Daily technical highlights – (NOTION, SALUTE)

kiasutrader

Publish date: Tue, 16 Feb 2021, 09:20 AM

Notion VTech Bhd (Trading Buy)

• NOTION is principally involved in the design and production of high precision metal components, which can be broadly segregated into 3 business divisions: (i) hard disk drive (HDD) for data centres and cloud computing; (ii) automotive (such as electronic braking system components); and (iii) engineered products, such as camera lens and Electronics Manufacturing Services (EMS) accessories. The Group has also diversified into the manufacturing of healthcare products (namely face masks and nitrile gloves).

• Interestingly, in its latest earnings announcement, NOTION mentioned that it has made inroads in the electric vehicles (EV) segment after the opening of a new business channel to supply extruded and machined aluminium parts to a contract manufacturer with the end customer being a globally known EV maker.

• For FY ended September 2020, the Group made net profit of RM6.3m (-16% YoY) while its balance sheet was backed by net cash of RM19.8m (or 3.8 sen per share).

• From a technical perspective, after overcoming a descending trendline recently, NOTION’s share price appears eager to plot higher highs ahead.

• And following yesterday’s 7.3% price jump on heavy volume, a resumption of buying interest may be forthcoming.

• With the momentum indicator cutting above zero and rising, the stock could find renewed strength to climb towards our resistance thresholds of RM1.11 (R1; 17% upside potential) and RM1.22 (R2; 28% upside potential).

• We have placed our stop loss price at RM0.81 (or 15% downside risk from yesterday’s closing price of RM0.95).

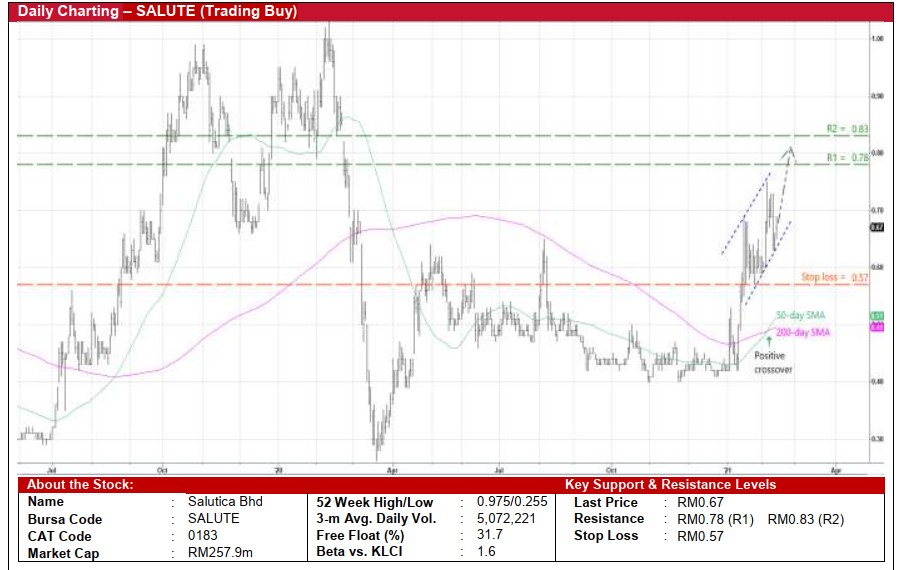

Salutica Bhd (Trading Buy)

• SALUTE is a manufacturer of Bluetooth wireless headsets and is also involved in the sale of computer peripherals products, tire pressure monitoring systems and other non-Bluetooth products such as smart home sensors/controllers, light guides and camera sub-parts.

• Despite posting a marginal loss of RM3.7m in 1Q ended September 2020 (mainly hit by lower margins), the Group has remained financially steady with its balance sheet backed by net cash holdings & short-term investments of RM42.1m (or 10.9 sen per share) as of end-September last year.

• On the chart, after bouncing up from a trough of RM0.42 in early January this year, the stock has plotted higher highs and higher lows along the way. Its ongoing pullback from a peak of RM0.75 at the beginning of this month to yesterday’s close of RM0.67 presents a buying opportunity for SALUTE shares.

• Following the crossing of the faster 50-day SMA line above the slower 200-day SMA line, its share price will likely see an upward bias in the near term.

• Riding on the positive momentum, the stock could be on its way to challenge our resistance targets of RM0.78 (R1) and RM0.83 (R2). This represents upside potentials of 16% and 24%, respectively.

• Our stop loss price is set at RM0.57 (or 15% downside risk).

Source: Kenanga Research - 16 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024

Created by kiasutrader | Nov 25, 2024