Daily technical highlights – (PESTECH, INSAS)

kiasutrader

Publish date: Thu, 05 Nov 2020, 09:57 AM

Pestech International Bhd (Trading Buy)

• A technical rebound could be on the cards for PESTECH’s share price, which has fallen to an oversold territory after sliding 48.5% YTD from RM1.31 in end-2019 to RM0.675 currently.

• The stock’s upward bias is predicted by our trading system, which is built on the RSI indicator to trigger buy signals when the RSI value crosses above the pre-set oversold level. Based on an exit rule of either a 9% profit or 10% stop loss (whichever comes first) from the trigger levels, the back-tested results showed that 13 of the 16 alerts generated by the trading system since 2015 were profitable trades (i.e. it has correctly predicted the ensuing share price gains of 9% or more), representing a hit rate of 81% (see chart).

• Therefore, the latest buy signals that appeared on 23 October and 3 November this year indicate that PESTECH shares could climb to at least RM0.75-RM0.78 going forward. On the chart, we have positioned our resistance thresholds at RM0.75 (R1; 11% upside potential) and RM0.81 (R2; 20% upside potential).

• Our stop loss price is set at RM0.61 (or 10% downside risk).

• On the fundamental front, PESTECH – which is involved in power transmission infrastructure, power generation & rail electrification, transmission assets and power products & embedded system software – is presently trading at undemanding forward PERs of 6.9x and 6.3x based on our research team’s net profit forecasts of RM75m in FY June 2021 and RM81m in FY June 2022, respectively

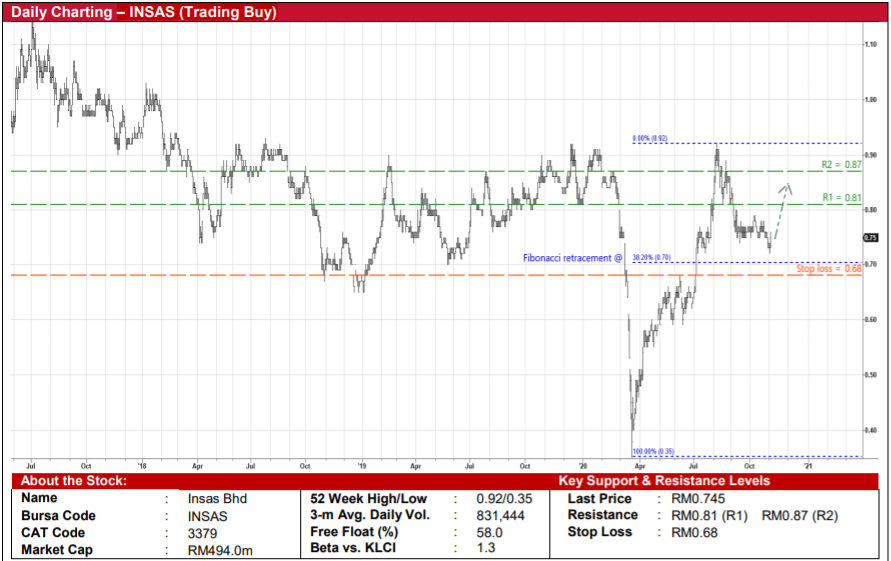

Insas Bhd (Trading Buy)

• INSAS’ share price has lagged the performance of 17%-owned semiconductor service provider Inari Amertron, which has extended its price rally by 50.3% since mid-2020 to RM2.54 currently.

• Noticeably, INSAS’ share of Inari Amertron’s existing market cap (17% of RM8,330.7m) works out to be RM1,416.2m currently, which is nearly tripled the former’s total market valuation of RM494.0m. In contrast, the market cap gap between the two companies previously stood at 2.2x back in July this year.

• The share price’s recent pullback towards an adjacent support line of RM0.70 (which is marked by the Fibonacci retracement level of 38.2%) represents a buying-on-weakness opportunity. It closed at RM0.745 yesterday.

• On the chart, the stock could play catch up to reach our resistance thresholds of RM0.81 (R1) and RM0.87 (R2). This translates to upside potentials of 9% and 17%, respectively. • Our stop loss price is set at RM0.68 (or 9% downside risk).

• Fundamentally, the stock – which also has exposure to the stock market activity (via its wholly-owned stockbroking company M&A Securities) – is currently trading at a PBV multiple of 0.28x (on its book value per share of RM2.64 as of end-June 2020) or 1SD below its 3-year historical mean.

Source: Kenanga Research - 5 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024