Prlexus (8966) performed poorly as expected, can we still buy the share? It's a time now!

karadis

Publish date: Fri, 08 Oct 2021, 12:31 PM

This argument is wrong and misleading. How to say it?

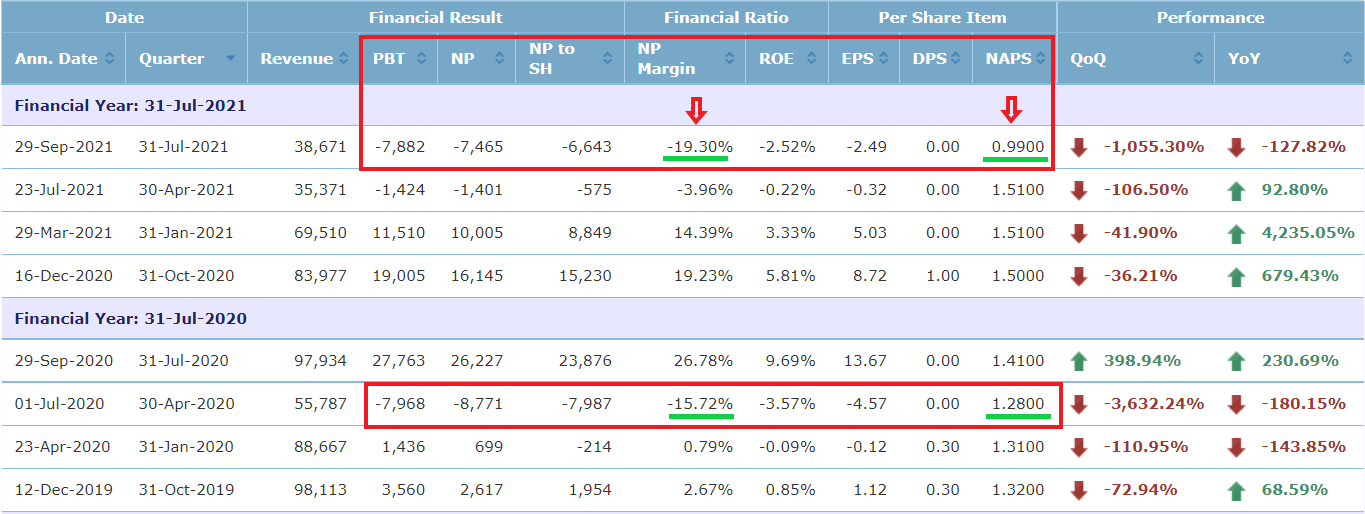

First of all, we can compare with the previous quarter to see if assets have increased or decreased? The NAPS in the last quarter was 1.51, while the NAPS in the latest quarter was only 0.99. That means the company sold its assets due to short for cash flow. Is that a good new?

Let's take a look at the "Cash and bank balances" of PROLEXUS BERHAD-interim report (2021-Q4) vs 2020-Q3, its shown drop from 84,935k to 43,491k.

These data are actually telling us a serious fact, that is, Prolexus's cash flow has problems, and it is already a serious negative cash flow. These problems have fully manifested after the severe reduction in mask orders.

Let's take a look at NP Margin, the latest quarter has fallen more severely than 2020-Q3, showing -19.30%.

It’s ridiculous that there are still people who said it's caused by MCO. First of all, uncle JoJo has clearly told everyone in the links with provided when Malaysia's MCO started. Q3 without MCO? Q4 with MCO? So Q4 is better than Q3? Really kidding! Last quarter Prolexus's insider alvin didn't seem to say it like that! There are different reasons that can be compiled with each quarter, which is ridiculous!

Let compare with the Magni Financial Report, Magni is shown positive and improving, then why Prolexus is still dropping only in the same environment issue? So, is that the worst state of Prolexus? I believe it may continue to get worse if the management team just sit and wait.

But I believe the next quarter should perform extremely better than this quarter, and it's hard to say the 2022-Q2 quarter result. Mean that it may be an opportunity to consider a small entry. This is just a personal opinion, for reference only.

More articles on Talk & Talk

Created by karadis | Sep 16, 2022

Created by karadis | Apr 04, 2022

Created by karadis | Jul 29, 2021

Created by karadis | Jul 01, 2021