Kenanga Research & Investment

Daily technical highlights – (OMESTI, QES)

kiasutrader

Publish date: Wed, 29 Apr 2020, 09:14 AM

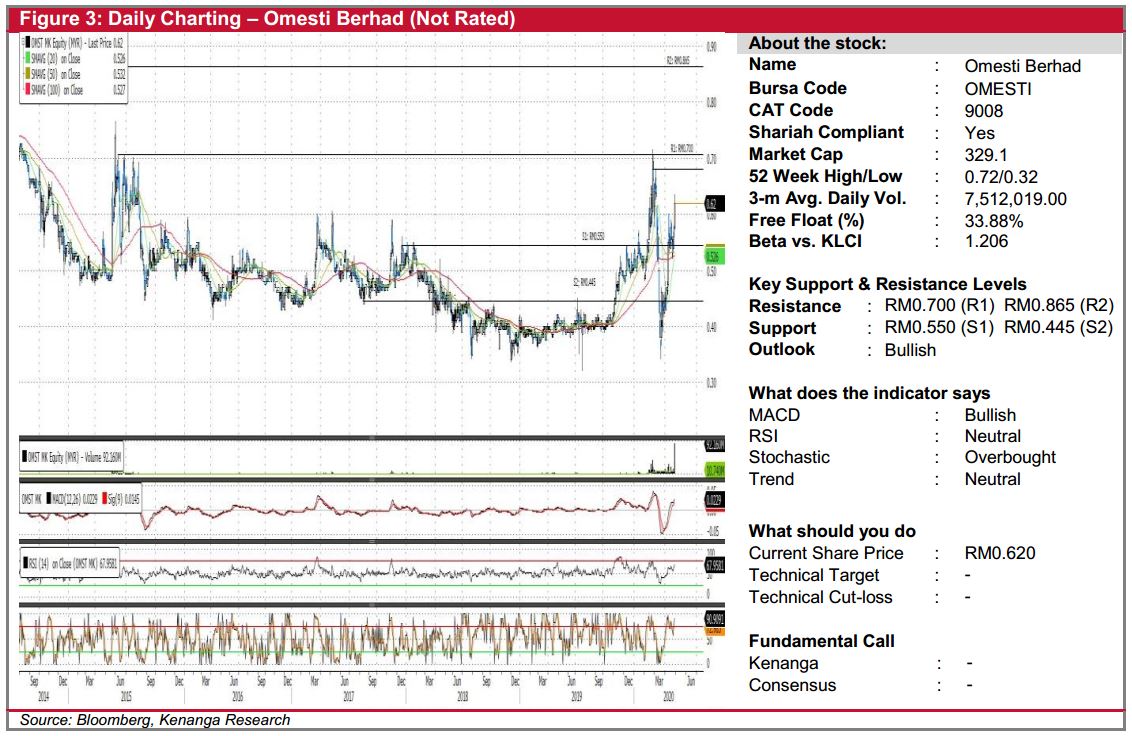

OMESTI (Not Rated)

- OMESTI rose 5.0 sen (+8.8%) to close at RM0.620 yesterday.

- Yesterday’s bullish candlestick closed higher on the back of stronger-than-average trading volume. Furthermore, there looks to be a forming “Golden Cross” as the 20-day SMA attempts to cross above the 50-day and 100-day SMAs, which signals strong potential for a continuation of the rally.

- Coupled with an uptick in key momentum indicators, we believe that the stock may be poised for more upside.

- Resistance levels can be seen at RM0.700 (R1) and RM0.865 (R2).

- Conversely, downside supports can be identified at RM0.550 (S1) and RM0.445 (S2).

QES (Not Rated)

- Yesterday, QES gained 1.0 sen (+6.7%) to end at RM0.160.

- Chart-wise, the stock has been on an uptrend since mid-March this year, which sees the stock currently trading above its 50- day and 100-day SMAs.

- Given the bullish MACD signal, we believe that there may be more upside.

- From here, overhead resistance is seen at RM0.185 (R1) and RM0.225 (R2).

- Conversely, support levels can be identified at RM0.100 (S1) and RM0.080 (S2).

Source: Kenanga Research - 29 Apr 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments