Daily Technical Highlights - (CSCENIC, LEESK)

kiasutrader

Publish date: Thu, 10 Sep 2020, 09:16 AM

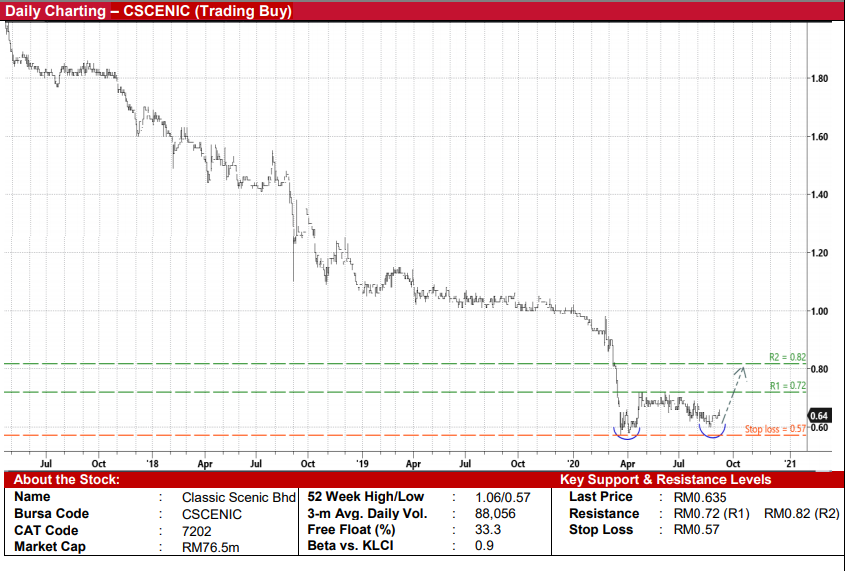

Classic Scenic Bhd (Trading Buy)

• CSCENIC shares may be due for a technical rebound after languishing near a multi-year trough since March this year.

• The stock saw price action recently when it started to move up from RM0.60 in the later part of August, probably making its way to test our first resistance target of RM0.72 (R1) initially before challenging our next resistance barrier of RM0.82 (R2).

• This represents upside potentials of 13% and 29%, respectively from yesterday’s closing price of RM0.635. • On the flip side, we have pegged our stop loss level at RM0.57 (or a downside risk of 10%).

• CSCENIC is in the business of manufacturing wooden picture frame mouldings and wooden pallets, which are mainly exported to North America, Australia, Europe and Japan.

• The Group has been profitable with annual net earnings ranging between RM6m and RM13m over the last five years. However, due to the Covid-19 led disruptions, it posted a marginal loss of RM0.5m in 2QFY20 (versus 2QFY19’s net profit of RM1.7m), dragging 1HFY20’s net profit to RM0.5m (1HFY19: net profit of RM3.7m).

• There is zero debt on its balance sheet, with cash holdings standing at RM15.2m (translating to 12.6 sen per share or onefifth of its existing share price) as of end-June this year.

• Given its strong financials, CSCENIC – which has historically paid out almost all of its annual earnings as dividends (ranging between 5 sen and 11 sen over the past five years) – is in a position to continue rewarding its shareholders. Even assuming an arbitrary DPS of 3 sen (down from FY19’s 5 sen), the stock still offers a prospective dividend yield of 4.7%.

Lee Swee Kiat Group Bhd (Trading Buy)

• LEESK shares staged a technical breakout from a downward sloping line in early June to plot a trend reversal pattern.

• Back then, the stock reached a high of RM0.62 before coming off subsequently to as low as RM0.44 in early September.

• A resumption of the uptrend may be in sight after its share price jumped to an intra-day high of RM0.535 amid increased trading activity on Tuesday.

• Riding on the positive momentum, the stock could climb to test our resistance thresholds of RM0.54 (R1) and RM0.62 (R2), which indicates upside potentials of 14% and 31%, respectively.

• We have set our stop loss level at RM0.42 (or 12% downside risk).

• LEESK is a manufacturer of natural latex mattresses and bedding accessories, with approximately 45% of its products exported.

• Over the past five years, the Group has reported annual net profit ranging between RM5m and RM10m. And despite the Covid19 triggered disruptions, it remained slightly profitable with net earnings of RM0.2m in 2QFY20 (versus 2QFY19’s net profit of RM1.6m), taking 1HFY20’s net profit to RM1.4m (-62% YoY).

• Financially sound, the Group was sitting on a net cash position of RM5.8m as of end-June 2020.

• LEESK also offers attractive dividend return of 5.3% based on yesterday’s closing price of RM0.475, assuming the Company maintains its DPS of 2.5 sen (which were the dividend quantum paid out in the last two years).

Source: Kenanga Research - 10 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024