Kenanga Research & Investment

Daily Technical Highlights – (MI, FRONTKN)

kiasutrader

Publish date: Tue, 27 Aug 2019, 10:02 AM

MI (Not Rated)

- MI gained 11.0 sen (+5.95%) to close at RM1.96 yesterday.

- We note that despite the FBMKLCI index’s decline, MI punched above its 100-day SMA with a long bullish candlestick, signifying strong buying momentum amidst the lacklustre local bourse.

- Key momentum indicators continue to display encouraging signals leading us to believe that a shift in the underlying trend could be on the cards.

- Key resistance levels to look at are RM2.02 (R1) and RM2.07 (R2). Conversely, support levels can be identified at RM1.86 (S1) and RM1.76 (S2).

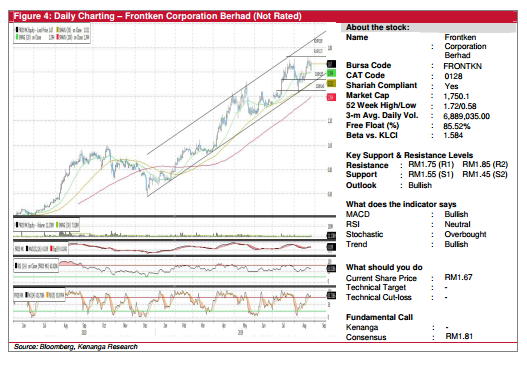

FRONTKN (Not Rated)

- FRONTKN gained 2.0 sen (+1.21%) to end at RM1.67 yesterday.

- Chart-wise, the share has shown a potential “Double-Top” chart pattern after it fails to break above the historical high at RM1.70 and formed a “Doji” candlestick pattern which indicating indecisive in the market.

- However, since the share is still trading above the upward trend line and the key SMAs, we opine that the bullish sentiment still remains intact until further bearish confirmation occurs that warrants a trend reversal.

- Should the share continue its upward movement, the resistance levels can be found at RM1.75 (R1) and RM1.85 (R2).

- Conversely, supports can be found at RM1.55 (S1) and RM1.45 (S2).

Source: Kenanga Research - 27 Aug 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments