Daily Technical Highlights - (AEMULUS, JCY)

kiasutrader

Publish date: Fri, 25 Sep 2020, 09:51 AM

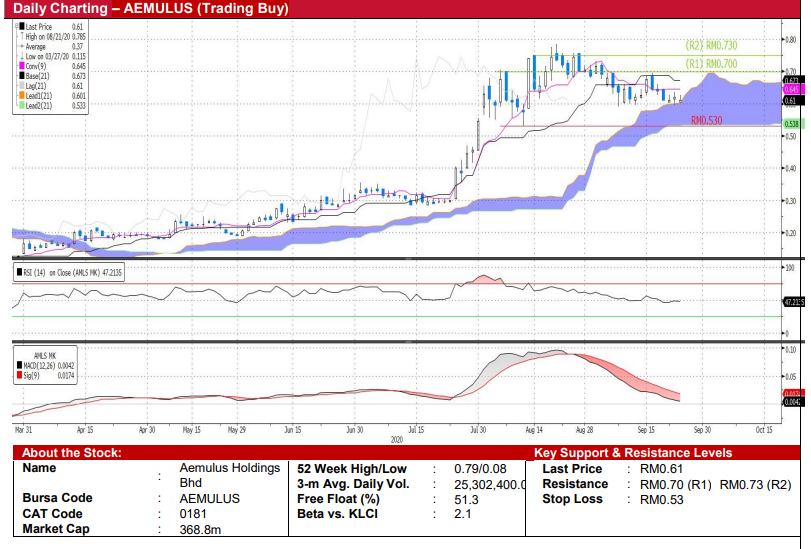

Aemulus Holdings Berhad (Trading Buy)

• AEMULUS is involved in the electronic tester segment and provides designing, assembling and consultancy services.

• The group is poised to benefit from the growth in the RF segment in 5G smartphones with its recently launched two new testers: (i) AE7300 that targets RF filters in the wireless devices, and (ii) AE5600 which is used in CMOS image services (CIS) for security and surveillance applications.

• In 3QFY20, the group’s revenue increased to RM5.1m (+88% QoQ) while turning in a net profit of RM87k after recording 5 consecutive quarters of losses. The better revenue and net income were backed by the maiden contributions from the AE5600 and AE7300 testers as aforementioned.

• Also, on 25th March 2020, the group had entered into a Joint Venture Agreement (“JVA”) with a China company (“Tangren Microintelligence”) to monetise its intellectual property (IP) in the radio-frequency tester market, while broadening its reach into the China market.

• Technically speaking, the stock has retraced from an all-time high of RM0.785 on 1st September to its current level. Ichimokuwise, we continue to see a bullish Kumo Cloud with a potential Kumo bounce from its current level, given the stock’s near oversold RSI indicator and potential bullish MACD crossover.

• Should the buying momentum resume, our overhead resistance levels are set at RM0.70 (R1, +15% potential upside) and RM0.73 (R2, +20% potential upside).

• Meanwhile, our stop loss is pegged at RM0.53 (or 13% downside risk).

JCY International Bhd (Trading Buy)

• JCY is in the business of manufacturing and trading of hard disk drive components. It currently has manufacturing facility located in South East Asia.

• The group is expected to benefit from the increasing number of data centres, given the accelerated digitalisation trend. Also, JCY’s prospects are tracking its two major customers (who account for c.80% of revenue), both of which are guiding for higher ramp-ups in 2H20 given their upcoming 16TB and 18TB drives demand.

• Consensus is currently projecting net income estimates of RM50.3m (+95%) in FY20E and RM151.0m (+200%) in FY21E. This translates to forward PERs of 29x and 10x, respectively.

• The stock has retraced from an all-time high of RM0.87 on 6 th August 2020. Since then, the stock has been charting higher lows along the way while forming a bullish pennant pattern.

• Should the buying interest resume, we expect the shares to trend higher and test its overhead resistance levels at RM0.78 (R1, +13% potential upside) and RM0.86 (R2, +25% potential upside).

• Meanwhile, our stop loss is pegged at RM0.61 (-12%, downside risk).

Source: Kenanga Research - 25 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024