Kenanga Research & Investment

Daily Technical Highlights – (KGB, DNEX)

kiasutrader

Publish date: Wed, 05 Sep 2018, 08:52 AM

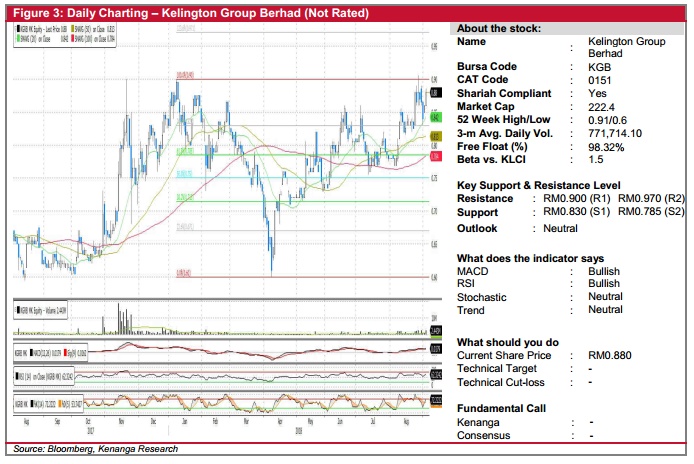

KGB (Not Rated)

- KGB gained 2 sen (+2.33%) to close at RM0.880 yesterday.

- The share had been rallying since the start of August and had been looking to break out from the RM0.900 resistance level.

- Key SMAs are now in a ‘Golden Cross’ position with other momentum indicators showing meaningful upticks.

- Should it be able to break above RM0.900 (R1), we may consider calling a trading buy as the next resistance level is identified at RM0.970 (R2).

- Any downside bias will see supports at RM0.830 (S1) and RM0.785 (S2).

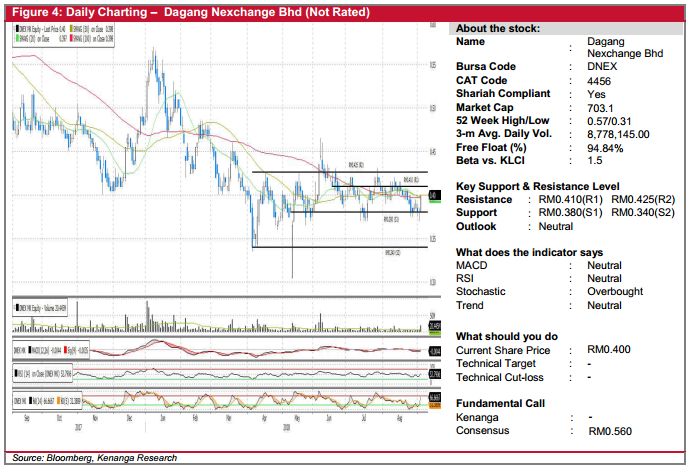

DNEX (Not Rated)

- DNEX gained 2.0 sen (+5.26%) to close higher at RM0.400 underpinned by stronger-than average trading volume.

- The share has been trending sideways within the range of RM0.370-RM0.425 since mid-May.

- Technical outlook seemingly in supportive for a short-term retracement as supported by weaknesses in momentum indicators as displayed by the MACD line below zero with recent crossover of RSI just above the 50-point level.

- From here, the RM0.380 (S1) is a crucial support level to look out where a decisive break-through would see the share on a lower note towards RM0.340 (S2).

- Conversely, resistance levels are identified at RM0.410 (R1) and RM0.425 (R2).

Source: Kenanga Research - 5 Sept 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments