Based on the severe operating conditions, will Prolexus (8966) may face the cruel fact of layoffs?

karadis

Publish date: Fri, 12 Mar 2021, 12:53 PM

But can the problem be solved after layoffs? Then, it will soar and recover or gradually enter a vicious circle, with smaller and smaller scales, withered talents, and gradually disappeared in the long river of history.

First, let's look at the following key contents of Prolexus's financial report:

- 24. Borrowings

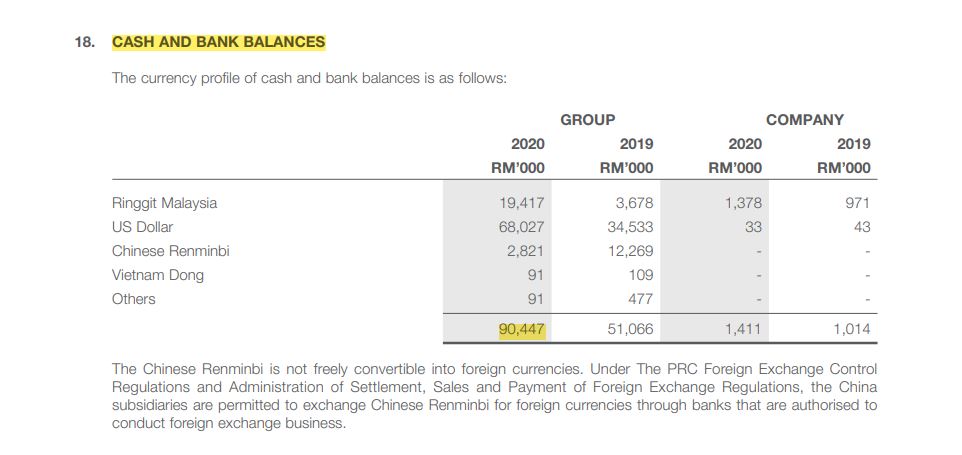

- 18. Cash and Bank Balances,

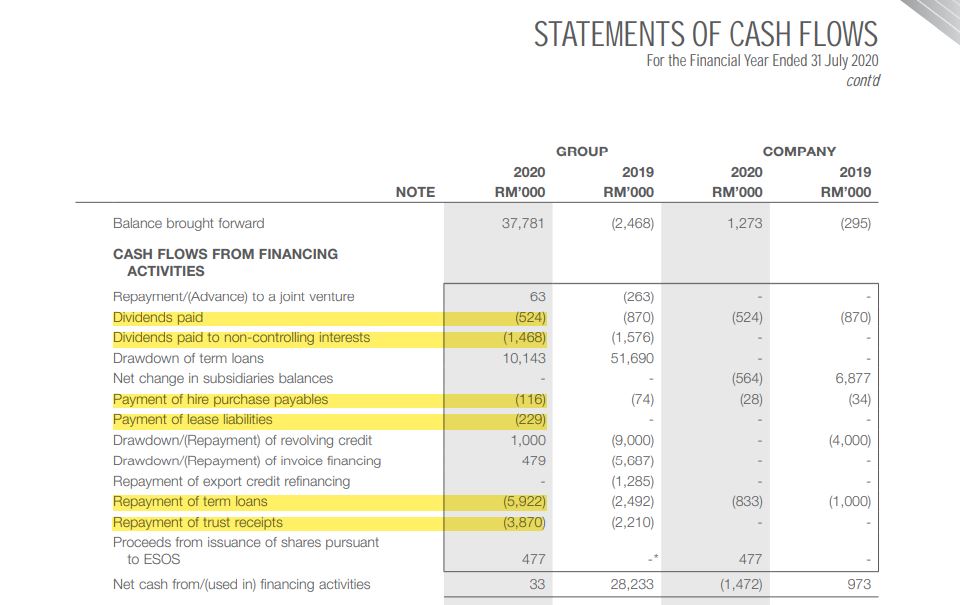

- Statement of Cash Flow

Understand that:

Total Borrowings = RM 94,198,000

Cash and Bank Balances = RM90,198,000

Loan - Repayment / Dividend Paid / Payment = 12,129,000

According to data, Prolexus has more than 3,000 employees. We assume that the average salary per person is RM 2500/month, which represents the monthly fixed labor cost expenditure = RM 7,500,000 (Yearly = RM 90,000,000)

Is it mean that:

Thinking points 1:

Their Cash and Bank Balances can support 1 year's fixed labor cost, if there is no order income at all. Of course they still have income although their revenue decline, but this is warning that their fixed cost (single labor cost) is very high in the case of order reduction, cash flow will turn to negative cash flow. So there is a great possibility that they will plan to “lay off” employees!

Cash and Bank Balances = RM90,198,000

Fixed labor cost = RM 90,000,000

Thinking points 2:

Their Cash and Bank Balances can support 7.4 years of Bank’s Loan-Repayment / Dividend Paid / Payment:

Cash and Bank Balances = RM90,198,000

Loan - Repayment / Dividend Paid / Payment = 12,129,000

Although Their Cash and Bank Balances can support 7.4 years of Bank’s Loan, but the money is liquid, it needs to flow according to the actual needs, such as salary payment, turnover of raw materials purchasing and etc.. So the actual support period may only be less than 2 years.

More articles on Talk & Talk

Created by karadis | Sep 16, 2022

Created by karadis | Apr 04, 2022

Created by karadis | Oct 08, 2021

Created by karadis | Jul 29, 2021

Created by karadis | Jul 01, 2021