Kenanga Research & Investment

Daily technical highlights – (HEVEA, LATITUD)

kiasutrader

Publish date: Wed, 09 Sep 2020, 10:55 AM

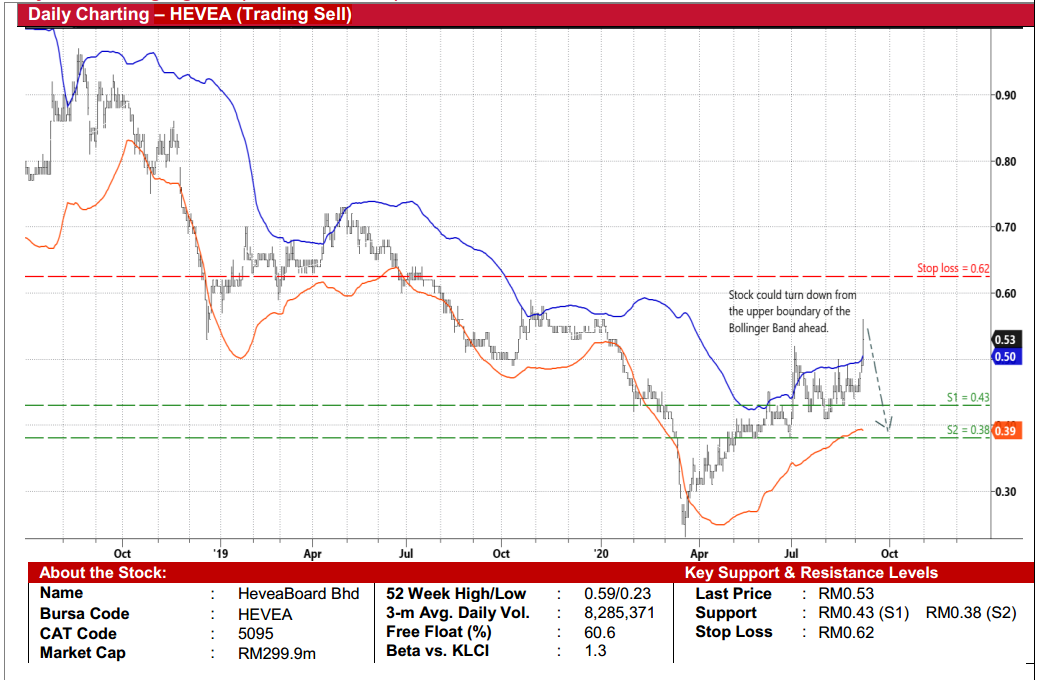

HeveaBoard Bhd (Trading Sell)

- We are recommending a Trading Sell / Take Profit on HEVEA shares, which jumped to a high of RM0.555 before closing at RM0.53 yesterday, exceeding our technical target price of RM0.50 set when we made our Trading Buy call on 2 July.

- Technically speaking, the stock is expected to retrace after breaching the upper boundary of its Bollinger Band (which indicates an overbought position).

- With that, HEVEA’s share price could pull back to RM0.43 (S1) and RM0.38 (S2), which represents downside potentials of 19% and 28%, respectively.

- Our stop loss level is pegged at RM0.62 (translating to an upside risk of 17%).

- From a fundamental perspective, HEVEA posted net loss of RM4.5m in 2QFY20 (versus 2QFY19’s net profit of RM1.3m), which then hit its 1HFY20’s bottomline with net loss of RM2.6m (versus 1HFY19’s net profit of RM3.3m), as the Group’s businesses (in the manufacturing of particleboard and ready-to-assemble furniture) were affected by the disruptions caused by the Covid-19 outbreak.

- Given the dismal half-time performance, the Group may struggle to meet current consensus full-year expectations for net earnings of RM11m in FY20 and RM16m in FY21.

Latitude Tree Holdings Bhd (Trading Sell)

- Against a wobbly market backdrop, LATITUD’s steep share price hike to RM2.81 before closing at RM2.44 yesterday has prompted us to recommend a Trading Sell. Our previous Trading Buy call was made on 2 July with a technical target price of RM2.60.

- The stock is expected to back off from a multi-year negative sloping trendline while its RSI indicator is already reversing from an overbought territory.

- On the chart, LATITUD shares could pull back to RM2.15 (S1) and RM1.88 (S2), which represents downside potentials of 12% and 23%, respectively.

- We have pegged our stop loss level at RM2.70 (or an upside risk of 11%).

- Fundamentally, LATITUD reported a marginal net profit of RM0.3m in 4QFY20 (from a net loss of RM8.6m in 4QFY19), taking FY20’s net profit to RM16.7m (-14% YoY), as its wooden furniture business was disrupted by the restricted movement control orders arising from the Covid-19 pandemic

Source: Kenanga Research - 9 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments