Daily technical highlights – (HUPSENG, PADINI)

kiasutrader

Publish date: Thu, 13 Aug 2020, 10:49 AM

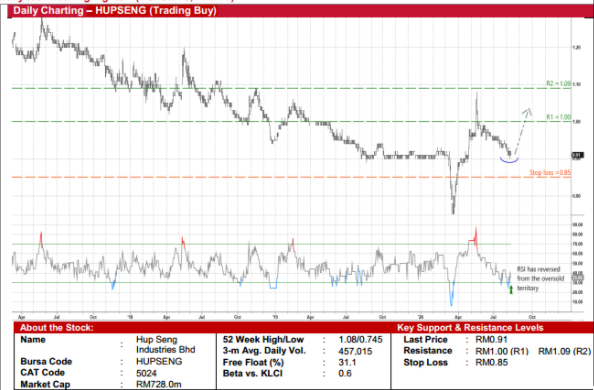

Hup Seng Industries Bhd (Trading Buy)

• HUPSENG – which is involved in the manufacture and sales of biscuits, beverages and confectionery food items – has been making annual net profits of more than RM40m in the past five years. The Group has just announced a net profit of RM8.8m (-2% YoY) in 2QFY20, taking its first half’s earnings to RM18.5m (-3% YoY).

• Using consensus net profit estimates of RM42m for FY Dec 2020 and RM44m for FY Dec 2021, the stock is currently trading at forward PERs of 17.3x this year and 16.5x next year.

• HUPSENG (which has consistently paid out DPS of 6.0 sen p.a. over the last four years) offers an attractive dividend yield of 6.6% based on consensus FY20 DPS forecast of 6.0 sen. The Group is currently debt-free with cash backing of RM71.9m (or 9 sen per share) as of end-June 2020.

• On the chart, after touching a high of RM1.08 in May this year, the stock has slipped gradually over the past 3 months to close at RM0.91 yesterday.

• A technical rebound could be seen ahead as its RSI indicator climbs out from an oversold position. This may then lift the stock towards the resistance thresholds of RM1.00 (R1) and RM1.09 (R2), representing upside potentials of 10% and 20%, respectively.

• Our stop loss level is set at RM0.85 (7% downside risk).

Padini Holdings Bhd (Trading Buy)

• PADINI – a home grown fashion company with its own brand labels and operates over 140 stores in Malaysia – has a steady financial track record with historical annual net profits ranging between RM137m and RM183m in the last four years.

• The Group – which made net earnings of RM16.6m (-52% YoY) in 3QFY20, thus bringing its 9-month result to RM92.0m (-13% YoY) – is projected to register annual net profit of RM105m in FY Jun 2020 and RM132m in FY Jun 2021 based on consensus numbers. This works out to forward PERs of 13.5x this year and 10.8x next year.

• In addition, the Company (which has declared dividends of 11.5 sen p.a. over the last four years) is forecasted to pay DPS of 9.5 sen in FY Jun 21, which implies a decent dividend yield of 4.4% based on yesterday’s closing price of RM2.16.

• Technically speaking, PADINI shares look interesting from a risk-reward perspective. The stock has fallen from RM2.82 in May to as low as RM2.01 in early August. It ended at RM2.16 yesterday.

• Following a brief consolidation period, PADINI could ride on an ensuing technical rebound to test the resistance levels of RM2.49 (R1) and RM2.69 (R2). This represents upside potentials of 15% and 25%, respectively.

• We have set our stop loss level at RM1.95 (10% downside risk).

Source: Kenanga Research - 13 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024