Daily Technical Highlights - (KGB,MYEG)

kiasutrader

Publish date: Tue, 31 Oct 2017, 10:00 AM

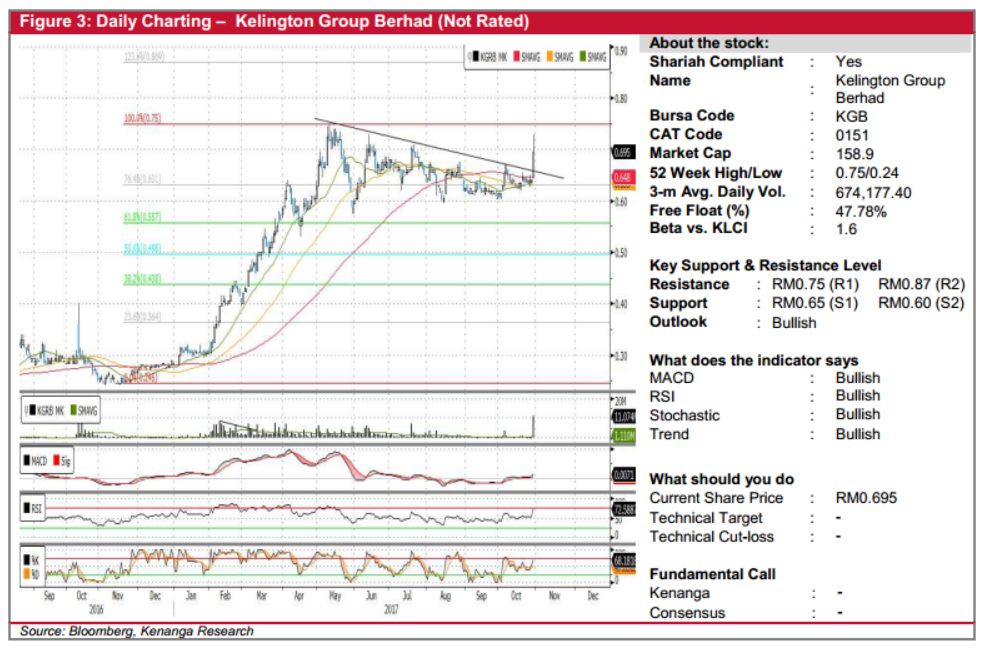

KGB (Not Rated). KGB saw its share climb 5.5 sen (8.6%) yesterday to a five-month high of RM0.695 after the company announced that it had been awarded a RM102.6m contract to supply and install bulk gas system and distribution piping for Gexin Integrated Circuit Manufacturing. Trading volume jumped ten-fold, with 11.1m shares changing hands for the day. As a result of the bullish move, KGB’s share price has broken out of its downtrend decisively. Momentum indicators have also been bullish over the recent three months, and this led us to believe that a renewed interest is on the cards. From here, expect a retest of the May-2017 high of RM0.75 (R1). Should this level be taken out next, the next resistance to target is RM0.87 (R2) further up. Downside support levels are RM0.65 (S1) and RM0.60 (S2) below.

MYEG (Not Rated). Yesterday, MYEG rallied an impressive 16.0 sen (7.8%), closing at an intraday high of RM2.21. This was accompanied by exceptional trading volume, with 30.9m shares exchanging hands – almost 4x its 20-day average. Notably, yesterday’s white “Marubozu” candlestick marks as the first bullish breakout from its sideways consolidation since mid-May, potentially signalling a continuation of prior uptrend seen earlier in the year. Likewise, upticks seen in key indicators could also be indicative of a continued move higher. Given sustained momentum, we expect the share to retest the recent high of RM2.37 (R1), with a higher resistance at RM2.59 (R2). Conversely, downside support can be identified at RM2.02 (S1) and RM1.91 (S2).

Source: Kenanga Research - 31 Oct 2017

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-08-28

KGB2024-08-28

KGB2024-08-28

KGB2024-08-28

KGB2024-08-28

MYEG2024-08-28

MYEG2024-08-23

KGB2024-08-23

MYEG2024-08-23

MYEG2024-08-23

MYEG2024-08-23

MYEG2024-08-22

KGB2024-08-22

KGB2024-08-21

KGB2024-08-21

MYEG2024-08-21

MYEG2024-08-21

MYEG2024-08-21

MYEG2024-08-21

MYEG2024-08-21

MYEG2024-08-20

MYEG2024-08-20

MYEG2024-08-20

MYEG2024-08-20

MYEG2024-08-20

MYEG2024-08-19

MYEG

.png)