Daily Technical Highlights - (ANCOMLB, PHARMA)

kiasutrader

Publish date: Fri, 02 Oct 2020, 09:13 AM

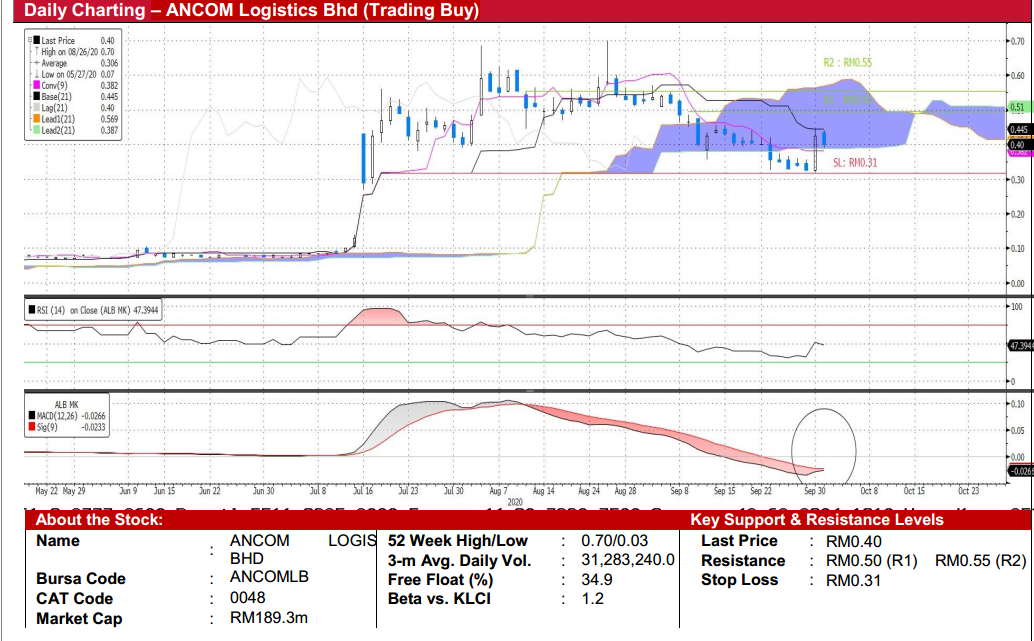

ANCOM Logistics Bhd (Trading Buy)

• ANCOMLB announced on 16th July that its holding company ANCOM had entered into an agreement with (i) S7 Holdings, (ii) Merrington Assets Limited, and (iii) MY E.G. Capital Sdn Bhd , which will allow S5 Systems Sdn Bhd (mainly owned by S7 Holdings) to perform a backdoor listing via ANCOMLB.

• Interestingly, S5 which has its expertise in the security and biometric registration, is said to be involved in all the major bids for the upcoming National Integrated Immigration System (NIIS), which is worth up to RM1.5b. Thus, the RTO is viewed positively for ANCOMLB.

• Chart-wise the stock has retraced from an all-time high of RM0.70 (26th of August 2020), to its current level, which is finding support near the “Kumo Bull Clouds”. We believe a trend reversal is in sight given the potential bullish MACD Crossover and uptick in RSI.

• Should the buying momentum resume, our overhead resistances are located at RM0.50 (R1: +25% upside potential) and RM0.55 (R2: +38% upside potential).

• Meanwhile our stop loss is pegged at RM0.31 (23% downside risk).

PHARMANIAGA Bhd (Trading Buy)

• PHARMA is involved in the (i) manufacturing of pharmaceutical medicine, (ii) logistics and distribution , and (iii) sales and marketing of medical products.

• The group is poised to benefit from the vaccine with its (i) well-integrated logistics and distribution network nationwide, and (ii) already existing Small Volume Injectable (SVI) plant located in Puchong which is suitable for the “fill and finish” of inactivated/kill vaccine.

• The stock has recently found support at its 50-Day SMA while forming a bullish “pennant” pattern after retracing from an alltime high of RM6.69 (on 25th August). Thus, should the buying interest persist, our overhead resistances are set at RM5.30 (R1:+13% upside potential) and RM5.60 (R2: +19% upside potential).

• Meanwhile our stop loss is pegged at RM4.20 (or 11% downside risk).

• Based on consensus estimates, the company is projected to turn from a loss to a net profit of RM70.2m in FY20E and RM71.6m (+2%, YoY) in FY21E. This translates to a forward PER of 17x in both years respectively.

Source: Kenanga Research - 2 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024