Kenanga Research & Investment

Daily Technical Highlight - (MASTER, DAIBOICI)

kiasutrader

Publish date: Fri, 07 Aug 2020, 12:13 PM

Master-Pack Group Bhd (Trading Buy)

- MASTER - a manufacturer of corrugated cartons which are fully recyclable - is set to capitalize on new business opportunities arising from the current pandemic, given the higher adoption rate in online shopping which translates to higher demand, especially from its customers in the Food & Beverage and Medical sectors (which supply essential items).

- Chart-wise, the stock has continued to close higher after plotting higher lows in the past 5 months to form an ascending triangle. With that, we believe the stock could be heading for a breakout.

- Our overhead resistance levels are pegged at RM2.25 (R1) and RM2.60 (R2), which represents potential upsides of +16% and +34%, respectively.

- Meanwhile, our stop loss level is set at RM1.70 (12% downside risk).

- Fundamentally, the group has experienced strong growth with its net profit growing by 5x to RM15.7m in FY19 over a period of 5 years while its balance sheet is strong, backed by net cash position of RM17.6m (or 32 sen per share) as of end-1QFY20. The stock is currently trading at an undemanding historical PER of 6.7x.

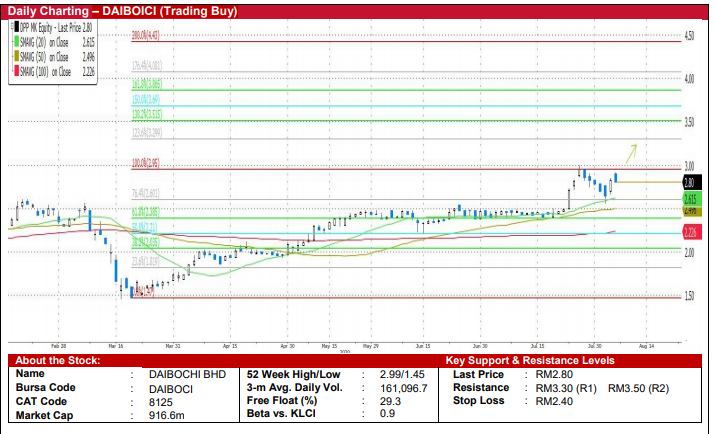

Daiboici Bhd (Trading Buy)

- Post the mandatory general offer (MGO) in April last year, DAIBOCI is now a packaging company that is 62%-owned by SCIENTX.

- The company – which focuses on flexible packaging - is expected to benefit from the pandemic given the rising demand for ready-made food and beverage products.

- Moreover, the group has further invested a capex of RM60m to enhance its capabilities and services to its customers with the purchase of 13 new lines in Malacca, which is expected to improve its production capacity by c.20% (and translate to better sales).

- Technically speaking, its 20-day SMA line is expected to provide a strong support as the stock has rebounded after 5 consecutive bearish candles in the period of late-July to early August this year. Given that all key SMAs continue to display a healthy upward bias, we thus believe the price uptrend could persist.

- Our overhead resistance levels are plotted using a Fibonacci projection, with R1 set at RM3.30 and R2 at RM3.50. This translates to upside potentials of 18% and 25%, respectively.

- We have placed our stop loss level at RM2.40 (representing a downside risk of 14%).

- Fundamentally, consensus is projecting FY20E/FY21E net incomes of RM48.5m (+280.3% YoY) and RM53.8m (+10.9% YoY). This translates to forward PERs of 20x and 19x, respectively.

Source: Kenanga Research - 7 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments