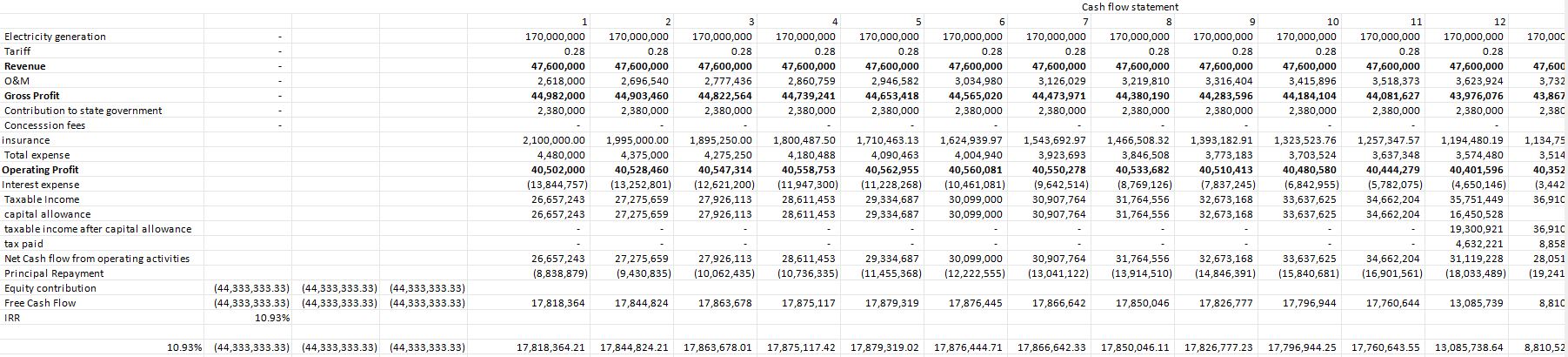

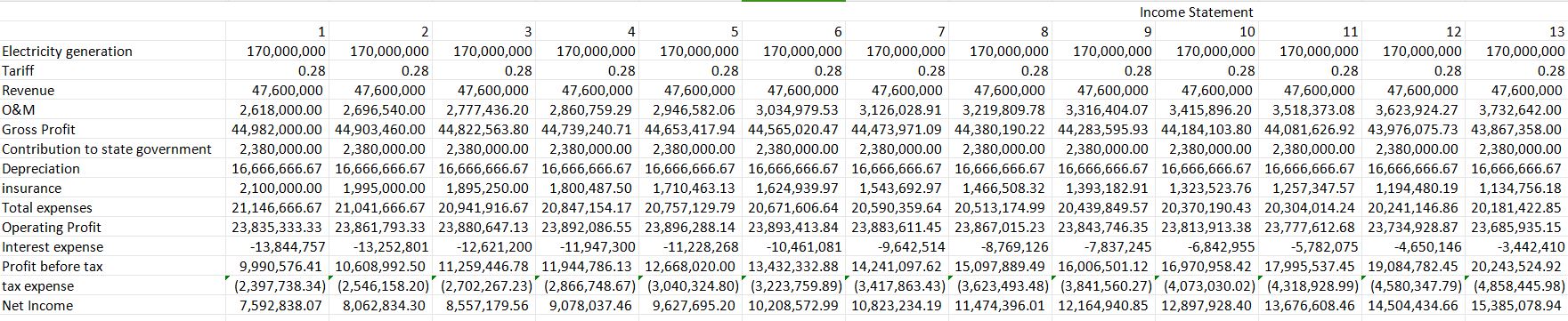

I am showing you a hypothetical hydropower project with assumptions: Capex is RM350million, The electricity output is 170million a year, tariff is RM0.28 per kwh, operation and management is 5.5% of total revenue, contribution to state government is 5% of total revenue as part of corporate social responsibility like helping indigenous people to relocate their houses, upskilling them and forest preservation, insurance is 0.6% of total capex, insurance premium declining rate is 5% a year due to wear and tear of capex,interest rate is 6.5%. loan tenure is 15 years, principal and interest repayment moratorium period is 3 years, there is no interest during construction, tax rate is 24%, inflation rate is 3% a year, capital allowance can be used to offset against 100% of statutory income(mind you, Green Investment tax allowance can be used to offset against 70% of statutory income), a 3 year construction period, 30:70 equity to loan ratio, ppa agreement is 21 years, depreciation is a straight line method with 4.76% depreciation rate a year.

If you compare net income with free cash flow in year 1 after Commercial Operation Date, net income is 7.5million but free cash flow is 17.8million on the back of capital allowance and depreciation. Depreciation is a non cash expense so it does not affect free cash flow. Tax expense is zero because capital allowance is utilized to offset against taxable income in the year 1 . However, starting from year 12, the company needs to pay tax to IRB because capital allowance has been fully utilized. In the above example, IRR of 10.93% indicates an annualized return of 10.93%.In the business, cash is king, free cash flow is important to the business, income statement is prepared on an accrual basis, revenue and expenses are recorded when they are incurred rather than being paid or made. Therefore, free cash flow gives a more complete picture on the company’s financial health.

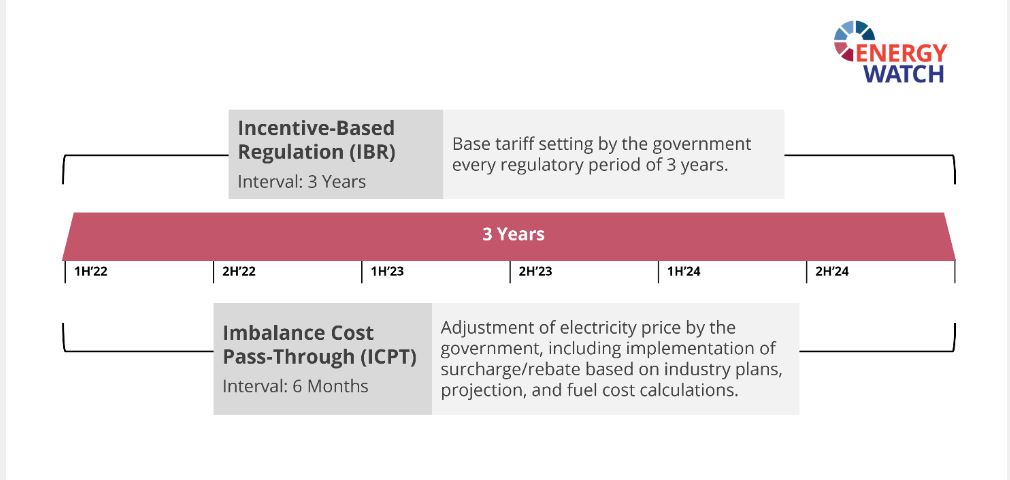

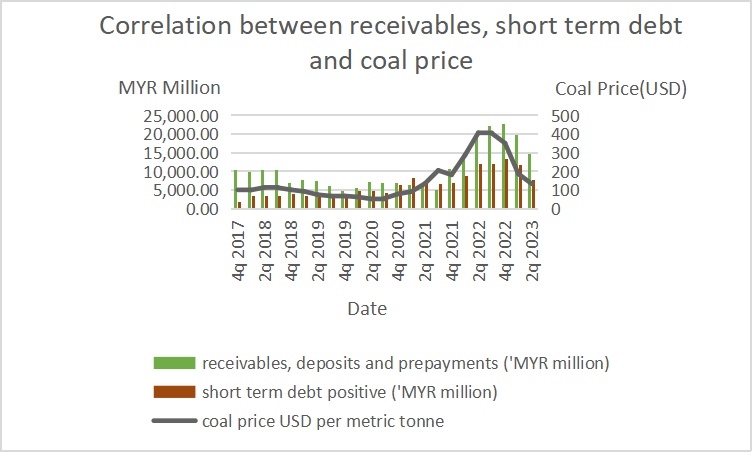

Malaysian’s electricity tariff is made up of two components under Incentive based regulation(IBR) Framework- Base Tariff and Imbalance Cost Pass-Through (ICPT). IBR was introduced in Malaysia in 2014 . Every three years, a base rate is determined by the Energy Commission (ST), taking into account variable factors such as the projected (or ‘budgeted’) prices of fuels, like coal and gas.The base rate also includes costs relating to operations and maintenance of the electricity supplier, such as overhead costs, customer service costs, as well as expenses incurred for infrastructure development.On top of the base rate, a cost adjustment is also ‘passed through’ to customers every six months, in the form of a tariff surcharge or rebate. This mechanism, called imbalance cost pass-through (ICPT) is operated as part of the IBR framework. Every six months, ICPT analyses the true cost of generating electricity against the initially projected costs.This mechanism aims to deliver a fair and transparent method of setting prices, by ‘passing through’ any costs or savings back to the end customer. For example, lower fuel prices and generation costs may lead to consumer rebates, while higher generation costs may lead to surcharges. Therefore, Tenanga Nasional Berhad pass through the volatility in fuel and other generation specific costs to the consumers, it is not subject to pricing risk of commodities from this perspective. Any over or under recovery of these costs would be payable to or reimbursable from the Government. Upon approval by the Government, the agreed over or under recovery costs will be adjusted in the billing to customers, as ICPT rebate or surcharge What is the example of under recovery costs? During the period of high fuel prices, the costs of power generation is higher and hence Tenaga Nasional Berhad will get reimbursement from the government, the government will impose surcharge the customers. On the other hand, the example of over recovery costs is during the period of low fuel prices, the costs of power generation is lower and hence the customer can get the rebate. During the high costs of generation, receivables, deposits and prepayments which contains amounts due from the Government under the ICPT mechanism is higher because Tenaga Nasional Berhad will get the under recovery costs after every six month. What is happening if the company has high receivables? The company need cash to run the business and hence Tenaga Nasional Berhad borrows short term loans.

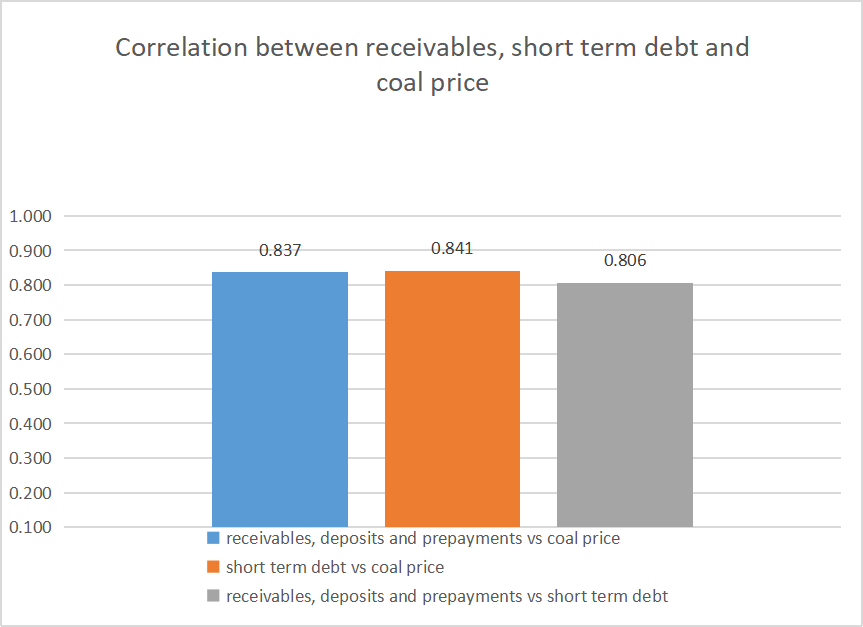

Therefore, you can see there is a high correlation between coal price and receivables, deposits and prepayments, coal price and short term debts, receivables , deposits and prepayments and short term debts. For example, the coal price increase from USD 181 per metric tonne in 4Q 2021 to USD 351 per metric tonne in 4Q 2022, the short term debts rose from RM6.99billion to RM13.26billion and receivables, deposits and prepayments increased from RM10.55 billion to RM22.83billion during the same period. However, please bear in mind that correlation is not a causation, let’s say you wash car, after that it rains, it does not mean that washing car will cause raining. Or after raining, your back pains. It does not mean that raining will cause your back pains. If you want to know causation, please learn regression from me in my investing course.

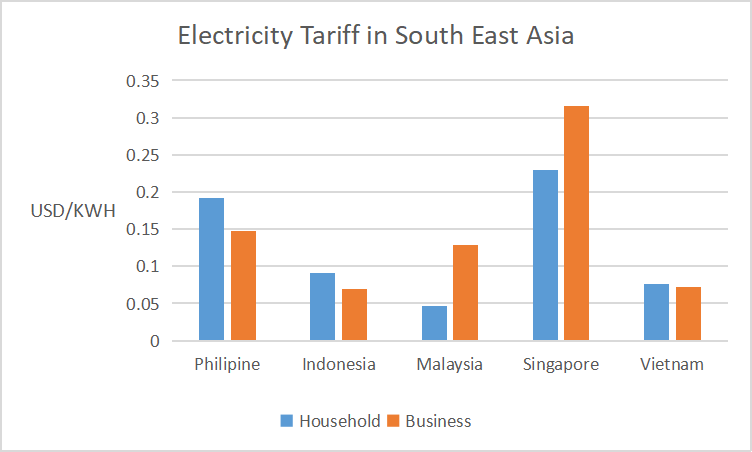

For your knowledge, Malaysia’s household electricity tariff is among the cheapest in South East Asia. In 1H 2023, Malaysian government subsidized electricity for the amount of RM10.4billion and has allocated RM5.2billion for the next cycle of ICPT from July 2023 to December 2023. The data from globalpetrolprices.com shows that on 1 March 2023 Malaysian household’s tariff is the cheapest in this region at USD0.046 per kwh, Vietnam at USD 0.076 per kwh, Indonesia at USD0.091per kwh, Philippine at USD 0.192 per kwh, Singapore at USD 0.229 per kwh, compared to business tariff for Indonesia at USD0.07 per kwh, Vietnam at USD0.072 per kwh, Malaysia at USD0.128 per kwh, Philipine at USD0.148 per kwh, Singapore at USD0.316 per kwh.

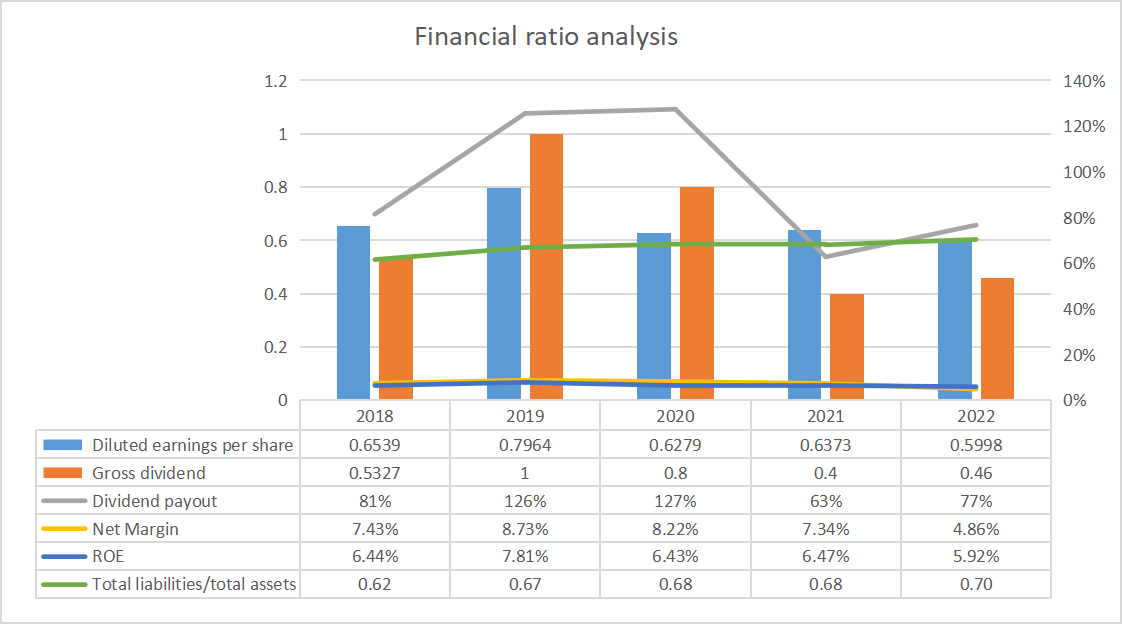

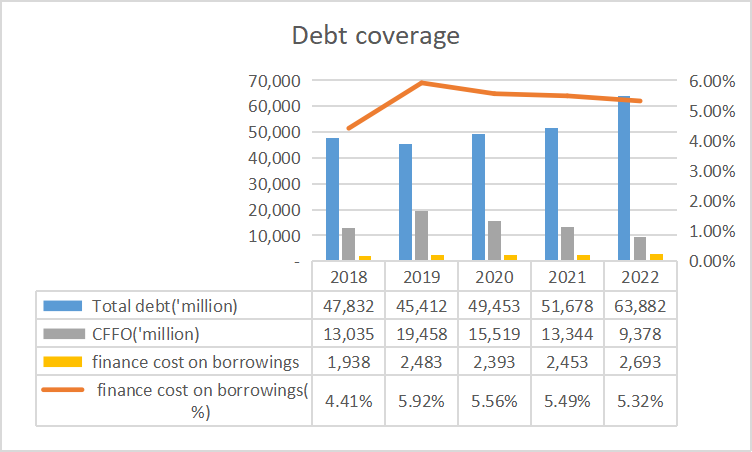

Tenaga Nasional Berhad’s revenue and net income increased from RM50.39billion and RM3.75billion in 2018 to RM73.18billion and RM3.56billion in 2022. However, net margin dropped from 7.43% to 4.86% during the same period. Over the years, the company’ return on equity is not performing well, ranging from 5.92% and 7.81%. The company’s total liabilities to total assets ratio increase from 0.6 to 0.7 during the same period. Is this a dangerous sign? In my humble opinion, Tenaga Nasional Berhad is a monopoly that can distribute electricity to the consumers, and the company incurs recurring cash flows from the consumers as electricity is an essential item to the people. Everyone needs electricity for survival. From the above reasons, Tenaga Nasional Berhad can manage the debts. On average, the company generated around RM14billion cash flows from operating activities, while financing cost on borrowing is around RM2.4billion a year. The total debts increased from RM47billion in 2018 to RM64billion in 2022, while borrowings costs increased from RM1.938billion to RM2.693billion, which represented an average interest rate of around 5.34%. In the worst case scenario, the company is still able to repay the total borrowing costs with its self generated cash flow from operations with the amount of RM 9.378billion in 2022.The dividend was declining in line with lower diluted eps. The company payout ratio ranges from 63% and 127% from 2018 to 2022 which is conflicted with the dividend policy of a 30% to 60% payout ratio based on Profit After Tax and Minority Interest (PATAMI). However, in the PRESENTATION TO INVESTORS, dividend payout ratio ranges from 49.4% and 58.5%. Reason being is adjusted PATAMI in the presentation to investors excluding Extraordinary, Non-Recurring items which were not listed in the slides. I do not know how it classifies extraordinary, non recurring items, but some examples of them are Impairment losses on intangible assets,(Gain)/Loss on disposal of subsidiaries,Reversal of impairment losses on financial guarantees.

Moving forward, Tenaga Nasional Berhad has focusing on the early retirement of coal plants, the repowering of plants with cleaner fuel and green technology and forging strategic technology partnerships. 1: to update and upgrade the Sungai Perak Hydroelectric Scheme with a capacity of 650.75 MW. The refurbishment works will commence in 2024 and commercial operations are expected to start in 2025. 2 :300 MW Nenggiri Hydroelectric Power Plant which is scheduled for commercial operations in 2027. 3: Large Scale Solar 4 project at TNB Bukit Selambau 2, which will add 50 MW of RE capacity. 4: plans to invest RM6.3 billion in the rebuild of TNB’s retired Sultan Ismail PowerStation in Paka, Terengganu using high-efficient Combined Cycle Gas Turbine by 2029 towards cleaner energy production 5: feasibility study of a 2.1 GW combined-cycle power plant in Kapar, which is slated for a commercial operation date by 2031 6:harnessing 2,500MW through innovative hybrid hydro-floating solar (HHFS) technology, complemented by an additional 500MW from five distinct LSSPs, each boasting a capacity of 100MW.

In conclusion, please don’t get me wrong. I am not saying renewable energy assets are not important, I am just wondering why Tenaga Nasional Berhad is spending our taxapayers’ money to buy low performing renewable energy assets and helping them in the UK

If you like my analysis, please follow my social media: Facebook , Youtube , you can watch my analysis of Tenaga Nasional Berhad in a video format on Youtube.

Disclaimer

This information is intended for educational purposes only. It shall not be understood or construed as, financial advice. It is very important to do your own analysis before making any decision

Hi, I am Lim Khai Woon. I passed CFA program in 2 years and achieved a distinction for my master degree in Finance, Investment and Risk from University of Kent .I was a senior investment analyst in a family office and a financial analyst in a physical commodity trading firm.

I will be providing an investment course for the participants who want to learn comprehensive fundamental investing. It is a 2 day training that will be conducted over the weekend that costs RM5,000. The course can be conducted in either English or Mandarin, but it will be taught separately. The date is not decided yet. The location will be held in Selangor/ Kuala Lumpur subject to availability of the training rooms . Other locations(e.g. Johor, Penang) can be considered if there are enough students interested to participate in the course.

If you are interested in learning the stock analysis from me , please fill up the google form.

https://docs.google.com/forms/d/19sr1vRPDctEmkN9Sx1bzjSDp6ff_XuypJHp7zJiGLlo/viewform?fbclid=IwAR2lN7hxdi9fYEovDp66h6XEHbDufW7_wJ1Nr-ScsmdH6fvMQ26wJkyTadQ&edit_requested=true

My email address is : investingiscommonsense@gmail.com

I am also providing a 2 day investment training that cost RM5,000. if you are interested, please fill up Google Form or contact me by my email(investingiscommonsense@gmail.com)

Sources:

1: UN

2" Annual Reports of Tenaga Nasional Berhad

3: Annual General Meeting

4: Quarterly Reports

5: Company Website

6: Bursa Malaysia

7: The Sun

8: Investing.com

9: Investors to presentation

10: Others

More articles on investment knowledge

Created by investingiscommonsen | Nov 14, 2023

Created by investingiscommonsen | Oct 23, 2023

Discussions

this perompak did same impairment loss in Turkey investmemt. look at latest Lira currency. then they intend to increase tariff on poor to cover its blunt

2023-11-01 19:49

Very long .... before reading, i hope i understand the title correctly. Does it mean that, Tenaga Nasional Berhad fails to acquire UK renewable energy assets after paying RM 14billion in cash ??

2023-11-01 20:54

the title is meant that Tenaga Nasional Berhad paid RM14bilion to buy the low performing return renewable energy assets in the UK

2023-11-01 21:43

thanks, so, Tenaga didn't pay the 14b, since it was fail? then, Tenaga has lost nothing materially but only the potential opportunity?

2023-11-01 22:33

Tenaga paid RM14billion to buy renewable energy assets in the UK. The assets are owned by Tenaga Nasional Berhad. But they are generating Return on invested capital from 0.37% and 4.18%. What is the meaning of 0.37% or 4.18%? If ROIC is 4.18%, the return of the 14billion is 4.18%X 14billion=RM585million, which is on par with Fixed deposit rate. Fixed deposit is risk free, meaning to say it is guaranteed. Tenaga Nasional Berhad invested in the projects with low returns with risks like volatile weathers .However, to have more accurate details, we can use IRR to determine the result.

I will be teaching an investing course. If you are interested, you can register with me . The details are in the article.

2023-11-01 22:52

investingiscommonsen

feel free to share your thoughts on Tenaga Nasional Berhad

2023-11-01 19:07