JCY: How high JCY share price can go by end 2H'24

kkwong13

Publish date: Fri, 07 Jun 2024, 08:59 AM

How high JCY share price can go by end 2H'24, moving into multi-baggar return in Data Center theme

Let us give estimate and assumption as of how high JCY share price can go by end of 2H'2024.

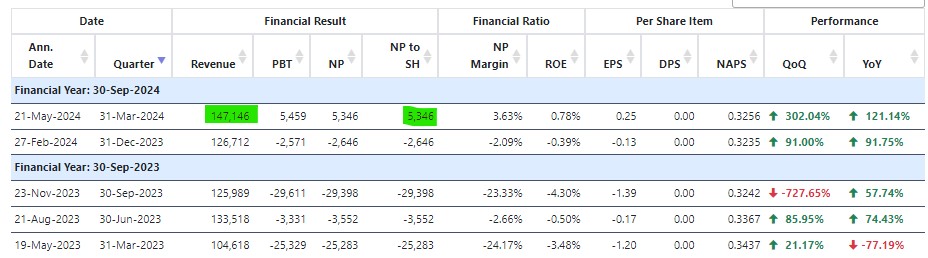

Based on latest Q2'FY'24 (Mar) quarter result, revenue was RM147mil with net profit for 2Q'FY24 reach RM5.3mil, a significant increase of 302% QoQ and 121.1% YoY, mainly due to a improved demand from their key customers. If investor review deeper into JCY's financial quarter result & its future business prospect, it does provide a very promising forecast revenue & earnings result guidance for entire year 2024 and beyond.

Improved Revenue: Revenue increased 16% QoQ and 40% YoY, purely improved with just 3% QoQ growth in quantity only, that alone able to boost up JCY's toward 22% QoQ rise in storage capacity shipped. This evidence proof that JCY successfully improve its ASP selling prices and/or shifted their product mix toward higher capacity HDD & SDD based on current JCY's 50% factory OEE utilization.

Revisit into JCY's revenue vs fixed factory operation cost (reference baseline on past fews quarters report), JCY require minimum RM140mil revenue to stay float on break-even operation cost, as a result any increase above RM140mil consider profits to JCY earnings before taxation.

Now, let's estimate sales order quantity increase 10% in coming Jun'24 vs previous quarter (Mar'24), this will improve JCY's revenue to 48% QoQ and 120% YoY (equivalent to revenue ~RM210mil), as a result of shifted of their product mix and ASP selling price increase. That's an increase of ~RM65mil earning before tax. After tax deduction, it net profit should be ~RM45mil earnings, convert into EPS approximately ~1.97sen.

(Assumption: This calculation assume all other variables remain the same + fixed operation cost of RM140mil)

Let's us do simple math calculation with assumption 10% QoQ qty sales order gradual increase (conservative):

Reported Q2'FY24 (Mar'24) = EPS 0.25 sen

if next Q3'FY24 (Jun'24) = EPS 1.97 sen (+10% QoQ qty sales order; +10% utilization toward 60% OEE)

then if next Q4'FY24 (Sep'24) = EPS 3.51 sen (+10% QoQ qty sales order; +10% utilization toward 70% OEE)

then if next Q1'FY25 (Dec'24) = EPS 5.26 sen (+10% QoQ qty sales order; + 10% utilization toward 80% OEE)

Sum up all these 4 quarters, total EPS is 10.99 by end of Dec'24 alone

Let say, if PE 10, share price is $1.09

if PE 15, that share price is $1.64

if PE 20, that share price is $2.19

If let say, JCY sales order & utilization remain same as 80% OEE utilization (after Q1'FY25) for next quarters moving forward with EPS 5.26sen, multiply by x4 Quarters, then total is EPS 21.04sen for year 2025 and onwards.

Let say, if PE 10, share price is $2.10

if PE 15, that share price is $3.15

if PE 20, that share price is $4.20

Likewise, we all knew starting from April'24, both Western Digital & Seagate communicated clearly to their customers to increase HDD & SDD's ASP price from 9% to 13% across various product mix to meet upraising customer demand order. Plus, analyst & expert also reported demand for data centers is very strong across Southeast Asia, where societies are rapidly going digital with regional global headquarters in Singapore, now all big giant corporation Microsoft, Nvidia, Google, Amazon & other are expanding their data center portfolio into countries like Malaysia, Indonesia, Vietnam, Thailand, and even Philippines, due to cost benefit considerations.

As long as AI cloud and more data centers continue to expand to meet Western Digital, Seagate and Nvidia's HDD & SDD memory storage requirement (Trendforce, Forbes, Business Insight experts projected AI market size to expand at a compound annual growth rate (CAGR) of >27% from 2024 to 2030), then the future of JCY, Notion & Dufu business revenue is highly secure and promising for many years to come.

[News] AI Market Growth Rescues HDD, Driving Half-Year Price Surge of 20%

To illustrate from Trendforce news, dated Apr 9th' 2024 stated AI market growth rescues HDD, driving half year 2024 price surge 20%.

"Trendforce projected a strong 13–18% increase in Q2 NAND Flash contract prices, with enterprise SSDs expected to rise highest. Despite Kioxia and WDC boosting their production capacity utilization rates from Q1 this year, other suppliers have kept their production strategies conservative. The slight dip in Q2 NAND Flash purchasing—compared to Q1—does not detract from the overall market’s momentum, which continues to be influenced by decreasing supplier inventories and the impact of production cuts"

According to industry sources cited by the same report, the global economic downturn in 2023 and the resulting decline in server demand have led to losses even for suppliers of smaller-volume HDDs. Consequently, manufacturers implemented production reduction strategies, reducing capacity by 20% in hopes of stabilizing HDD prices.

Despite this, the burgeoning demand in the AI market since early 2023 has sparked a surge in demand for high-capacity HDD products. As suppliers have not announced plans to increase production capacity, industry sources cited by the report predict that the supply shortage for large-capacity HDD products will persist throughout this quarter and possibly extend for an entire year.

The report further cited sources indicating that HDD prices are expected to continue rising in the second quarter of 2024, with a potential increase of 5% to 10%. Sources also indicate that HDD prices have remained stagnant amid SSD competition. Reportedly, suppliers are unlikely to expand production immediately to sustain the upward price trend of HDDs. Therefore, the timing of HDD price stabilization hinges on developments in the artificial intelligence and high-performance computing markets."

Stay happy, Stay invest!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Discussions

ASP increase will attract competition especially in super competitive industry like technology.What is JCY economic moat to defend market share and raise price?

3 weeks ago

Time barrier to entry for glove very low as it takes less than 6 months to start New Glove factory in China

Time barrier for setting up new HDD/ SSD factories high

it took Jcy long time more than one to two decades to be what it is today

better don't dilly dally and miss the HDD/SSD Superbull run time

3 weeks ago

AFTER GREAT SUCCESS IN VSTEC - JCY & NOTION ARE TWO CHUN CHUN BUY CALLS OF CALVIN TAN

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-06-09-story-h-159761067-AFTER_GREAT_SUCCESS_IN_VSTEC_JCY_NOTION_ARE_TWO_CHUN_CHUN_BUY_CALLS_OF_

1 minute ago

calvintaneng

VSTEC (5162) A MONOPOLY ON THE INTERNET ECONOMY & E-COMMERCE PLUS HIGH DIVIDENDS , Calvin Tan Research

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2020-05-29-story-h1507893343-VSTEC_5162_A_MONOPOLY_ON_THE_INTERNET_ECONOMY_E_COMMERCE_PLUS_HIGH_DIVI

VSTEC IS LOCAL WHY JCY, NOTION & DUFU ARE GLOBAL!!

3 weeks ago

calvintaneng

JCY

J = Jumping

C = Clapping

Y = Yelling

70 sen

85 sen

Rm1.00

buy and hold

But buy this for safety

HI GUYS

Long ago in 1997/8 Bull run

One guy from Reko, Kajang made Rm300,000 from Share market trading

RM300K was big money in those days

After having made Rm300K (or Rm1 to Rm3 million in today's money) he decided to cash out and bought a piece of land in Jalan Reko, Kajang to lock into REAL ASSET VALUE (LANDS!!!)

Then Asian Financial Crisis Hit

Many went bankrupted

This guy built a Shop on his land to sell Electrical Stuff

He did very well

NOW IF YOU WANT TO PRESERVE YOUR PROFITS

CAN CONSIDER BUYING AND HOLDING TSH RESOURCES (9059)

Final decision is yours

TSH RESOURCES (9059) PRIME GOLDMINE LANDS SELLING AT LESS THAN RUBBISH PRICES (NOW I KNOW WHY WARREN BUFFET SAID, "I KNOW I WILL BE RICH"!!

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2024-06-07-story-h-159794673-TSH_RESOURCES_9059_PRIME_GOLDMINE_LANDS_SELLING_AT_LESS_THAN_RUBBISH_PR

https://klse.i3investor.com/web/blog/detail/www.eaglevisioninvest.com/2020-03-13-story-h1484835012-THE_ASIAN_FINANCIAL_CRISIS_1997_1998_Why_It_Hit_Johor_Hardest_BECAUSE_O

3 weeks ago