Daily technical highlights – (SCIB, MAGNI)

kiasutrader

Publish date: Wed, 10 Mar 2021, 09:28 AM

Sarawak Consolidated Industries Bhd (Trading Buy)

• SCIB is a company that sells precast concrete, pipes, prestressed spin concrete piles and other related concrete products.

• To sharpen its competitive edge, the group has embarked on three key strategies: (i) diversifying its geographical presence, (ii) strengthening its in-house construction capabilities, and (iii) exploring new supply chain technologies such as 3D printing.

• The group has achieved an orderbook replenishment of RM1.5b in FY20 and RM2.4b in FY21, which would underpin forward earnings visibility.

• YoY, the group’s FY20 revenue increased to RM516m (+500% YoY) lifted by regional contributions from its EPCC segment. Meanwhile, the group’s net income rose in tandem to RM52.2m (+1640% YoY) on the back of higher recognition from the completion of various construction projects.

• Chart-wise, the stock has retraced from its recent high of RM2.63 in early February this year to its current price of RM1.75. With the stock now finding support at its 100-day SMA while its RSI appears to be staging a recovery, we thus believe the stock could be heading for a rebound.

• With that, our resistance levels are set at RM1.95 (R1; +11% upside potential) and RM2.00 (R2; +14% upside potential).

• Meanwhile, our stop loss is set at RM1.56 (-11% downside risk).

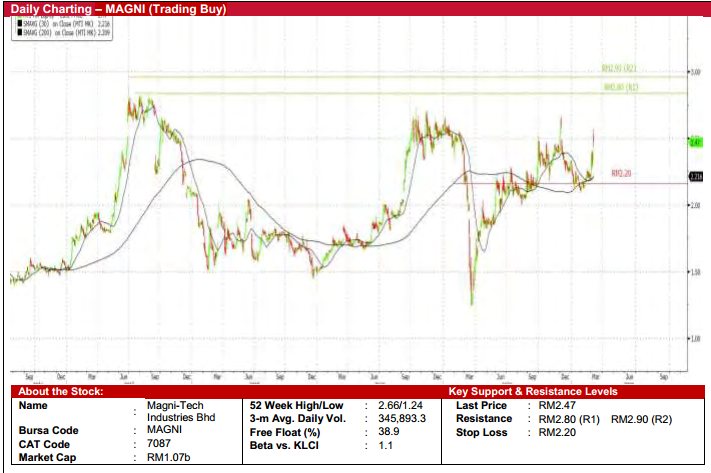

Magni-Tech Industries Berhad (Trading Buy)

• MAGNI is a company that is engaged in the manufacturing and sales of: (i) garments, and (ii) flexible plastic and corrugated packaging products.

• The group stands to benefit from its main customers’ success in driving their business to the online segment following the shift in consumer preference as a result of the Covid-19 pandemic. In addition, global demand for sportswear is expected to continue its upward trajectory as the economy recovers.

• Due to the aforementioned reasons, the group delivered a strong set of results with revenue rising to RM367.8m (+37% QoQ) in 3QFY21 thanks to better sales from the garment and packaging divisions. Meanwhile, its core net income (after stripping out the gain on disposal of properties) increased to RM42.1m (+102% QoQ) due to better operational efficiency and lower raw material costs in the packaging division.

• Chart-wise, after retracing since late December last year, the stock is in the midst of completing its mini-saucer pattern while its shorter-term key SMA continues to provide price support. With that, we expect the stock to maintain its upward momentum.

• Our key resistance levels are set at RM2.80 (R1; +13% upside potential) and RM2.90 (R2; +17% upside potential).

• Meanwhile, our stop loss is pegged at RM2.20 (-11% downside risk).

Source: Kenanga Research - 10 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024