Rationale for privatizing a public listed company

isquare

Publish date: Wed, 13 Nov 2019, 01:49 PM

Being a public company has its pros and cons. On the plus side: a public listed company usually implies a company with a significant level of operational and financial size and success, therefore attracting more talents to join the company. Also, suppliers and customers tend to place more trust in a public company.

Hence, an initial public offering (IPO) is a common occurrence. However, the reverse scenario may also occur.

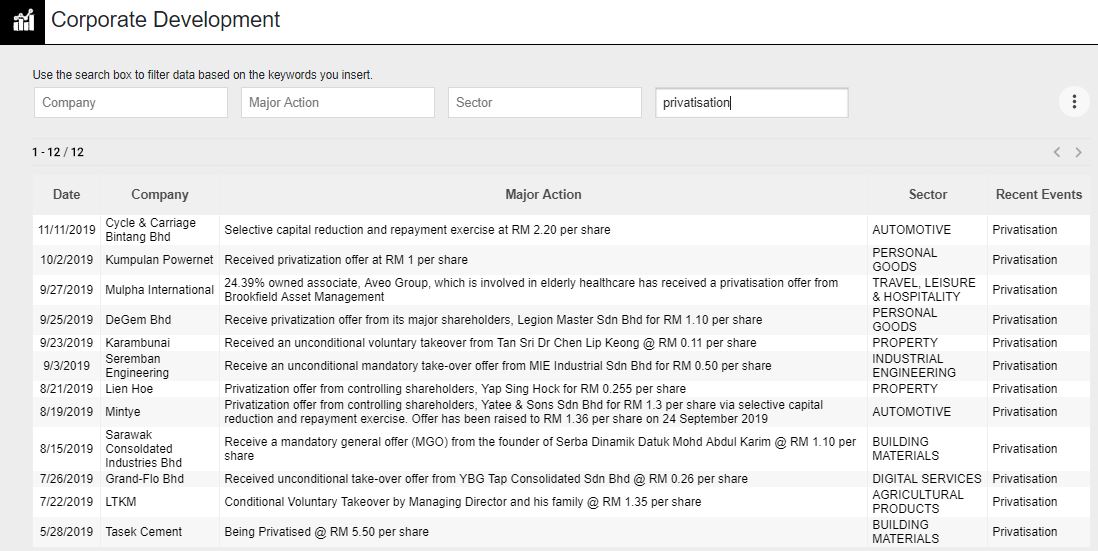

Privatisation takes place when a group of investors purchases the majority of a public company’s outstanding shares and de-listing it from a public stock exchange. Here are some of the reason why a company choose to delist themselves from an exchange.

1) Being a listed company also means there are tremendous regulatory, administrative, financial reporting and corporate governance bylaws that public companies must comply with. These activities can shift management's focus away from operating and growing a company and toward adherence to government regulations.

2) Being a listed company put them subjects to the quarterly earnings cycle that puts enormous pressure on the management to make decisions that may be right for a given quarter, but not necessarily right for the long-term. In order to meet quarterly earnings expectations, it may reduce prioritization of longer-term functions and goals such as research and development, capital expenditures.

3) Credit availability: When market conditions make credit readily available, more private-equity firms are able to borrow the funds needed to acquire a public company. When the credit markets are tightened, debt becomes more expensive and there will usually be fewer take-private transactions.

4) While companies may be privatized for a multitude of reasons, this event most often occurs when a company is substantially undervalued in the public market although there can be other reasons such an action is taken.

Besides, here are some of the considerations an acquirer have to think of before deciding to offer a buy-out.

1) Does taking on leverage to privatize the company make sense for the long term?

2) Will cash flow from operations be able to support the new interest payments?

3) What is the future outlook for the company and industry?

After the whole process, we can be sure that companies that are being privatised are definitely going to do well in the near future.

The Bottom Line

Privatization can be a windfall to current public shareholders, as the acquirer taking the firm private will typically offer a premium on the share price. However, it also means there are one less good companies for public investors to invest in. In the long run, this may not bode well for the local capital market.

In our opinion, the automotive industry may be bottoming as we already saw 2 automotive companies being privatised over the past 6 months.

If you are an investor, identifying what’s happening in the industry will give you a long-term view of the industry and ignore the noises. We had built a tool to help you to focus on the trends that are shaping the landscape much easily.

More articles on Industry Insights

Created by isquare | Oct 08, 2020

Created by isquare | Jul 26, 2020

Chokhmah

thanks for sharing, this is quite informative to me

2019-11-13 14:14