Kenanga Research & Investment

Daily Technical Highlights – (MRCB, JAKS)

kiasutrader

Publish date: Thu, 09 May 2019, 09:05 AM

MRCB (Not Rated)

- Yesterday, MRCB slipped 1.0 sen (-0.97%) to close at RM1.02.

- The share has been on a rally since mid-Dec 2018, reaching a high of RM1.15.

- From a technical perspective, we believe that the share is likely to consolidate in the near-term, given that it failed to break above a significant level and as we observed lacklustre signals from key momentum indicators.

- Key resistance levels to look out for are RM1.06 (R1) and RM1.15 (R2).

- Any downward bias should see supports coming in at RM0.880 (S1) and RM0.785 (S2).

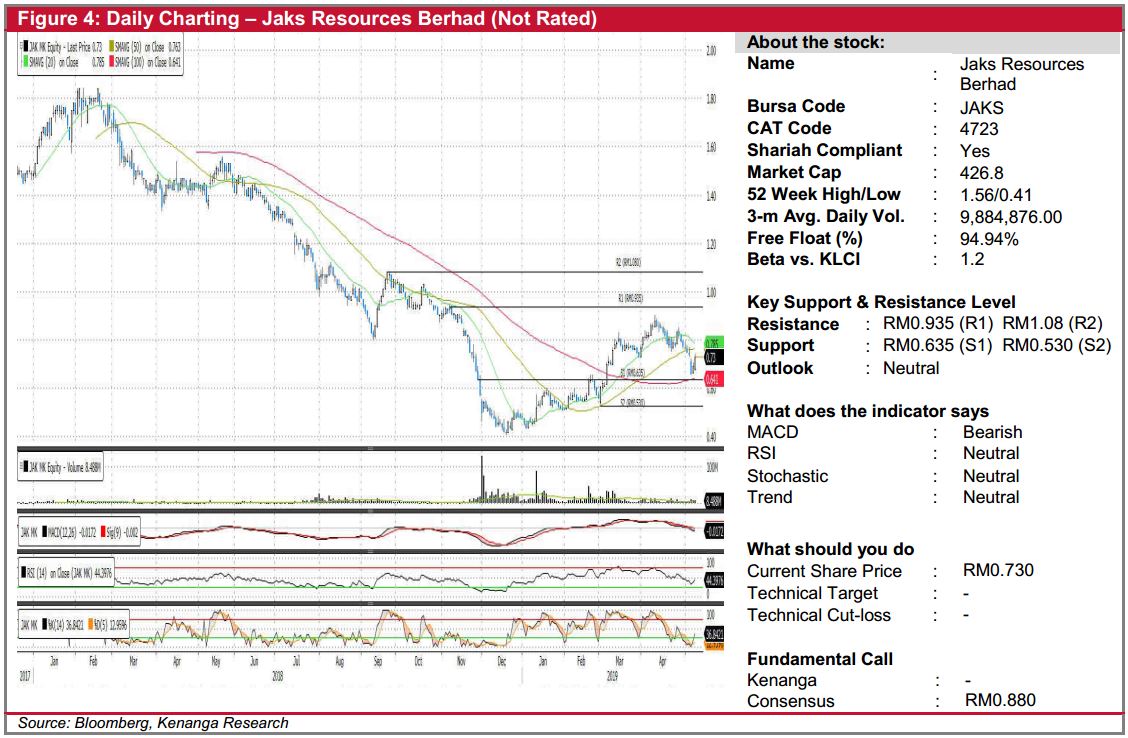

JAKS (Not Rated)

- JAKS gained 4.0 sen (+5.80%) yesterday to end at RM0.730.

- Chart-wise, the share has retraced following what seems to be a mini "head-and-shoulders" formation, finding support close to its 100-day SMA (at RM0.640-level).

- We believe that the retracement is likely to be over and that there is more room for upside given stochastic and RSI indicators, which have bounced from oversold/near oversold territory. Note that this could be a healthy retest of its 100-day SMA after breaking above it in early-Mar 2019.

- Should buying momentum continue, expect to see the share move to its resistance levels of RM0.935 (R1) and RM1.08 (R2).

- Conversely, support levels can be seen at RM0.635 (S1) and RM0.530 (S2).

Source: Kenanga Research - 9 May 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Bond Weekly Outlook - MGS/GII likely to rise amid ongoing US economic resilience

Created by kiasutrader | Nov 22, 2024

Discussions

Be the first to like this. Showing 1 of 1 comments

Tim2812

8811967.

2019-05-10 19:15