Daily technical highlights - (JOHOTIN, MINETEC)

kiasutrader

Publish date: Fri, 28 Aug 2020, 12:49 PM

Johore Tin Berhad (Trading Buy)

• JOHOTIN is engaged in the: (i) manufacturing of tins, cans and other containers, (ii) manufacturing and selling of milk and other related dairy products, and (iii) investment holding.

• In the latest quarterly results, the group saw an improvement in its net income for 2QFY20 to RM11.1m (+146% QoQ). This was due to better margins in its F&B segment (+6bps QoQ), which contributed c.80% to PBT, backed by better cost rationalisation and product mix. The group expects its F&B segment to remain profitable given the strong demand for milk.

• Consensus is projecting net income estimates of RM40.5m (-16% YoY) in FY20E and RM51.9m (+28.1% YoY) in FY21E, which translates to forward PERs of 12x and 9x, respectively.

• Balance-sheet wise, JOHOTIN is currently in a net cash position of RM14.1m (translating to 4.5 sen per share) as of the latest quarter.

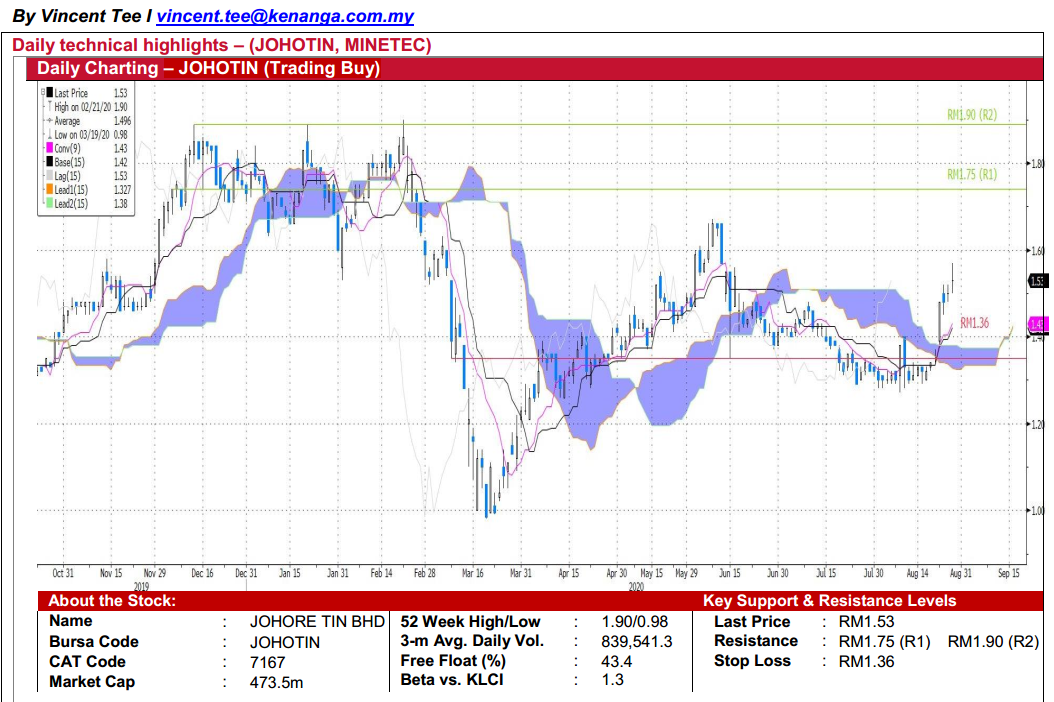

• The stock has experienced a retracement since June before re-gaining some buying interest as seen in the consolidation pattern from mid-July to mid-August this year.

• Ichimoku-wise, the stock has shown a “Kumo Breakout” backed by above average trading volumes. Should the buying momentum persist, we expect the bullish Kumo Cloud to push the stock to test our overhead resistance levels at RM1.75 (R1, potential upside of +14%) and RM1.90 (R2, potential upside of +24%).

• Meanwhile, our stop loss is set at RM1.36 (11% downside risk).

Minetech Resources Bhd (Trading Buy)

• MINETEC’s principal activities are in: (i) EPCC (Engineering, Procurement, Construction & Commissioning), (ii) quarry, premix and bituminous products, and (iii) energy.

• The company recently saw the entry of a new major shareholder Dato’ Awang Daud bin Awang Putera (a co-founder of Serba Dinamik ), who holds a 23.4% stake in the company following his most recent purchase of 10.9m shares as of 18th June 2020.

• With a new management on board, the group currently has an active tender book of RM1.2b. Also, the group is currently constructing its 1st solar plant in Manjung, Perak which has a 21-year concession and is expected to be ready by 2021, thus ensuring forward earnings visibility.

• Chart-wise, the stock has retraced from its all-time high of RM0.355 (on 9 July this year) before finding support recently at its 100-day key SMA line. Coupled with a bottoming RSI and a potential bullish MACD crossover in sight, we thus believe there could be a potential price trend reversal ahead.

• With that, our overhead resistance levels are set at RM0.330 (R1) and RM0.355 (R2), which translates to upside potentials of 22% and 31%, respectively.

• On the flipside, our stop loss is set at RM0.225 (-17% downside side risk).

Source: Kenanga Research - 28 Aug 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024