Daily technical highlights – (ELKDESA, EDGENTA)

kiasutrader

Publish date: Thu, 12 Nov 2020, 09:34 AM

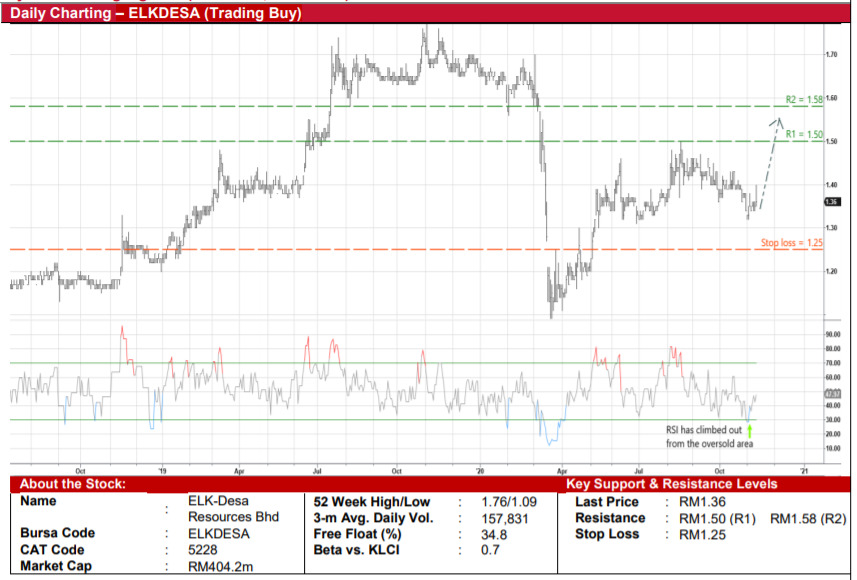

ELK-Desa Resources Bhd (Trading Buy)

• ELKDESA – a non-bank lender whose niche is in the hire purchase (HP) financing for used motor vehicles (as well as selling general insurance policies) – is a beneficiary of rising used car sales. According to media reports, used car sales jumped 25% YoY in July and 17% YoY in both August and September, taking the 3QCY20 sales to 112,400 units.

• The Group’s historical track record showed that its gross HP receivables has grown steadily at a CAGR of 23.1% from RM377.6m in FY16 to RM867.5m in FY20 while non-performing loans ratios stood at below 1.5% throughout the five years. As a result, its annual net profit has increased every year from RM18.8m in FY March 2016 to RM34.9m in FY March 2020.

• Nonetheless, for 1QFY21, the Group’s earnings of RM2.3m (-75% YoY) was dragged by business disruptions arising from the Covid-19 outbreak. This comes as ELKDESA would be focussing on credit risk management to protect the quality of its assets in the near term.

• On the chart, after sliding from a high of RM1.50 in mid-August to as low as RM1.32 at the beginning of November, a technical rebound could be on the horizon as the RSI indicator reverses from an oversold territory.

• That being the case, the stock is expected to climb towards our resistance levels of RM1.50 (R1; 10% upside potential) and RM1.58 (R2; 16% upside potential).

• Our stop loss level is pegged at RM1.25 (or 8% downside risk from its last traded price of RM1.36).

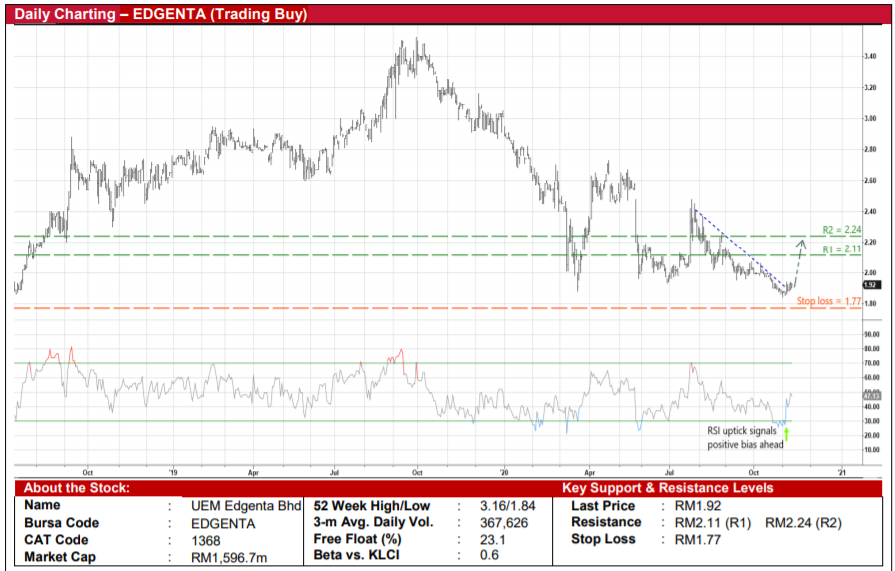

UEM Edgenta Bhd (Trading Buy)

• EDGENTA is principally involved in the provision of: (i) healthcare support (comprising both concession and commercial segments, serving over 300 hospitals in Malaysia, Singapore, Taiwan and India); (ii) property & facility solutions; (iii) infrastructure services; and (iv) asset consultancy.

• The Group’s 1HFY20 performance was hit by a one-off impairment of RM50m on unsold property inventories as well as Covid19-related disruptions, which resulted in a net loss of RM15.8m (compared with a net profit of RM67.0m in 1HFY19). Going forward, consensus is forecasting the Group to post net profits of RM95m in FY20 and RM145m in FY21, which translates to forward PERs of 17x and 11x, respectively.

• EDGENTA has been paying dividends (ranging between 7.0 sen and 31.0 sen per share) in the past five years. Consensus is projecting DPS of 8.6 sen for FY20 and 13.0 sen for FY21, which implies attractive dividend yields of 4.5%-6.8% based on yesterday’s closing price of RM1.92.

• Technically speaking, the stock has climbed out from an oversold position as reflected by its rising RSI value, suggesting that the share price is on the recovery after hitting a bottom recently.

• A probable technical rebound is expected to lift EDGENTA shares to challenge our resistance levels of RM2.11 (R1) and RM2.24 (R2). This represents upside potentials of 10% and 17%, respectively.

• We have set our stop loss price at RM1.77 (or 8% downside risk).

Source: Kenanga Research - 12 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024