Kenanga Research & Investment

Daily technical highlights – (SOP, JHM)

kiasutrader

Publish date: Fri, 14 Aug 2020, 10:24 AM

Sarawak Oil Palms Bhd (Trading Buy)

- Sarawak Oil Palms is the business of cultivation of oil palm plantation, milling, refining of oil palm products and trading of oil palm products.

- The group has increased its net income for 3 consecutive quarters on the back of better CPO prices. Based on its current quarter results (1QFY20), the group made a core net income of RM41m (+28% QoQ). The coming quarter earnings is expected to hold too given the pent-up demand (partly due to the Deepavali festival in November).

- Based on consensus estimates, the group’s net incomes are forecasted at RM111.0m (+23.5% YoY) in FY20E and RM148.0m (+33% YoY) in FY21E. This translates to forward PERs of 18x and 15x, respectively.

- Chart-wise, the stock has been trending in an upward sloping channel since the March market melt-down while forming higher lows. Given its rising RSI indicator from an oversold region and backed by above average trading volume, we thus believe the price uptrend could persist.

- With that, our overhead resistance levels are set at RM3.95 (R1) (+10% potential upside) and RM4.20 (R2) (+17% potential upside).

- Meanwhile, our stop loss is set at RM3.35 (-7% downside risk).

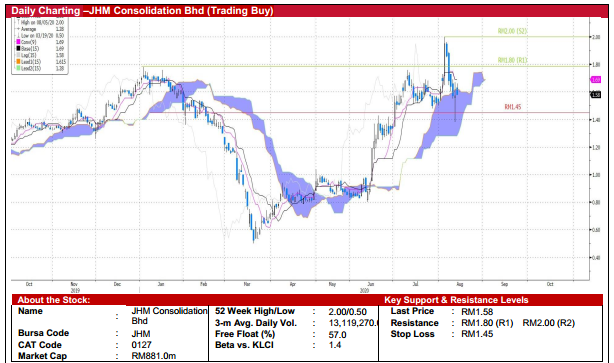

JHM Consolidation Bhd (Trading Buy)

- JHM is engaged in the: (i) production of precision miniature engineering metal parts and components, (ii) assembly of electronic components using surface mount technology, (iii) assembly of automotive rear lighting, and (iv) production of light emitting diode’s application to support 3D effects.

- The company is expected to see its automotive LED orders ramp up by 4x of its normal capacity given the strong rebound in car sales, despite the Covid-19 impact. Besides that, the group is working with a US customer on Electric Vehicle & Autonomous Vehicle charging stations to be deployed globally.

- Ichimoku-wise, the stock’s “Kumo Cloud” serves as a strong support as seen in the formation of a long wick candle recently. In addition, with the Kumo Cloud still indicating an upward bias, we thus believe the stock’s upward momentum will persist.

- Our overhead resistance levels are set at RM1.80 (R1) and RM2.00 (R2), which translates to upside potentials of 14% and 27%, respectively.

- Our stop loss is pegged at RM1.45 (-8% downside risk).

- Based on consensus estimates, the group is expected to make net profits of RM29.8m (-0.1% YoY) in FY20E and RM44.8m (+50.3% YoY) in FY21E. This translates to forward PERs of 28.7x and 19.5x, respectively.

Source: Kenanga Research - 14 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments