Kenanga Research & Investment

Daily technical highlights – (LYC, NTPM)

kiasutrader

Publish date: Wed, 01 Jul 2020, 09:57 AM

LYC Healthcare Bhd (Trading Buy)

- After rising from RM0.12 on 19 March to hit a high of RM0.54 on 1 June, LYC’s share price subsequently pulled back by as much as 52% to a low of RM0.26 recently before closing at RM0.33 yesterday.

- On the chart, its RSI indicator – which has been sliding towards the oversold territory in tandem with the share price weakness – saw a tick-up recently, possibly indicating that a short-term trend reversal may be underway.

- A likely rebound could push the stock to reach our resistance target of RM0.39 (R1), before challenging the next resistance level of RM0.44 (R2) thereafter. This represents potential returns of 18% and 33%, respectively.

- Our stop loss threshold is pegged at RM0.28 (or 15% downside risk).

- Meanwhile, pursuant to an ongoing private placement exercise involving the issuance of up to 30% of its share base (representing 107.2m shares), LYC’s major shareholder Lim Yin Chow (who currently holds a 18.3% stake) has stated his intention to take up any unsubscribed portion of up to 50.0m shares. This could be a seen as a vote of confidence in the Group’s fundamentals from its substantial shareholder.

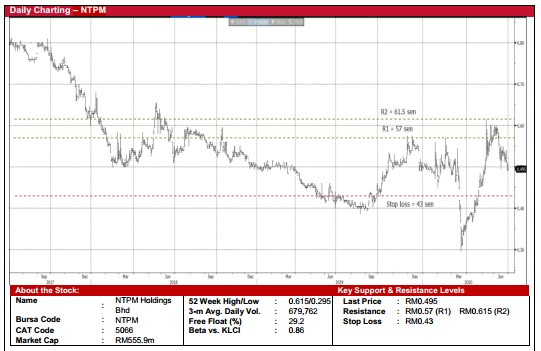

NTPM Holdings Bhd (Trading Buy)

- After the March market meltdown, NTPM’s share price has since recovered from a trough of RM0.295 to peak at RM0.615. It saw a subsequent correction and settled at RM0.495 yesterday.

- On the chart, the stock is looking to find support around the current price levels. This could then pave the way for its shares to resume its uptrend soon.

- Riding on the positive momentum, its share price will probably climb to our resistance target of RM0.57 (+15% potential upside), before testing the next resistance line of RM0.615 (+24% potential upside).

- On the downside, the stop loss level is set at RM0.43 (-13% downside risk).

- Fundamentally, NTPM stood out in the current result reporting season with a better earnings performance (unlike the majority of listed companies which were hit by the Covid-19 restrictions). It posted net profit of RM4.1m in the Feb-Apr quarter (versus net loss of RM4.9m in the previous year) on the back revenue of RM201.6m (+11% YoY) as the Group (which is involved in the business of tissue paper and personal care products) remains largely unaffected by the Covid-19 pandemic.

Source: Kenanga Research - 1 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments