Kenanga Research & Investment

Daily Technical Highlights – (KGB, GTRONIC)

kiasutrader

Publish date: Wed, 31 Oct 2018, 11:21 AM

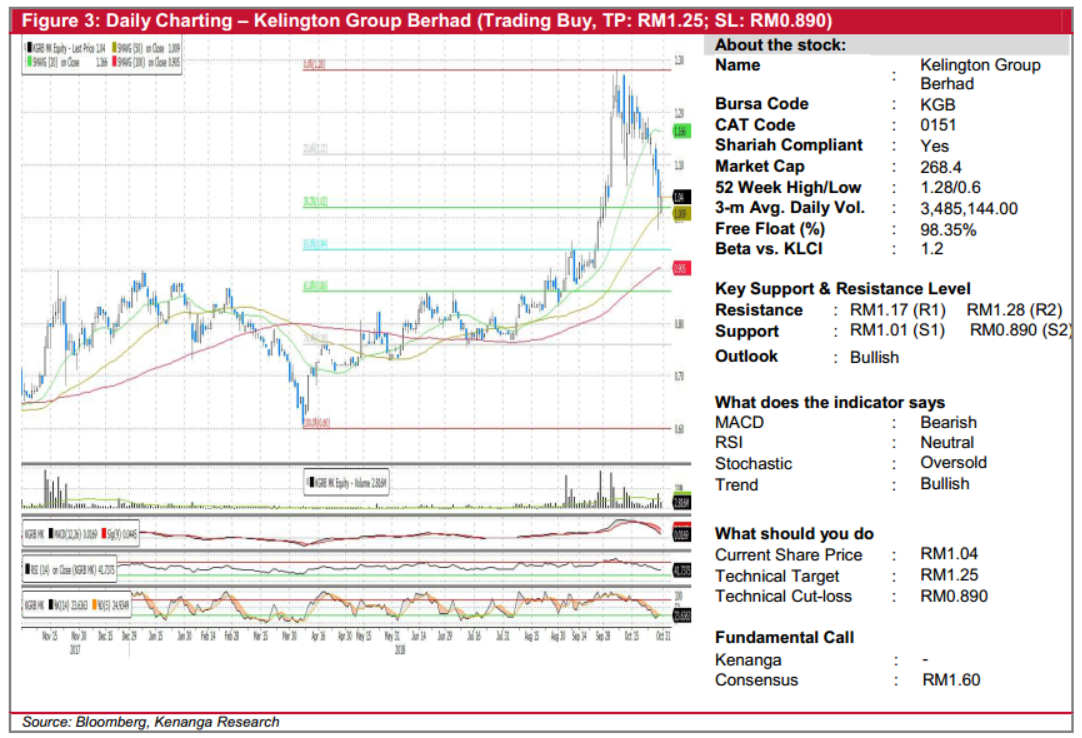

KGB (Trading Buy, TP: RM1.25; SL: RM0.890)

- KGB traded unchanged yesterday to close at RM1.04.

- Recall that earlier this month we closed our position on KGB, reeking in a 33% gain in just less than a month. Upon closing our position, we wrote that we may reconsider a re-entry should prices fall to an attractive level.

- Recent price actions have brought KGB to the aforementioned attractive level and we believe that there may be some upside rooms from here. Yesterday’s candlestick seems to have found support at a level near both the 50-day SMA and a key Fibonacci level, which provides strong confluence signalling a potential continuation of the rally.

- From here, we look towards RM1.17 (R1), near its 20-day SMA and RM1.28 (R2) as resistances while any further downside bias should see support at RM1.01 (S1), close to its 50-day SMA and RM0.905 (S2), near its 100-day SMA.

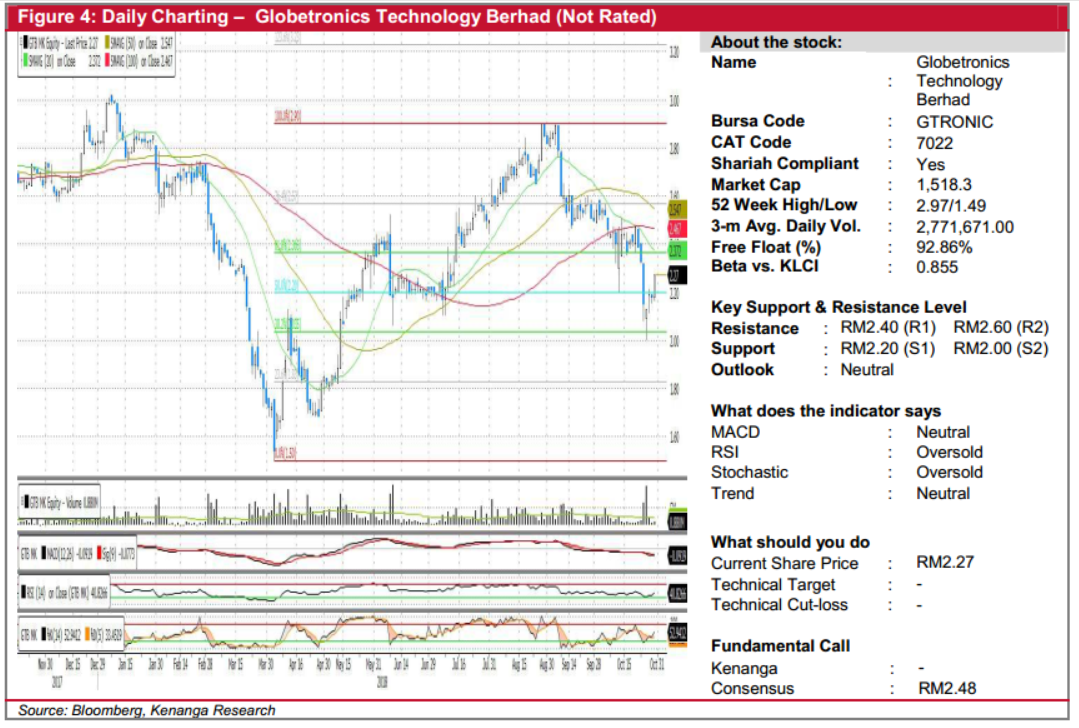

GTRONIC (Not Rated)

- GTRONIC gained 9.0 sen (+4.13%) last night to close at RM2.27.

- Chart-wise, the share appears to be recovering from the sell-down that happened in the past two months. More notably, both RSI and stochastic indicators have now rebounded from their oversold zones.

- Coupled with its quarterly results released yesterday, which showed headline profit almost doubling, we think that the share is now poised for a rally to test its resistance level at RM2.40 (R1) and RM2.60 (R2).

- Conversely, downside support can be found at RM2.20 (S1) and RM2.00 (S2)

Source: Kenanga Research - 31 Oct 2018

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Market Weekly Outlook - Domestic yields set to rise ahead of Trump’s inauguration

Created by kiasutrader | Jan 17, 2025

Oil & Gas - Clearing Clouds on Petronas Petros Issue (OVERWEIGHT)

Created by kiasutrader | Jan 16, 2025

Discussions

Be the first to like this. Showing 0 of 0 comments