Kenanga Research & Investment

Daily technical highlights – (ENGTEX, MASTEEL)

kiasutrader

Publish date: Wed, 27 Jan 2021, 11:03 AM

Engtex Group Bhd (Trading Buy)

- ENGTEX is principally involved in the: (i) manufacturing and sale of steel and ductile iron pipes and fittings, valves, welded wire mesh, hard-drawn wire and other steel-related products; and (ii) wholesale and distribution of pipes, valves, fittings, steel-related products and construction materials.

- After slipping into net loss of RM0.9m in FY Dec 19, the Group is on track to return to the black in FY20. Its bottomline came in at RM9.3m in 3QFY20 (versus 3QFY19’s net profit of RM1.1m and 2QFY20’s net loss of RM7.3m), which then brought YTD net earnings to RM4.4m (+101% YoY) in the nine-month period ended September 2020.

- In essence, the QoQ performance turnaround was mainly attributable to higher margins arising from better cost management of procurement of raw materials and operations for selected manufacturing plants.

- Technically speaking, a trend reversal will be underway should the stock convincingly overcome a multi-year downward sloping trendline that stretches back to May 2017.

- And given the bullish signal arising from the share price cutting above its 100-day SMA line, ENGTEX will likely continue its upward trajectory ahead.

- A resumption of the positive momentum is expected to lift the stock to challenge our resistance targets of RM0.65 (R1; 14% upside potential) and RM0.71 (R2; 25% upside potential).

- We have placed our stop loss price at RM0.51 (or 11% downside risk from its last traded price of RM0.57).

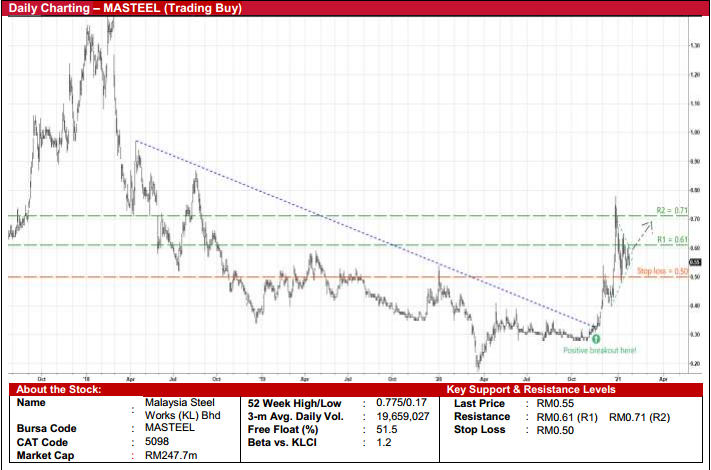

Malaysia Steel Works (KL) Bhd (Trading Buy)

- MASTEEL is principally involved in the production of steel billets and steel bars which are mostly used in the construction and infrastructure sectors.

- The Group turned around from net loss of RM22.5m in 2QFY20 to net profit of RM3.8m in 3QFY20 lifted by higher sales volume and selling prices amid the recovery of global steel demand, which translated to better margins. This narrowed its YTD loss to RM22.9m (versus net earnings of RM67.7m previously) in the nine-month period ended September 2020.

- Meanwhile, in December last year, MASTEEL announced a fund-raising exercise involving a proposed 1-for-2 rights issue with free detachable 5-year warrants (on the basis of 1 free warrant for each rights share subscribed). The estimated proceeds of RM81.5m would be used for working capital and debt repayment purposes.

- On the chart, the share price’s crossover of a descending trendline in November last year – which led to the subsequent plotting of higher highs and higher lows – suggests that the stock is currently riding an uptrend.

- A probable breakout from a symmetrical triangle formation could then push MASTEEL shares towards our resistance thresholds of RM0.61 (R1; 11% upside potential) and RM0.71 (R2; 29% upside potential).

- Our stop loss price is pegged at RM0.50 (representing 9% downside risk from yesterday’s close of RM0.55).

Source: Kenanga Research - 27 Jan 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024