Kenanga Research & Investment

Daily Technical Highlights – (FRONTKN, VS)

kiasutrader

Publish date: Thu, 01 Aug 2019, 09:05 AM

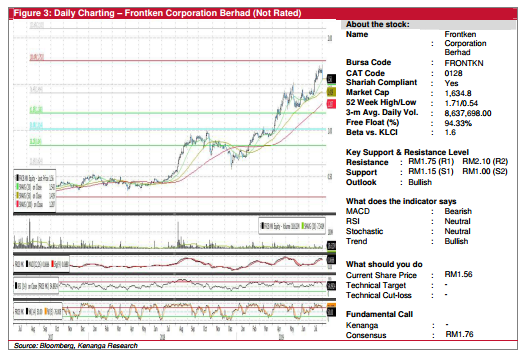

FRONTKN (Not Rated)

- Yesterday, FRONTKN lost 9.0 sen (-5.45%) to close at RM1.56.

- Chart-wise, the share has been on stable uptrend since the second half of 2018.

- Despite yesterday’s bearish candlestick, the share’s overall uptrend remains intact as the share persists to trade securely above its key SMAs.

- With no signs of overbought from its key momentum indicators, we expect the share to trend upwards to test its resistance levels at RM1.75 (S1) and RM2.10 (S2).

- Conversely, support levels can be identified at RM1.15 (S1) and RM1.00 (S2).

VS (Not Rated)

- VS was down by 1.0 sen (-0.83%) to end at RM1.20 yesterday.

- Chart-wise, the share has been trending upwards steadily since the end of last year.

- Albeit with yesterday’s decline, we note that the share has been finding comfort on its 20-day SMA, which has been providing a sturdy support to the share.

- Should bullish momentum persist, it is expected that the share to test its immediate resistance level of RM1.39 (R1), where a break above would see the share head towards RM1.74 (R2).

- Conversely, support levels can be identified at RM0.955 (S1) and RM0.800 (S2).

Source: Kenanga Research - 1 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Malaysia Consumer Price Index - Eases further to 1.7% in December, lowest in almost a year

Created by kiasutrader | Jan 22, 2025

Discussions

Be the first to like this. Showing 1 of 1 comments

Peter Chu

Lol

2019-08-02 19:52