Daily technical highlights – (WONG, TECHBND)

kiasutrader

Publish date: Thu, 03 Dec 2020, 08:42 AM

Wong Engineering Corporation Bhd (Trading Buy)

• After slipping from a recent peak of RM1.07 in mid-October to as low as RM0.705 in early November this year, a technical rebound could be in store for WONG shares (which settled at RM0.735 yesterday).

• In essence, the stock’s uptrend remains intact as the share price is still hovering above: (a) the 50% Fibonacci retracement level (as measured from its mid-July’s trough to the mid-October’s peak) following the pullback; and (b) the 100-day SMA line.

• When the buying interest resumes, the stock is expected to continue its upward journey by climbing towards our resistance levels of RM0.81 (R1; 10% upside potential) and RM0.91 (R2; 24% upside potential).

• We have set our stop loss price at RM0.67 (or 9% downside risk).

• On the fundamental front, WONG – which is principally engaged in the manufacturing and sales of high precision stamped and turned metal parts & components – offers exposure to the E&E (electrical & electronics) industry. The Group is also involved in the trading of environmental and health products and construction & property development activities.

• The Group saw an earnings recovery to RM2.2m in 3QFY20 (versus net profit of RM1.1m in 3QFY19 and net loss of RM0.1m in 2QFY20), taking its bottomline to RM2.8m (+45% YoY) for the 9-month period ended July 2020.

• As of end-July this year, the Group’s net cash holdings stood at RM9.3m (or 8.4 sen per share).

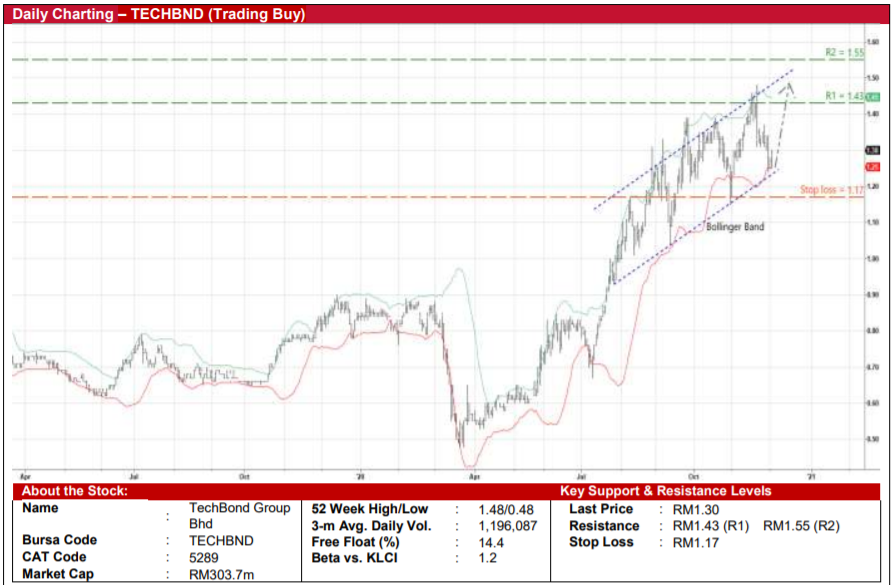

TechBond Group Bhd (Trading Buy)

• TECHBND’s share price will probably see more upside potentials than downside risks based on its technical outlook.

• With TECHBND shares currently striding at the: (a) lower range of its Bollinger Band; and (b) bottom part of an ascending price channel that stretches back to late-July this year, the stock is eager to extend its uptrend pattern ahead.

• A resumption of the upward momentum could then push the share price towards our resistance thresholds of RM1.43 (R1) and RM1.55 (R2). This represents upside potentials of 10% and 19%, respectively.

• Our stop loss level is pegged at RM1.17 (or 10% downside risk from its last close of RM1.30).

• In terms of business activities, TECHBND manufactures industrial adhesives (comprising water-based and hot melt adhesives which are mainly used for woodworking, paper & packaging and automotive applications) and industrial sealants (for building and construction applications).

• TECHBND registered net profit of RM10.7m (+52% YoY) in FY June 2020 and remained profitable in 1QFY21 with overall earnings coming in at RM2.5m (-7% YoY).

• Listed in December 2018, debt-free TECHBND is currently sitting on a cash pile of RM55.4m (or 23.7 sen per share) as of endSeptember this year whereby the Group plans to utilise the bulk of its listing proceeds for capex (RM27.2m) and working capital (RM7.4m) purposes.

Source: Kenanga Research - 3 Dec 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024