Kenanga Research & Investment

Daily Technical Highlights – (KGB, CCM)

kiasutrader

Publish date: Tue, 12 Feb 2019, 09:01 AM

KGB (Not Rated)

- KGB rose 6.0 sen (+5.17%) to close at RM1.22.

- Technically, the share has been on a rally after rebounding and breaking above its 100-day in mid-December. Coupled with upticks in key momentum indicators and above-average trading volume at 5.4m, we believe the overall technical outlook may continue to be positive.

- Should the buying momentum persist, we look towards RM1.25 (R1) and RM1.30 (R2).

- Conversely, support levels can be identified at RM1.16 (S1) and RM1.06 (S2).

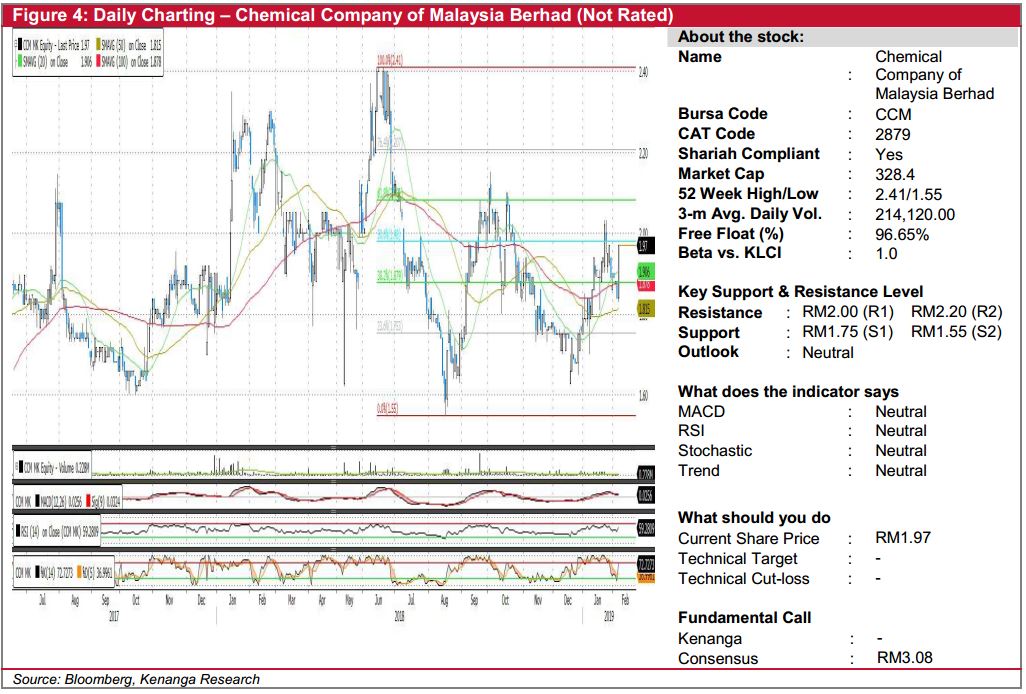

CCM (Not Rated)

- CCM gained 13.0 sen (+7.07%) to close at RM1.97 last night.

- Despite the gain, we are not convinced that the bullish run yesterday will continue as there is no technical indicator, which shows a prominent sign of a potential rally. Moreover, yesterday’s move was not backed by strong trading volume.

- Expect the share to retrace back to its support levels at RM1.75 (S1) and even RM1.55 (S2).

- Should there be positive news flow, the share may then test its resistances at RM2.00 (R1) and RM2.20 (R2).

Source: Kenanga Research - 12 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments