Kenanga Research & Investment

Daily Technical Highlights – (AWC, SUPERMX)

kiasutrader

Publish date: Wed, 27 Feb 2019, 10:12 AM

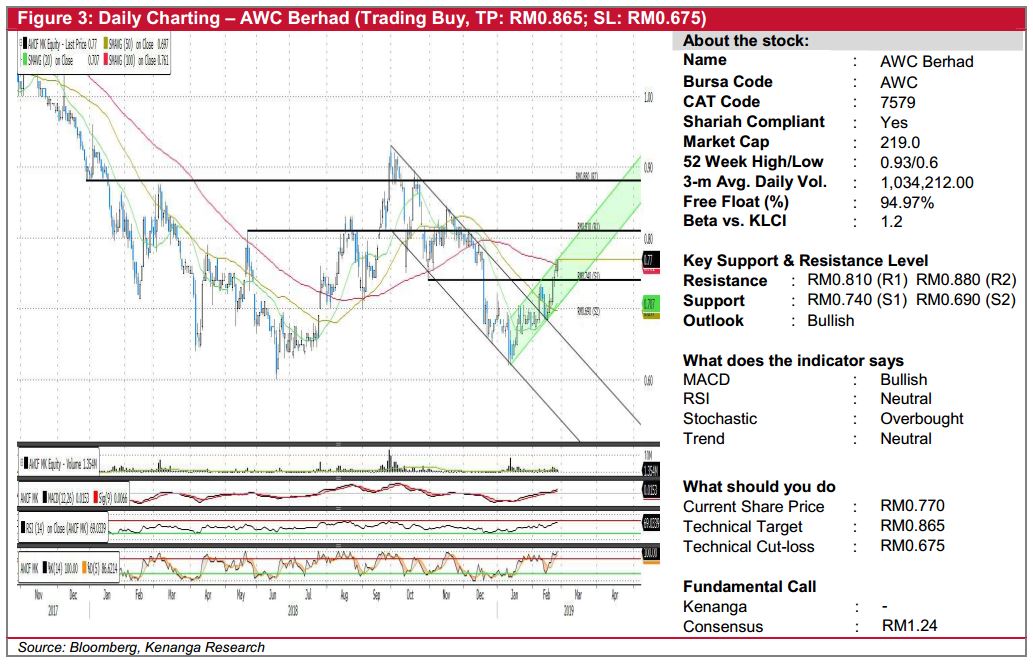

AWC (Trading Buy, TP: RM0.865; SL: RM0.675)

- AWC gained 1.0 sen (+1.32%) to close at RM0.770 yesterday.

- Recall we mentioned in our previous report that we may consider a “Trading Buy” should AWC break above its 100-day SMA. Yesterday’s move saw the share punching through the 100-day SMA fulfilling our condition. Coupled with positive upticks in key momentum indicators, we believe that there could be more room for upside.

- From here, we expect AWC to test its resistance at RM0.810 (R1) where a break above it would see a further rally to RM0.880 (R2).

- Immediate downside support is at RM0.740 (S1), failing which further support is located at RM0.690 (S2) below.

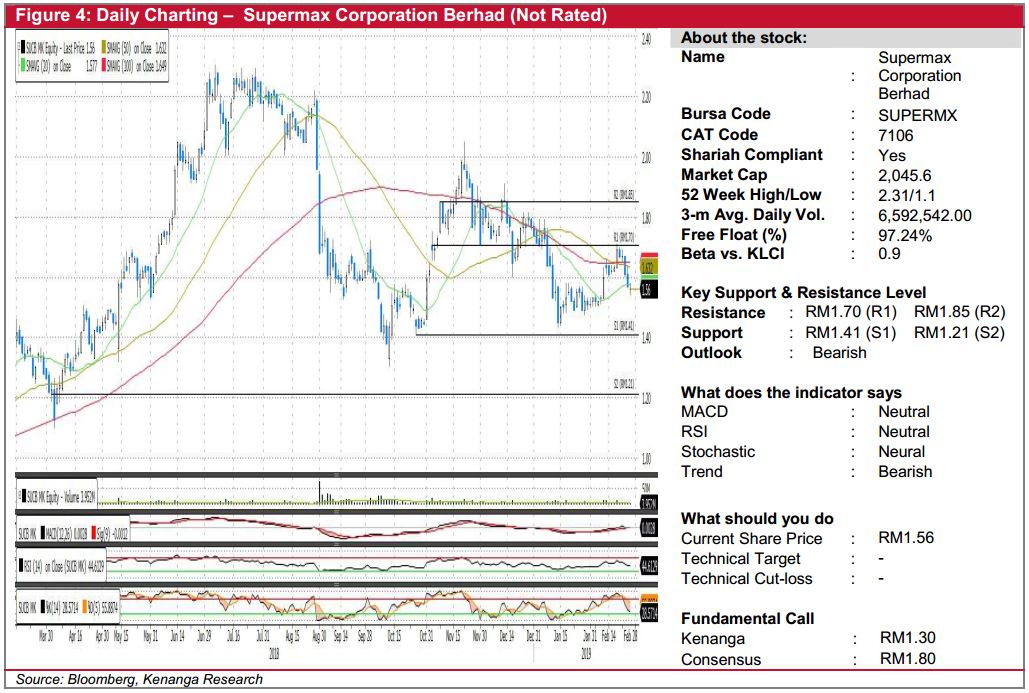

SUPERMX (Not Rated)

- Yesterday, SUPERMX lost 1.0 sen (-0.64%) to close at RM1.56.

- Chart-wise, the share seems to be undergoing a bearish momentum after losing c.7% over the past five-day. Notably, the share is currently trading below all of its SMAs as it closed below its 20-day SMA yesterday.

- Shorter-term SMAs are also trading below longer-term SMAs which indicate that the downtrend is still intact. We believe that there may be further downside owing to lacklustre key momentum indicators.

- Immediate support levels can be found at RM1.41 (S1) and RM1.21 (S2). Conversely, resistance can be identified at RM1.70 (R1) and RM1.85 (R2).

Source: Kenanga Research - 27 Feb 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Discussions

Be the first to like this. Showing 0 of 0 comments