Kenanga Research & Investment

Daily Technical Highlights – (ADVCON, OMESTI)

kiasutrader

Publish date: Tue, 30 Jun 2020, 10:51 AM

Advancecon Holdings Bhd (Trading Buy)

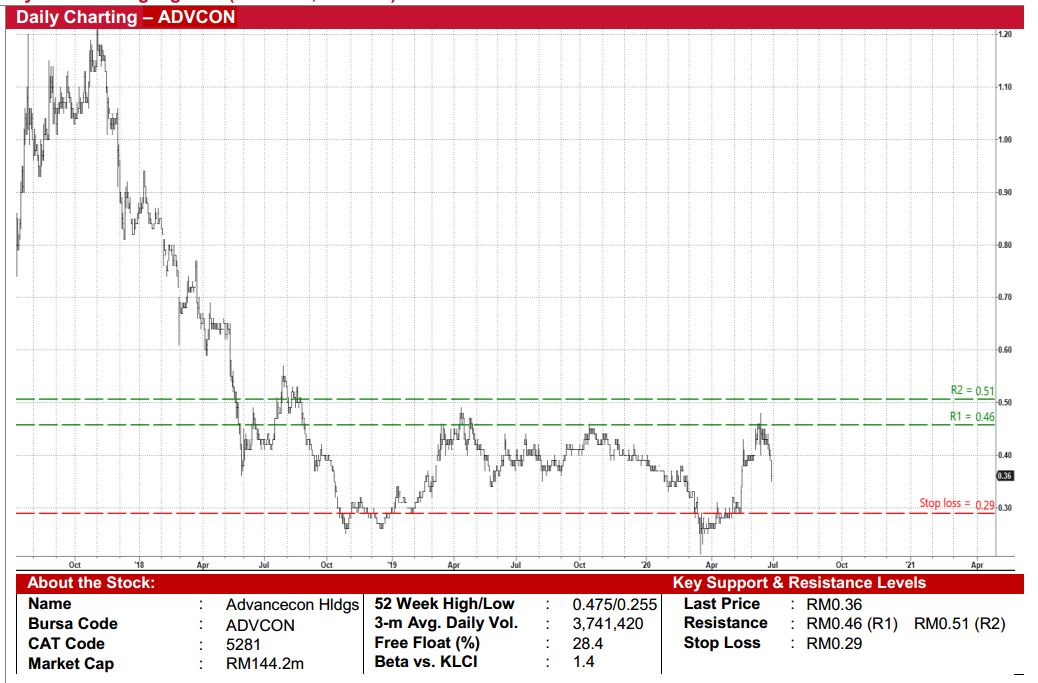

- ADVCON’s share price jumped from RM0.29 in mid-May to as high as RM0.48 in mid-Jun before pulling back gradually to settle at RM0.36 yesterday.

- On the back of a potential technical rebound, the shares could climb to challenge our resistance lines of RM0.46 (R1) and RM0.51 (R2), which imply potential upsides of 28% and 42%, respectively.

- We have pegged our stop loss level at RM0.29, representing a downside risk of 19%.

- Meanwhile, the Group has just inked a MOU to develop a rooftop solar photovoltaic system in Malacca under a build-own operate-transfer model for the Net Energy Metering scheme in Malacca. This is a positive development as ADVCON continues to pursue its strategy to diversify from the existing business of providing earthworks and civil engineering services in the construction industry to venture into the renewable energy sector.

OMESTI BHD (Trading Buy)

- OMESTI’s share price has been swinging up and down within a trading range in recent years.

- After pulling back from a recent high of RM0.65 to close at RM0.505 yesterday, the stock may be on its way to stage a technical rebound.

- On the chart, we have identified our resistance target at RM0.59 (R1), which offers a potential upside of 17%.

- A breakout from R1 could subsequently lift the stock towards our next resistance line of RM0.65 (+29% potential upside).

- On the downside, our stop loss level is set at RM0.44 (-13% from its last done price).

- In terms of corporate development, OMESTI’s 30:70 joint investment vehicle with CRIF has just been granted a credit reporting agency licence by the Ministry of Finance, which would pave the way for OMESTI to be involved in the provision of credit scoring and analytics services in Malaysia.

Source: Kenanga Research - 30 Jun 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments