Kenanga Research & Investment

Daily Technical Highlights – (SAPNRG, MRCB)

kiasutrader

Publish date: Tue, 08 May 2018, 08:49 AM

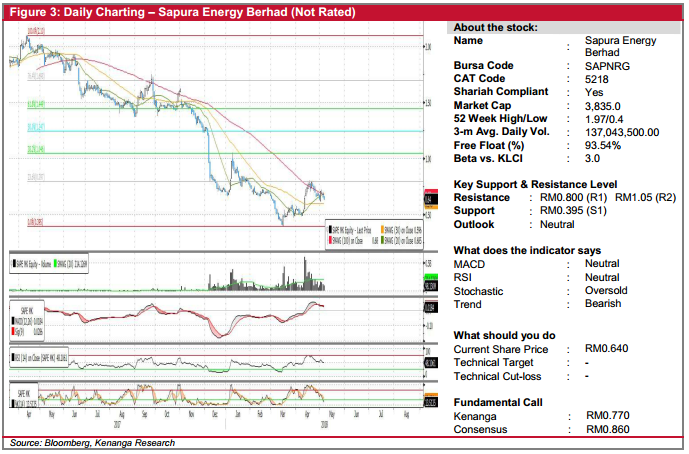

SAPNRG (Not Rated)

- SAPNRG saw 98.1m shares traded yesterday, making it one of the most actively traded stocks of the day. It ended the day lower by 1.5 sen (2.3%) at RM0.64 amidst the poor market breadth.

- The share has appeared to be in consolidation mode recently, after bottoming-out in mid-March. However, the share price is still yet to decisively cross above its longer-term 100-day SMA, despite hovering above its 20 and 50-day SMAs for a large part of last month. Nonetheless, the tapering momentum indicators further suggested some overhang in negative sentiments before the share can fully stage a rebound play.

- From here, look out for resistances at RM0.800 (R1) and RM1.05 (R2). Meanwhile, a breach below crucial support at RM0.395 (S1) will be deemed as highly negative.

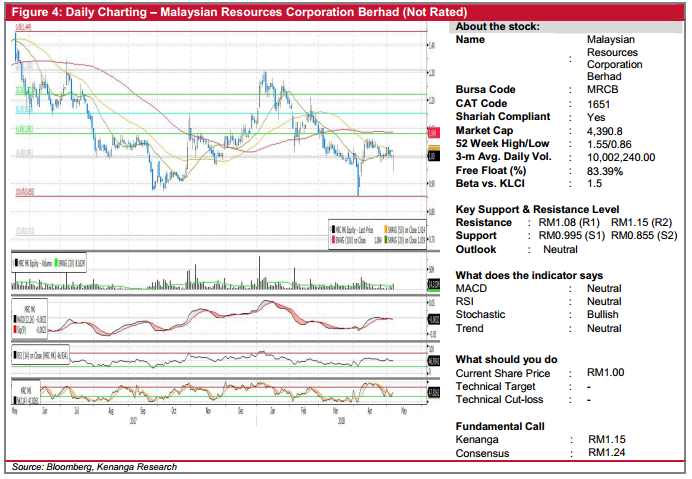

MRCB (Not Rated)

- MRCB closed flat at RM1.00 yesterday with strong trading volume of 14.3m, above 20-day moving average volume of 8.2m.

- Yesterday’s movement formed a candlestick that highly resembles a dragonfly doji, in which upon a continued positive movement could confirm a bullish reversal.

- While momentum indicators have yet to turn bullish, 20-day SMA has recently crossed above 50-day SMA, indicating improving outlook.

- Upon confirmation, expect share to rebound towards RM1.08 (R1) and RM1.15 (R2) further up.

- Immediate support is identified at RM0.995 (S1) with next support at RM0.855 (S2).

Source: Kenanga Research - 8 May 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments