Kenanga Research & Investment

Daily technical highlights – (KNM, ASTRO)

kiasutrader

Publish date: Wed, 08 Jul 2020, 09:37 AM

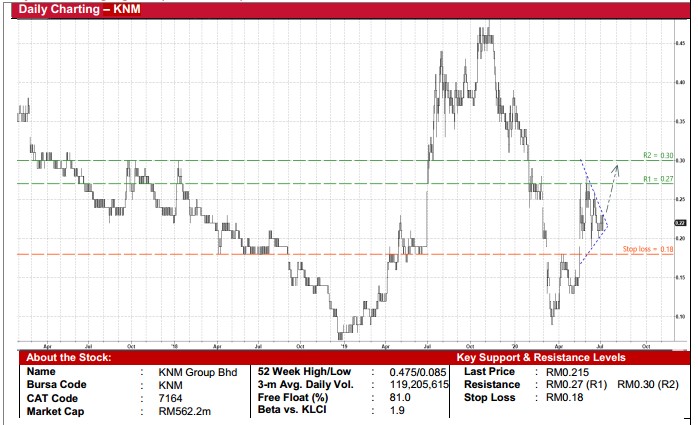

KNM Group Bhd (Trading Buy)

- KNM has just announced that it has entered into a Heads of Joint Venture Agreement with ADAP Capital (a Sarawak based Bumiputera-controlled company) to set up a 49%:51% joint venture company to undertake oil, gas and petrochemical projects in Sarawak, specifically relating to: (a) EPC contracts for oil, gas & petrochemical plants; (b) manufacture and supply of process equipment, tanks, piping and structures for oil, gas & petrochemical plants; and (c) build, own and operate strategic projects. If the plan materialises, KNM will then get to participate in the promising oil & gas market in Sarawak going forward.

- From a technical perspective, the stock could break out from a symmetrical triangle pattern soon, probably climbing towards our resistance target of RM0.27 (R1) (+26% potential upside). A further lift may push the share price to the next resistance level of RM0.30 (R2) (+40% potential upside).

- We have pegged our stop loss level at RM0.18 (or 16% downside risk).

- Fundamentally, the Group recently reported a net profit of RM20.3m (+10% YoY) on the back of revenue of RM336.6m (- 7% YoY) in its 1QFY20 results.

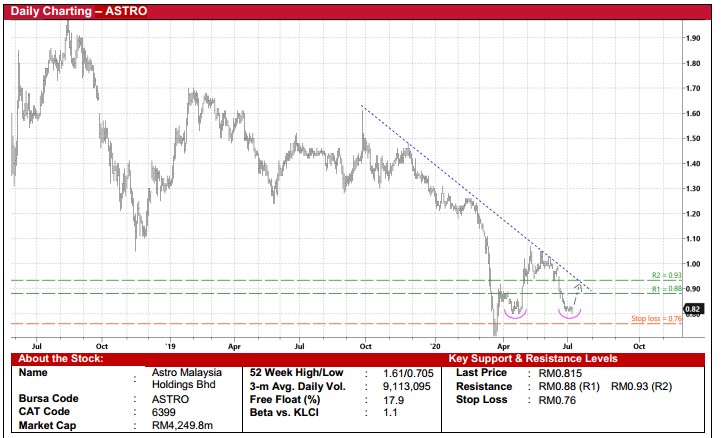

Astro Malaysia Holdings Bhd (Trading Buy)

- ASTRO will appeal to income-seeking investors with its attractive dividend returns amid a possible market correction from an overbought position.

- On the chart, the stock could stage an intermediate technical rebound after plotting a double bottom formation. This may then push the stock to test our immediate resistance target of RM0.88 (R1) (+8% potential upside). Beyond R1, its further upward movements may be capped at our next resistance barrier of RM0.93 (R2) (+14% potential upside) and a negative sloping trendline.

- Our stop loss level is set at RM0.76 (or 7% downside risk).

- Against a backdrop of challenging industry landscape, there is a possibility that ASTRO may cut its future dividends to conserve cash. Consensus is already anticipating likely lower dividend payments with DPS estimated to decrease from 7.5 sen in FYJan20 to 5.9 sen in FYJan21. Still, based on the reduced dividend forecast for the current financial year, ASTRO is presently trading at a generous dividend yield of 7.2%, thus providing near-term share price support

Source: Kenanga Research - 8 Jul 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments