Kenanga Research & Investment

Daily technical highlights – (SUNREIT, IGBREIT)

kiasutrader

Publish date: Wed, 18 Nov 2020, 11:00 AM

Sunway Real Estate Investment Trust (Trading Buy)

- Riding on a recovery theme, SUNREIT – with its diversified portfolio of assets comprising retail malls, hotels, offices, medical centre, education institution and industrial property – is expected to see a revival as economic activities pick up on the back of expectations that Covid-19 vaccines will be available sooner rather than later.

- Reflecting the adverse impact on the Group’s fundamentals following the recent resurgence of Covid-19 cases, the stock plummeted from a high of RM1.72 in mid-September to a 6½-year low of RM1.34 in early November this year (which was even below March’s lowest price level of RM1.50).

- SUNREIT’s share price has subsequently recovered from the trough to close at RM1.52 yesterday amid increased buying interest.

- With the momentum indicator (a measure of the velocity of price changes) triggering a buy signal after crossing above the zero line, the stock is expected to extend its upward trajectory going forward, probably climbing towards our resistance thresholds of RM1.69 (R1) and RM1.80 (R2). This translates to upside potentials of 11% and 18%, respectively.

- We have placed our stop loss price at RM1.39 (or 9% downside risk).

- In terms of fundamental valuations, SUNREIT shares are presently trading at prospective dividend yields of 5.1% and 5.6% based on consensus DPU projections of 7.7 sen for FY Jun 2021 and 8.5 sen for FY Jun 2022, respectively.

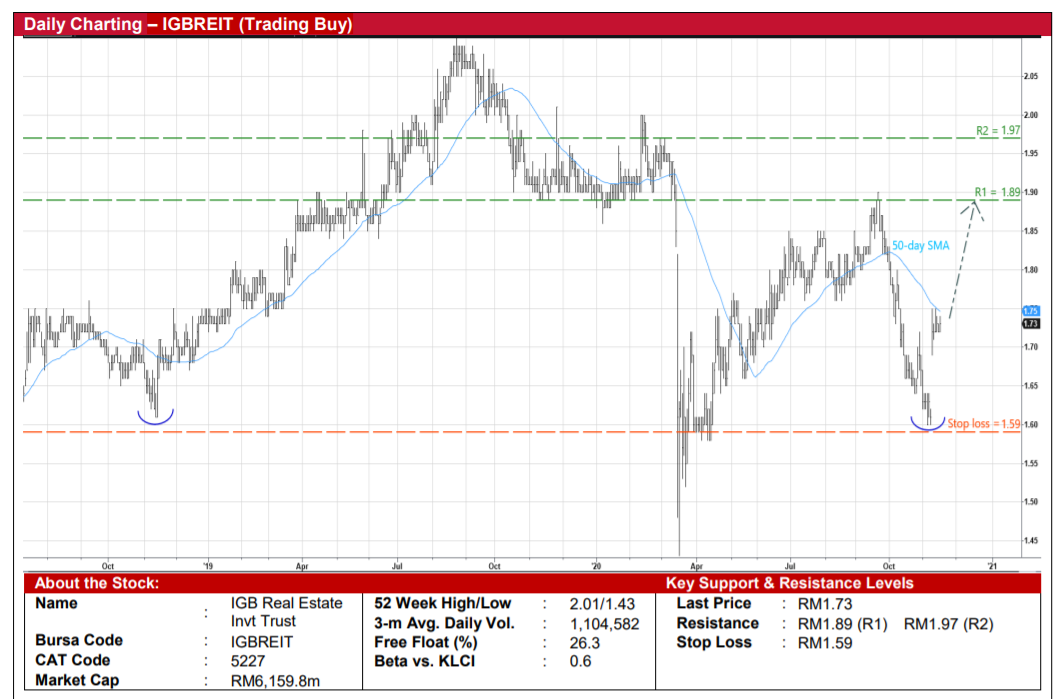

IGB Real Estate Investment Trust (Trading Buy)

- An economic recovery play, the worst may be over for IGBREIT – a retail-focussed REIT which owns two huge malls in the Klang Valley – amid hopes that vaccines to stop the Covid-19 virus spread will be made accessible in the near future.

- • IGBREIT shares were sold down in the wake of the recent surge of Covid-19 cases, sliding from a high of RM1.90 in the second half of September to as low as RM1.60 in early November. Since then, the stock has recovered partially to close at RM1.73 on high trading volume yesterday.

- With momentum on the way up, the share price will likely continue its journey by showing a positive bias ahead.

- A confirmation of the trend reversal may be forthcoming when the stock overcomes the 50-day SMA line (which is hovering only marginally above the share price now).

- In which case, this will then pave the way for the share price to climb towards our resistance levels of RM1.89 (R1; 9% upside potential) and RM1.97 (R2; 14% upside potential).

- Our stop loss price is pegged at RM1.59 (or 8% downside risk).

- From a fundamental valuation perspective, IGBREIT shares currently offer dividend yields of 3.6% and 4.9% based on consensus DPU forecasts of 6.3 sen for FY Dec 2020 and 8.5 sen for FY Dec 2021, respectively.

Source: Kenanga Research - 18 Nov 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

SUNREIT2024-11-21

SUNREIT2024-11-20

IGBREIT2024-11-20

SUNREIT2024-11-19

IGBREIT2024-11-19

IGBREIT2024-11-19

IGBREIT2024-11-19

SUNREIT2024-11-18

IGBREIT2024-11-18

SUNREIT2024-11-15

IGBREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-15

SUNREIT2024-11-14

IGBREIT2024-11-14

IGBREIT2024-11-14

SUNREIT2024-11-13

IGBREIT2024-11-13

SUNREIT2024-11-12

IGBREIT2024-11-12

IGBREITMore articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments