Weekly Technical Review - 07 December 2020

kiasutrader

Publish date: Mon, 07 Dec 2020, 10:29 AM

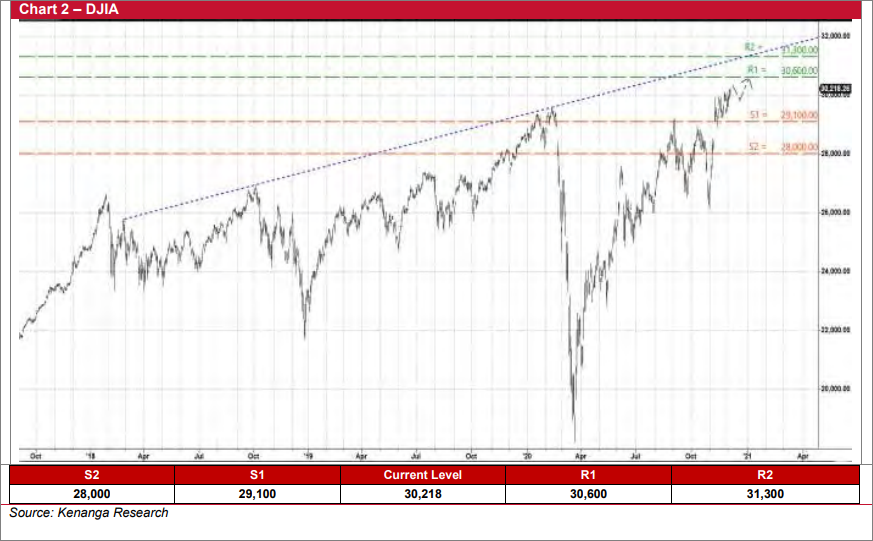

What a volatile week it has been as the stage is set for the rollercoaster ride to continue. The key FBMKLCI swung wildly last week, fluctuating from a trough of 1,563 on Monday before soaring as high as 1,629 last Friday. In the end, the benchmark index settled at 1,622 for a weekly gain of 14.3 points or 0.9%. Over on Wall Street, the DJIA climbed further to finish at its intraweek high of 30,218, up 307.9 points or 1.0% week-on-week.

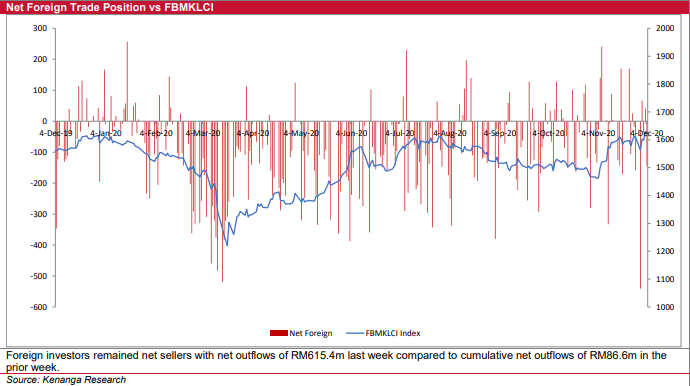

Trading interest was skewed towards the mid and big-caps on the local bourse during the week as daily average transaction volume and value rose to 10.8b shares (from 9.2b shares the week before) and RM6.3b (versus RM4.6b previously), respectively. By investor profile, domestic retail investors and local institutions were net buyers (amounting to RM443m and RM173m, respectively) for the week while foreigners posted net outflows of RM616m. With persistent foreign selling of Malaysian equities in all of the 11 months so far this year, this has led to aggregate net foreign outflows of RM24.5b year-todate till end-November.

For the week ahead, the routine macro data (namely the November plantation statistics due on Thursday and the October Industrial Production Index on Friday) aside, the spotlight will be on industry bellwether Top Glove Corporation’s earnings report card for the September to November 2020 quarter to be announced during lunch hour this Wednesday. Separately, it may also be worthy to keep an eye on investors’ reaction following last Friday evening’s Fitch Ratings downgrade of Malaysia's credit rating (for the Long-Term Foreign-Currency Issuer Default Rating to 'BBB+' from 'A-' with a stable outlook).

From a technical perspective, our stance is still that the FBMKLCI could stay elevated for the time being but remains vulnerable beyond the short-term. Of concern now is a potential bearish signal arising from the divergence between the RSI and the FBMKLCI, whereby the RSI recently plotted lower highs while the index (up 3.8% since end-November) has continued to chart new highs (see chart). Our major support and resistance thresholds for the FBMKLCI are kept at 1,600 (S1) / 1,550 (S2) and 1,645 (R1) / 1,675 (R2), respectively.

On Wall Street, the DJIA will probably show a positive bias to extend its upward journey ahead. We are maintaining our key support and resistance levels for the DJIA at 29,100 (S1) / 28,000 (S2) and 30,600 (R1) / 31,300 (R2), respectively.

Source: Kenanga Research - 7 Dec 2020

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024