Daily technical Highlights - (JTIASA, SKPRES)

kiasutrader

Publish date: Wed, 30 Sep 2020, 11:53 AM

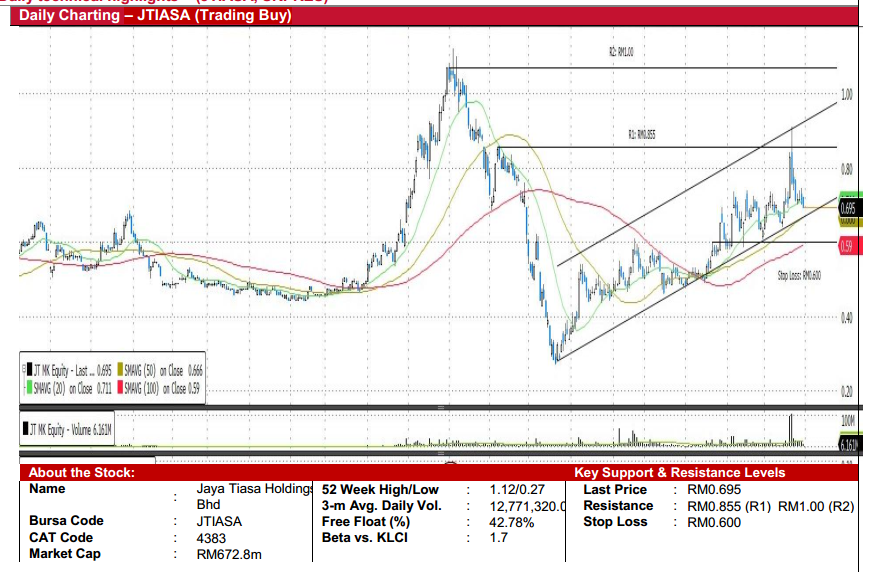

Jaya Tiasa Holdings Bhd (Trading Buy)

• JTIASA is principally involved in the oil palm plantation and crude palm oil milling business. Besides that, the group also manufactures and distributes a wide range of timber products such as round logs, plywood and rotary veneer.

• According to the latest consensus view, the Group is forecasted to make net profit of RM32.65m in FY June 2021 and RM48.55m in FY June 2022. This translates to forward PERs of 19x and 14x, respectively.

• For the latest FY20 results release, its core net earnings came in at RM28.2m (versus core net loss of RM263.4m in FY19) thanks to lower-than-expected production costs from its plantation segment and narrower losses from its timber division.

• Technically speaking, the stock has been on an uptrend in an ascending channel after bottoming out from the sell down in March. Notably, it is currently hovering near the bottom of the ascending channel, serving as an attractive entry level.

• That said, we reckon JTIASA shares may climb towards our resistance thresholds of RM0.855 (R1) and RM1.00 (R2). This represents upside potentials of 23% and 44%, respectively.

• Our stop loss level is pegged at RM0.600 (or 14% downside risk).

SKP Resources Bhd (Trading Buy)

• SKP Resources Bhd is an Electronics Manufacturing Services (EMS) provider, principally involved in the manufacturing of plastic components, precision mould making, advance secondary processes, sub-assembly of electronics equipment and full turn-key contract manufacturing.

• For the latest 1Q21 results release, the group reported a net profit of RM10m (+42% QoQ; -46% YoY). The YoY dip was mainly attributable to the shutdown of majority of its factory capacity due to the Movement Control Order (MCO).

• Fundamentally, the group could be due for sequential improvements ahead, premised on (i) ramp up in production with its key client reinstating orders back to pre-covid levels, as well as (ii) potential margin expansion from new models launches, the internalisation of PCBA supply, coupled with the end of gestation period for the battery pack assembly.

• According to the latest consensus view, the Group is forecasted to make net profit of RM121.0m in FY March 2021 and RM151.3m in FY March 2022. This translates to forward PERs of 19x and 16x, respectively.

• On the chart, the stock has been on a steady uptrend after the sell down in March, which sees it trending above all of its key SMAs.

• With its uptrend remaining intact coupled with a bullish MACD crossover, the bullish momentum could persist to test our resistance thresholds of RM2.10 (R1; 14% upside potential) and RM2.35 (R2; 27% upside potential) going forward.

• We have placed our stop loss level at RM1.60 (or 14% downside risk).

Source: Kenanga Research - 30 Sept 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024