Kenanga Research & Investment

Daily technical highlights – (AMBANK, ECONBHD )

kiasutrader

Publish date: Thu, 04 Feb 2021, 12:49 PM

AMMB Holdings Berhad (Trading Buy)

- AMBANK is principally involved in providing merchant and commercial banking, retail financing, stock and futures broking and investment advisory. As of FY20, 55% of its gross loans are from retail banking and 33% are from corporate banking with the balance coming from the other segments.

- The recent share price descend (which started in December 2020 and coincided with the implementation of MCO 2.0) offers an opportunity to accumulate the stock. Following the announcement of MCO 2.0’s extension (with no full economic lockdown as initially feared) on February 2nd, its share price jumped 4.5% to close at the intraday high.

- Moving forward, with net interest margin likely to be shielded by our in-house view of no further OPR reductions in the BNM’s March 2021 meeting, AMBANK is a proxy to an economic recovery theme.

- Meanwhile, consensus is expecting AMBANK’s BVPS to come in at RM6.36 in FY21 and RM6.70 for FY22, which translates to attractive PBV of 0.51x and 0.48x based on the current share price of RM3.24. These are both below its 2-year average PBV of 0.6x and 5-year average PBV of 0.7x.

- Technically speaking, following the recent slide, its share price has subsequently bounced off a support level of RM3.12. The large green candle that followed the large red candle shows strong price rejection around the support area.

- With the MACD line about to cross above the signal line, a breakaway could push AMBANK’s share price to challenge our resistance levels of RM3.62 (R1; 12% upside potential) and RM3.80 (R2; 17% upside potential).

- We have pegged our stop loss price at RM3.00 (7% downside risk).

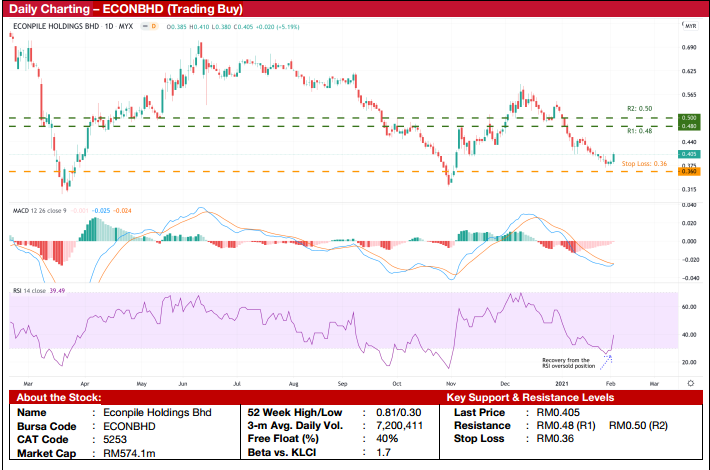

Econpile Holdings Bhd (Trading Buy)

- ECONBHD is a specialist foundation and civil engineering contractor in Malaysia. The Company’s services include foundation and geotechnical works, civil engineering works, structure works and design and build packages.

- The recent sell down in its share price was likely due to the implementation of MCO 2.0 amid fears of a derailed economic recovery. Still, we believe that the company is poised to benefit from the likelihood of the government’s revival of mega infrastructure projects to pump prime the economic recovery.

- Moving forward, consensus is expecting ECONBHD to make net profit of RM19.4m in FY20 and RM38.7m in FY21, which translates to forward PERs of 29.3x and 14.7x, respectively.

- Technically speaking, following the recent pullback, the stock has recovered from the RSI oversold position.

- The MACD histograms are also showing that any downward pressure on the price has been waning, with the MACD line on the verge of crossing above the signal line.

- Bouncing off the recent swing low of RM0.38, the share price could challenge our resistance targets of RM0.48 (R1; 19% upside potential) and RM0.50 (R2; 23% upside potential).

- We have pegged our stop loss at RM0.36 (11% downside risk).

Source: Kenanga Research - 4 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

AMBANK2024-11-22

ECONBHD2024-11-21

AMBANK2024-11-21

AMBANK2024-11-20

AMBANK2024-11-20

AMBANK2024-11-20

AMBANK2024-11-19

AMBANK2024-11-19

AMBANK2024-11-19

AMBANK2024-11-18

AMBANK2024-11-18

AMBANK2024-11-15

AMBANK2024-11-14

AMBANK2024-11-13

AMBANK2024-11-13

AMBANK2024-11-12

AMBANKMore articles on Kenanga Research & Investment

Actionable Technical Highlights - PRESS METAL ALUMINIUM HLDG BHD (PMETAL)

Created by kiasutrader | Nov 25, 2024

Actionable Technical Highlights - PETRONAS CHEMICALS GROUP BHD (PCHEM)

Created by kiasutrader | Nov 25, 2024

Weekly Technical Highlights – Dow Jones Industrial Average (DJIA)

Created by kiasutrader | Nov 25, 2024

Malaysia Consumer Price Index - Edge up 1.9% in October amid food price surge

Created by kiasutrader | Nov 25, 2024

Discussions

Be the first to like this. Showing 0 of 0 comments