Technical highlights - (BIOHLDG, BINTAI)

kiasutrader

Publish date: Tue, 16 Mar 2021, 10:01 AM

Bintai Kinden Corporation Bhd (Trading Buy)

• From a peak of RM0.395 in July last year, BIOHLDG shares subsequently pulled back and swung sideways for the past eight months. With the stock currently treading near the lower boundary of a rectangle formation, a share price bounce-up appears probable in the short-term.

• In essence, a technical rebound could be on the way as suggested by the following positive signs: (i) the Bollinger Band, which saw the share price crossing back above the lower band in recent days after moving below the lower band initially, (ii) the stochastic, as the %K line has just crossed above the %D line when both values were below the oversold level, and (iii) the emergence of the bullish dragonfly doji candlesticks.

• With that, we reckon the stock will likely climb towards our resistance thresholds of RM0.28 (R1; 17% upside potential) and RM0.32 (R2; 33% upside potential).

• We have pegged our stop loss price at RM0.20 (or 17% downside risk).

• In terms of recent corporate developments, BIOHLDG – which is principally involved in the manufacturing and sale of health supplement products – has expanded its business in January this year into the vaccination programme via: (i) an agreement with Shanghai Bukun Trading Co Ltd for the procurement and distribution of vaccines in Malaysia, including but not limited to the Covid-19 vaccine developed by Sinovac Biotech Co. Ltd, (ii) an MOU with Zuellig Pharma to facilitate the importation, warehousing and distribution of the Covid-19 vaccine in Malaysia, and (iii) an MOU with iHEAL Medical Services to work in collaboration to provide Covid-19 vaccination services to the public (whereby BIOHLDG would source for Covid-19 vaccine and iHEAL would administer the vaccine to the identified recipients).

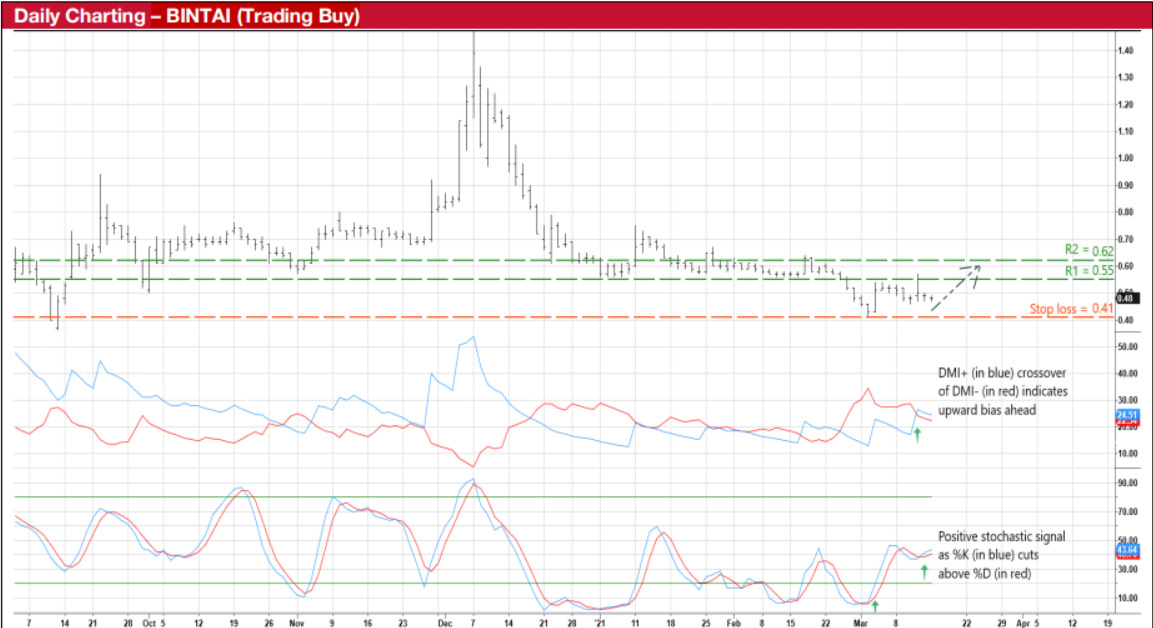

Bintai Kinden Corporation Bhd (Trading Buy)

• A technical rebound may be imminent for BINTAI’s share price following its 68% tumble from a high of RM1.47 in early December last year to close at RM0.475 yesterday.

• After finding support around RM0.41 recently, the stock is expected to head higher given the bullish signals of: (i) the DMI Plus crossing over DMI Minus, and (ii) the reversal of the stochastic indicator from an oversold territory with the %K line crossing above the %D line.

• As such, we reckon the share price will probably rise to challenge our resistance targets of RM0.55 (R1; 16% upside potential) and RM0.62 (R2; 31% upside potential).

• Our stop loss price is set at RM0.41 (or 14% downside risk).

• In terms of recent news flows, BINTAI – with businesses in mechanical & electrical engineering, construction, property development, concessionaire arrangement, civil & structural, turnkey & infrastructure project and project management – has entered into a distribution agreement in January this year with SLAB Asia Co. Ltd. from South Korea to appoint BINTAI as the exclusive distributor for Greenie Cold Chain Box (which is designed specifically to enable proper storage and distribution of vaccines, including Covid-19 vaccine) in Malaysia, Saudi Arabia and Philippines and non-exclusive distributor for other South East Asia countries

Source: Kenanga Research - 16 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024