Kenanga Research & Investment

Kenanga Technical Watch - KSL Holdings

kiasutrader

Publish date: Mon, 18 May 2020, 09:27 AM

KSL Holdings (Trading Buy, TP: RM0.87, SL: RM0.56)

- KSL Holdings (KSL) is a cash-rich, profitable and undervalued property counter. Given these investment merits, the company is seen as a tempting privatisation target.

- The Johor-based property group has been consistently making money every year since its listing in Feb 2002, with its last three years’ net profit coming in at RM220.6m in FY17, RM223.2m in FY18 and RM247.2m in FY19.

- Interestingly, the Group is sitting on a cash pile of RM258.3m as of end-Dec last year, equivalent to 25 sen per share which accounts for 41% of its last traded price of RM0.615.

- The stock is presently trading at a low PBV multiple of just 0.20x or -1.5SD below its historical mean. This is attractive, hovering at a steep 80% discount to its latest BV per share of RM3.01.

- Even the major shareholders of KSL – the Ku Family – seem to believe that the stock is undervalued. On 6 May this year, they scooped up 35.9m shares (at an average price of RM0.61 per share) via off-market transactions to raise their combined stake by 3.5% to 57% (direct and indirect holdings).

- Assuming a valuation reversion to mean PBV multiple of 0.29x, this would peg the stock at a fair value of RM0.87 (representing a 41% potential return).

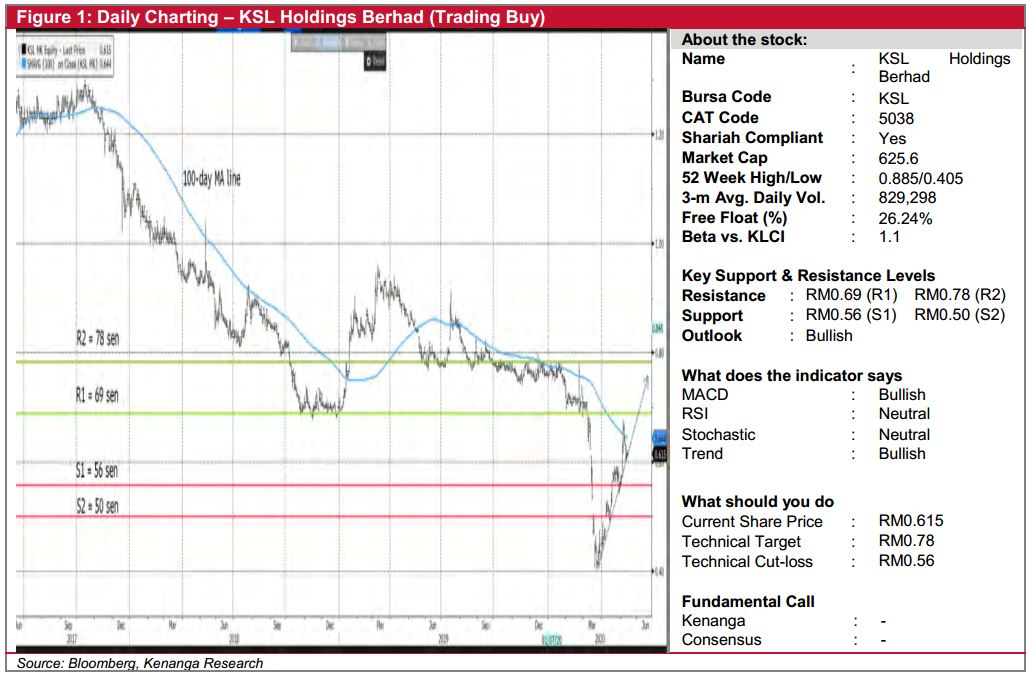

- On the chart, the stock has slid from a peak of RM2.49 in Sep 2014 to a trough of RM0.405 in late Mar this year before rebounding subsequently to close at RM0.615 last Friday. Riding on an upward sloping trendline, KSL is poised to challenge the immediate resistance target of RM0.69 (R1) (+12% potential upside).

- A convincing breakout from R1 – which is to be confirmed when the share price crosses over its 100-day MA line – could then propel the counter to test the next resistance threshold of RM0.78 (R2) (+27% potential upside), as the stock makes its way towards our fundamentally-derived fair value of RM0.87.

- On the downside, we have set our stop loss at our first support level of RM0.56 (S1) (or 9% downside risk).

Source: Kenanga Research - 18 May 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

- Ringgit Weekly Outlook Fairly balanced risks, but potential USD rebound looms over risk assets

Created by kiasutrader | Nov 29, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments