Kenanga Research & Investment

Daily Technical Highlights – (SCGM, TOPGLOV)

kiasutrader

Publish date: Thu, 22 Feb 2018, 09:26 AM

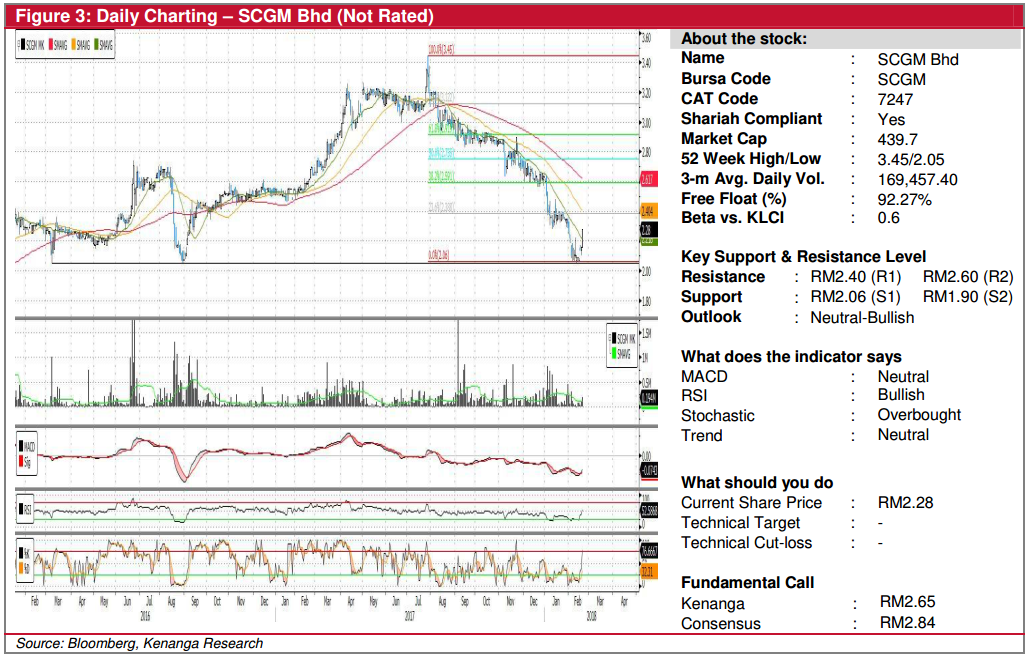

SCGM (Not Rated)

- SCGM rose 12.0 sen (5.6%) to close at RM2.28.

- Yesterday's candlestick confirms the earlier "Hammer" reversal pattern, to kick off a near-term recovery.

- On a longer-term technical perspective, SCGM rebounded from its multi-year support level near RM2.06, suggesting that a long term floor has been established at that level.

- RSI has broken above the 50.0 level displaying more positive technical picture.

- Expect a rebound towards RM2.40 (R1) and RM2.60 (R2) further up. Support levels can be found at the above-mentioned support of RM2.06 (S1), though a break below may trigger a capitulation towards RM1.90 (S2).

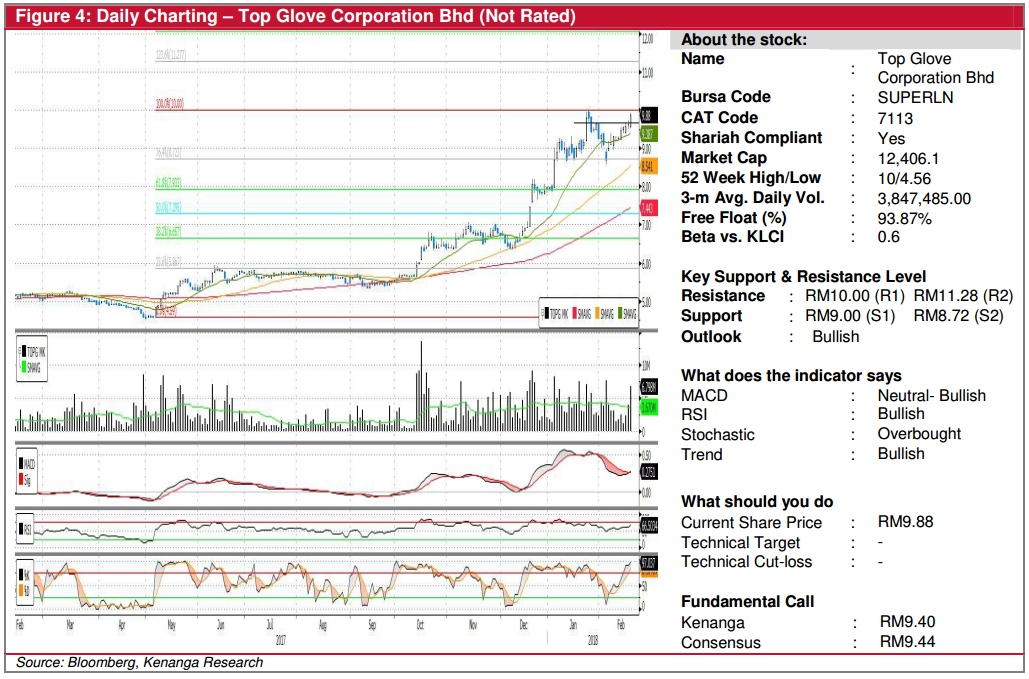

TOPGLOV (Not Rated)

- TOPGLOV climbed 25.0 sen (2.60%) to close at RM9.88 on increased trading volume of 6.8m shares.

- Yesterday’s close marked a decisive breakout from the key resistance level of RM9.67 which it had retested thrice previously, to suggest the share price is poised for an uptrend continuation.

- Positive momentum indicators such as MACD-signal line crossover as well as bullish on RSI and Stochastic are supportive for TOPGLOV making a fresh high towards resistance level RM10.00 (R1) fairly soon.

- Should this level be taken out next, further gains could then be expected towards RM11.28 (R2).

- Any downside is likely limited by strong supports at RM9.00 (S1) and RM8.72 (S2).

Source: Kenanga Research - 22 Feb 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Pharmaniaga - Better outlook at medical supply unit, PN17 Stays

Created by kiasutrader | Nov 27, 2024

Malaysia Airports Holdings - Buoyed by High-Yielding Passengers

Created by kiasutrader | Nov 27, 2024

Actionable Technical Highlights - INFOLINE TEC GROUP BHD (INFOTEC)

Created by kiasutrader | Nov 27, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments