Daily Technical Hightlight - (MGRC, PWROOT)

kiasutrader

Publish date: Fri, 04 Sep 2020, 11:44 AM

Malaysian Genomics Resources Centre Bhd (Trading Buy)

• MGRC was previously involved in the business of providing clinical pathology and medical laboratory services via MPath group (which contributed c.99% of FY19 revenue).

• However, post the disposal of MPath group in Dec 2019 for RM42.0m, MGRC now plans to leverage on its expertise in marketing and distribution in the clinical pathology business by adding companion diagnostic and cancer immunotherapy to its products portfolio.

• On June 30th 2020, the group announced that it has secured a 20-year exclusive licensing rights for Malaysia, Singapore, Thailand and 5 other South East Asian countries for CAR T-cell therapy for solid cancers of organs (such as liver, pancreas and stomach) under a tripartite licensing agreement signed recently with ICARTAB Biomedical (iCARTab) and Advance Immune Therapeutics (AIT).

• Financially, MGRC is a debt-free company with RM6.0m in cash, which translates to 5.8 sen/share.

• On the chart, the stock has retraced from an all-time high of RM0.84 on 7th August 2020. Since then, the stock has been consolidating near the bullish Kumo Cloud while forming higher lows. A pennant pattern is also in sight, which indicates signs of a potential breakout.

• Should the buying momentum return, our overhead resistance levels are set at RM0.62 (R1) and RM0.71 (R2), which translates to potential upsides of 16% and 33%, respectively.

• Our stop loss is set at RM0.47 (-12% downside risk).

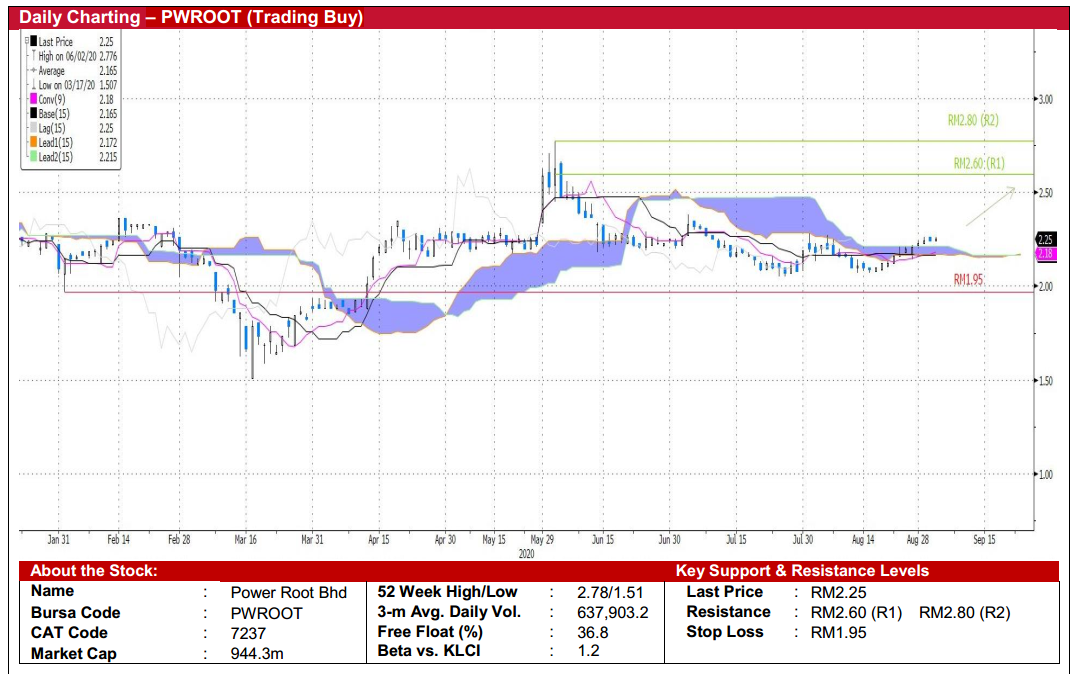

Power Root Bhd (Trading Buy)

• PWROOT is engaged in the production of pre-mixed instant powder beverages in Malaysia. The group manufactures and distributes its beverage products in the FMCG (Fast Moving Consumer Good) segment.

• The group saw its 1QFY21 net income declined to RM10.7m (-15% QoQ) due to lower sales at shopping malls following the implementation of the movement control order (MCO) in March. Nevertheless, sales are on the recovery since the relaxation of the MCO in May.

• Consensus is currently projecting net incomes of RM53.7m (+4.6% YoY) in FY21E and RM59.7m (+11.1% YoY) in FY22E, which translates to forward PERs of 17x and 16x, respectively.

• Chart-wise, the stock has been consolidating within the range of RM2.06 to RM2.28 since early-July. Ichimoku-wise, the stock has broken above the Kumo Cloud, indicating that it could potentially continue its upward momentum.

• With that, our resistance levels are set at RM2.60 (R1) (+16% potential upside) and RM2.80 (R2) (+24% potential upside). • Our stop loss level is pegged at RM1.95 (-13% downside risk)

Source: Kenanga Research - 4 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024