Daily Technical Highlights - (YILAI, MUIPROP)

kiasutrader

Publish date: Tue, 15 Sep 2020, 01:07 PM

Yi-Lai Bhd (Trading Buy)

• YILAI shares may attract renewed buying interest as its new major shareholder (Au Yee Boon who is now the single biggest shareholder with a 13.9% stake) is seeking to jointly venture into IT solutions business (specialising in the field of blockchain and system integration services).

• The diversification strategy will hopefully turn around the Group, whose existing tiles manufacturing business has been lossmaking over the past three financial years.

• Financially strong with a debt-free balance sheet that is backed by cash holdings & unit trust investments of RM82.7m (or RM0.57 per share which represents almost two-thirds of its current share price of RM0.87) as of end-June, YILAI is wellpositioned to scout around for interesting business deals ahead.

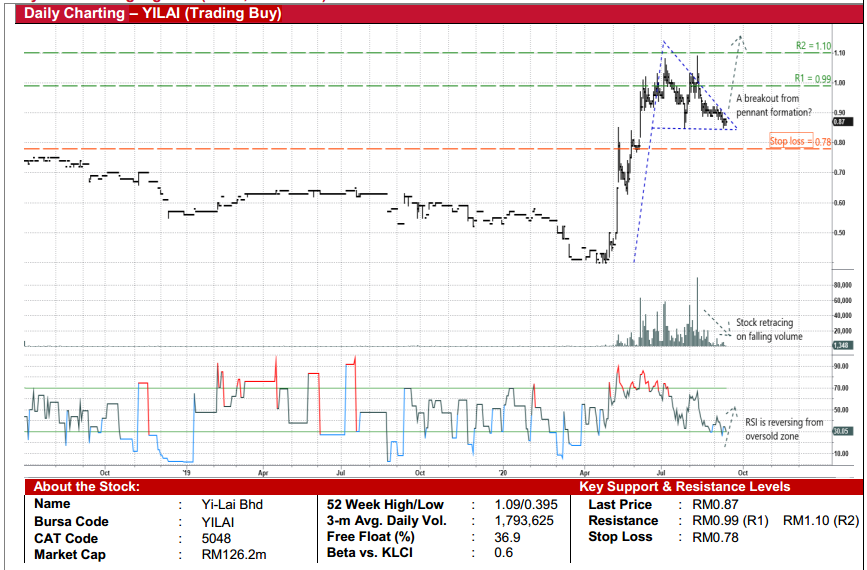

• From a charting perspective, after reaching a high of RM1.09 on 11 August, the stock has retraced to as low as RM0.85 last Thursday on declining trading volumes while its RSI is indicating that the share price is reversing out from an oversold territory.

• The appearance of a pennant formation, which is a bullish continuation pattern, also suggests the share price may ride on the positive momentum going forward.

• On the back of a probable technical breakout, YILAI shares could climb towards our resistance thresholds of RM0.99 (R1) and RM1.10 (R2). This translates to upside potentials of 14% and 26%, respectively.

• Our stop loss level is set at RM0.78 (or 10% downside risk).

MUI Properties Bhd (Trading Sell)

• The cessation of MUIPROP’s exposure in gold mining has prompted us to recommend a Trading Sell on the stock. Our previous Trading Buy call made on 28 July this year was on the premise of MUIPROP being a proxy to rising gold prices, which subsequently saw its share price soaring to as high as RM0.53 on 7 August. Its last traded price of RM0.25 remains above our previously set technical target price of RM0.24.

• This comes after the Company announced: (i) on 4 September that Nex Metals Explorations Ltd (Nex Metals) (a listed company in Australia which is involved in gold exploration) has failed to convene an EGM to seek its shareholders’ approval for MUIPROP’s conversion of AUD1.5m Secured Convertible Note issued by Nex Metals into ordinary shares, which otherwise would have resulted in MUIPROP owning a 40.7% stake in Nex Metals; and (ii) on 9 September that Nex Metals has fully settled the outstanding AUD1.5m Secured Convertible Note and accrued interest of AUD0.4m, thus effectively terminating its debt-to-equity conversion plan in Nex Metals.

• On the chart, a probable sell-off in MUIPROP could push the stock to hit RM0.20 initially (S1, the price level when we last recommended the stock) before testing RM0.17 (S2) thereafter. This represents downside potentials of 20% and 32%, respectively.

• We have pegged our stop loss level at RM0.29 (or an upside risk of 16%).

Source: Kenanga Research - 15 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024