Weekly Technical Review - 24 August 2020

kiasutrader

Publish date: Mon, 24 Aug 2020, 03:40 PM

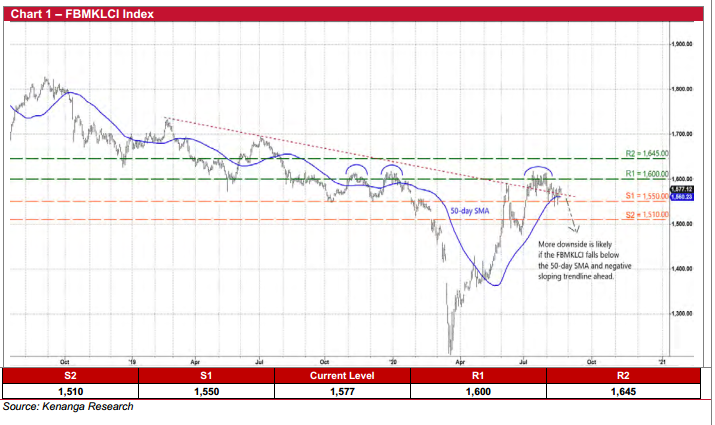

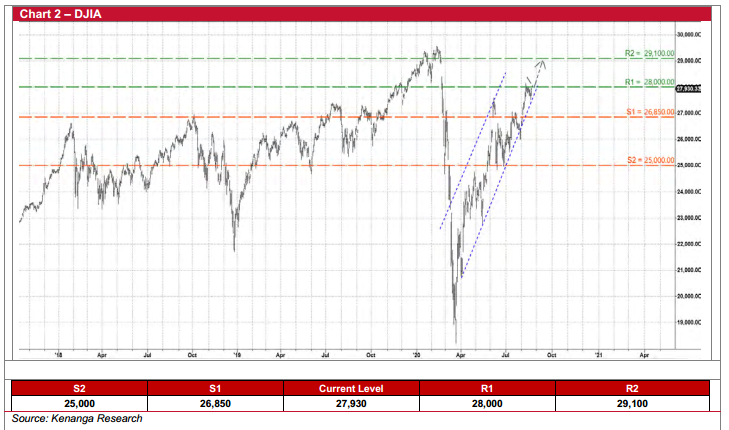

As volatility rises, the Malaysian stock market is expected to face persistent headwinds going forward. The key FBMKLCI fluctuated between 1,543 and 1,584 during the holiday-shortened week before closing at 1,577 last Friday. This translates to a weekly increase of 12.5 points or 0.8%. On Wall Street, after posting strong gains recently, the DJIA ended little changed last week at 27,930 (compared with the previous Friday’s closing level of 27,931).

With investor sentiment turning cautious, trading activity slowed to a daily average volume of 8.9b shares valued at RM6.0b last week, down from the 17.8b shares worth RM6.7b traded the week before. Meanwhile, foreign investors were net sellers on our local bourse again with a net selling value of RM344m last week, reversing the net inflows of RM274m registered in the prior week (which marked the first time in 26 weeks that saw net foreign buying).

On the news front, the week ahead will be filled with a flood of earnings announcements from listed companies, which must release their April to June quarterly report cards by end-August. Among which, the more keenly awaited results will be from the likes of Kossan Rubber (on Tuesday), CIMB (Wednesday), Genting Bhd, Genting Malaysia, Maybank (all on Thursday) and Tenaga (Friday). In terms of macro-economic data, the external trade statistics for July is due on Friday.

From a technical perspective, the key FBMKLCI is expected to show a negative bias, probably swinging down towards our support lines of 1,550 (S1) and 1,510 (S2) amid profit-taking activities. On the chart, a break beneath a downward sloping trendline and its 50-day SMA line could see the benchmark index plotting lower lows ahead. We are keeping our resistance barriers at 1,600 (R1) and 1,645 (R2), posing as road-blocks to the upside of the market barometer.

Separately, the DJIA on Wall Street may continue its consolidation pattern after its recent sharp rally. With its upward sloping channel pattern still intact, we are maintaining our key support and resistance levels at 26,850 (S1) / 25,000 (S2) and 28,000 (R1) / 29,100 (R2), respectively.

Source: Kenanga Research - 24 Aug 2020

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024