Daily Technical Highlights – (FRONTKN, MI)

kiasutrader

Publish date: Fri, 23 Oct 2020, 09:19 AM

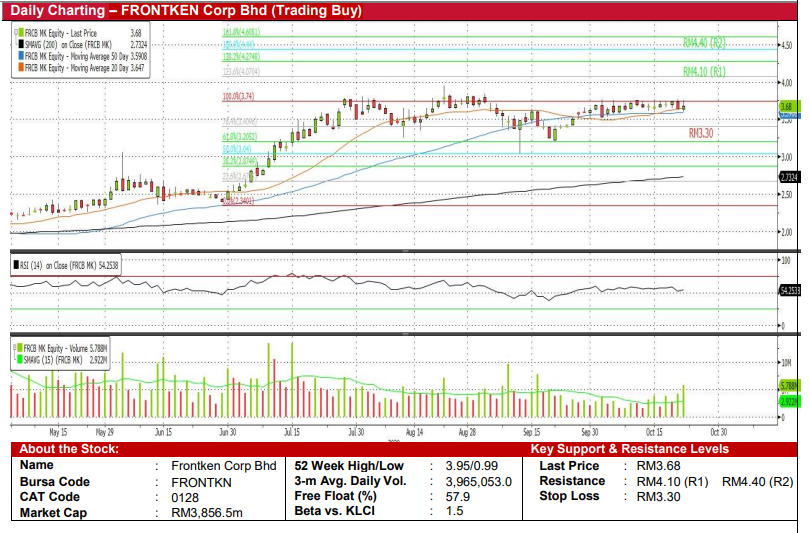

Frontken Corp Bhd (Trading Buy)

• FRONTKN is a company that provides surface treatment and precision cleaning for the thin film transistor liquid crystal display and semiconductor industries.

• With its major customer TSMC holding c.40% of the global semiconductor wafer foundries capacity, the group is poised to tag along and ride the global 5G rollout. In addition, TSMC has raised its 2020 revenue forecast by c.30%, as compared to its previous forecast of c.20%, as it sees higher orders coming in given the accelerated digitalisation trend.

• Given the aforementioned reason, the group experienced a record quarter in 2QFY20 with net income stood at RM20.3m (+19% QoQ). This has brought its 6MFY20 net income to RM37.3m (+17% YoY).

• Chart-wise, the stock has rebounded from its 50-day SMA in mid-September and continued to find support at its 20-day SMA. Given that the shorter-term key SMA continues to trend above the longer-term key SMA, we thus believe the uptrend shall persist.

• With that, our overhead resistance levels are positioned at RM4.10 (R1; +11% upside potential) and RM4.40 (R2; +20% upside potential).

• Meanwhile, our stop loss is pegged at RM3.30 (10% downside risk).

Mi Technovation Berhad (Trading Buy)

• MI is a company which is involved in the design, development, manufacturing and sale of wafer level chip scale packaging, sorting machines with inspection and testing capabilities.

• YoY, the group experienced an increase in its 6M20 revenue to RM97.1m (+28% YoY) while its bottom line improved to RM28.5m (+17% YoY). This was mainly due to: (i) higher orders given the capital investment from its customers located in the North East region; and (ii) the completion of both its manufacturing facility home 1 and home 2, which is poised to ride the 5G wave.

• The group has also entered into an MOU to acquire Accurus Scientific Co.Ltd.(Accurus) on 8th October 2020. Given Accurus’ principal activity is in the manufacturing of solder sphere (which are widely used for Advanced Packaging and Wafer Level Packaging), the move is viewed positively as it would allow MI to diversify into a wider product portfolio within the same distribution channel and value chain, thus enhancing its margins.

• The stock has continued to challenge its key resistance near the RM4.60 level in late-August and mid-October this year. On the back of the bullish “Kumo Cloud” indicator and the uptick in RSI, we thus believe the stock will continue its upward movement.

• Based on our Fibonacci projections, the stock is set to test our resistance levels at RM4.95 (R1; +12% upside potential) and RM5.15 (R2; +17% upside potential).

• Meanwhile, our stop loss is pegged at RM3.86 (or 13% downside risk).

Source: Kenanga Research - 23 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024