Kenanga Research & Investment

Daily Technical Highlights – (BAHVEST, KOSSAN)

kiasutrader

Publish date: Tue, 10 Jul 2018, 09:10 AM

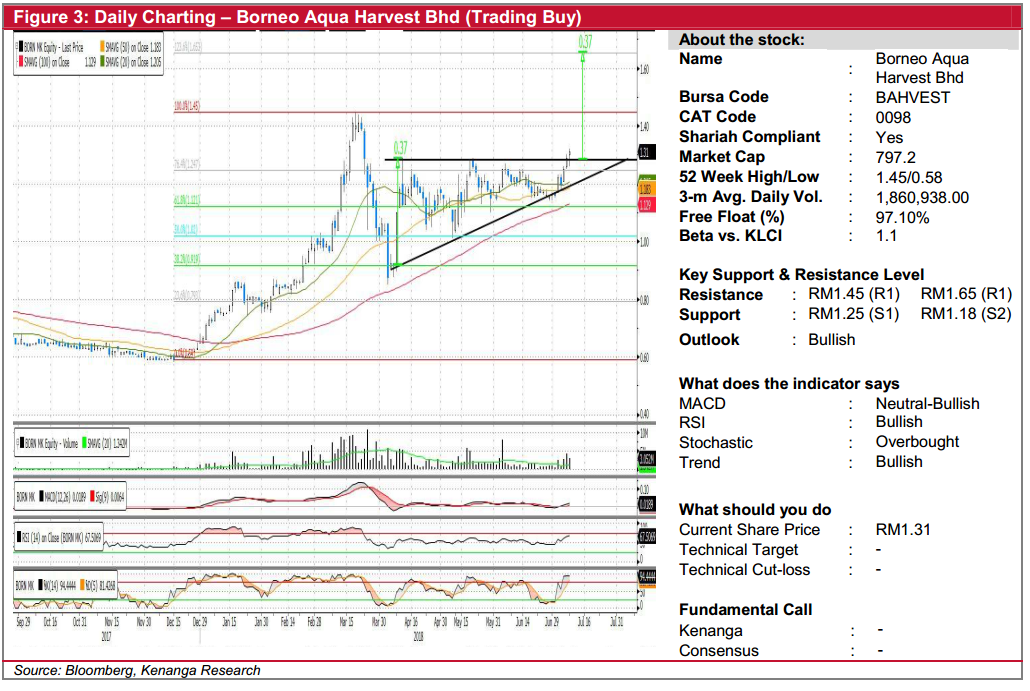

BAHVEST (Trading Buy, TP: RM1.62; SL: RM1.15)

- BAHVEST closed higher yesterday at RM1.31 (+2.0 sen or +1.56%).

- Notably, the display of ascending triangle breakout could be a signal of continuation of the prior bullish rally.

- Momentum indicators are showing uptick coupled with the stronger trading volume.

- From here, we see the potential for a swift move towards RM1.45 (R1) and the measurement objective of RM1.65 (R2) further up.

- Conversely, an interim support can be identified at RM1.25 (S1), whilst our stop loss level is placed at RM1.15, being three ticks below RM1.18 (S2).

KOSSAN (Not Rated)

- Yesterday, KOSSAN closed 30.0 sen (3.53%) lower at RM8.20 on the back of above-average volume.

- From the indicators, we observed that RSI was sharply rejected from an overbought level and the MACD line had just crossed over the signal line, implying a shift in sentiment. Thus, we believe that the sell down is not over yet and the retracement for KOSSAN would likely continue.

- From here, we expect KOSSAN to retest supports of RM8.10 (S1) and RM7.77 (S2). Conversely, resistances can be identified at RM8.63 (R1) and RM9.33 (R2).

Source: Kenanga Research - 10 Jul 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

BAHVEST2024-11-26

KOSSAN2024-11-26

KOSSAN2024-11-26

KOSSAN2024-11-25

BAHVEST2024-11-25

BAHVEST2024-11-25

BAHVEST2024-11-25

BAHVEST2024-11-25

KOSSAN2024-11-22

BAHVEST2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-21

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-20

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-19

KOSSAN2024-11-18

BAHVEST2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-18

KOSSAN2024-11-15

BAHVEST2024-11-15

KOSSAN2024-11-15

KOSSANMore articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments