Kenanga Research & Investment

Daily technical highlights – (MGRC, GREATEC)

kiasutrader

Publish date: Thu, 18 Jun 2020, 09:04 AM

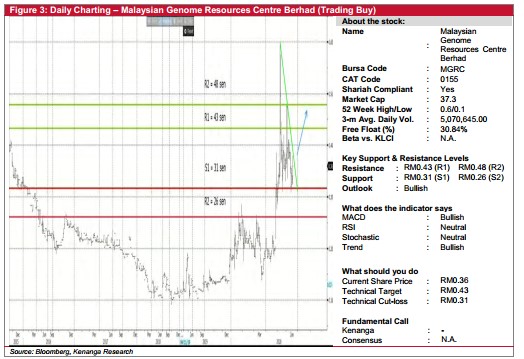

Malaysian Genomics Resource Centre Bhd (Trading Buy, TP: RM0.43, SL: RM0.31)

- Malaysian Genomics Resource Centre Bhd (MGRC) shares could see a technical breakout from its consolidation pattern soon.

- Looking back, the stock has tripled from RM0.20 on 24 Apr this year to hit a high of RM0.60 on 12 May, before trending down to as low as RM0.31 last Friday.

- Its price action back then followed some interesting changes of key shareholders in the company. Synamatix (which previously held a 56.4% stake and is partly owned by Khazanah Nasional) has exited the company while Crest Advisory (a private equity entity with a 28.0% stake) and an individual by the name of Liw Chai Yuk (7.8%) have emerged as the new substantial shareholders of MGRC. It may also be worthy to note that Tan Sri Ahmad Mohd Don (former Bank Negara Malaysia Governor) has been appointed as an independent director in the company in early May.

- The Group – currently involved in the genetic screening services business following the divestment of MPath Group (which provides pathological and medical laboratory services) in Dec 2019 for RM42.0m – is presently on the lookout for new opportunities in the healthcare sector.

- It posted a marginal net loss of RM1.7m for the Jan-Mar 2020 quarter. The Group is debt-free, sitting on a cash pile of RM9.5m (or 9.2 sen per share) with net book value per share of RM0.12 as of end-Mar 2020.

- On the chart, the stock has recovered from its recent low to close at RM0.36 yesterday amid rising trading volume. A breakout from the downward sloping trendline that stretches back to its recent peak would then signal a resumption of the positive momentum.

- This could then push the share price towards our resistance targets of RM0.43 (R1) and RM0.48 (R2), representing potential upsides of 19% and 33%, respectively.

- In terms of downside risks, our support levels are set at RM0.31 (S1) and RM0.26 (S2), or 14% and 28% below its last closing price.

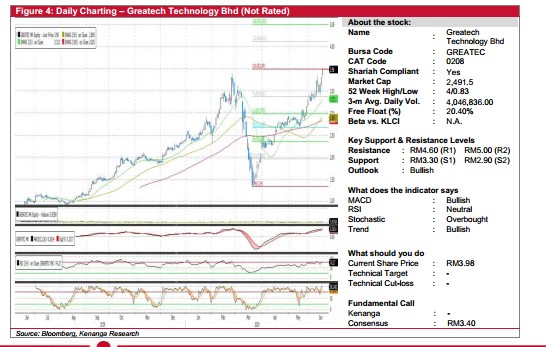

GREATEC (Not Rated)

- GREATEC gained 18.0 sen (+4.74%) to close at RM3.98 yesterday.

- Chart-wise, the stock has broken above the previous high yesterday, backed by higher-than-average trading volume.

- Given the bullish MACD signal and upticks from key momentum indicators, the stock may continue to trend higher.

- Key resistance levels are seen at RM4.60 (R1) and RM5.00 (R2).

- Conversely, support levels can be identified at RM3.30 (S1) and RM2.90 (S2).

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments