Daily technical highlights – (LAGENDA, JFTECH)

kiasutrader

Publish date: Fri, 19 Mar 2021, 09:04 AM

Lagenda Properties Berhad (Trading Buy)

• LAGENDA is a property developer which targets the affordable housing segment.

• The group currently has two major township developments in Perak, namely Bandar Baru Setia Awan Perdana and Lagenda Teluk Intan. Moving forward, the group intends to launch its third and fourth township in Tapah and Sungai Petani, which are expected to contribute positively to its earnings in the medium-term.

• YoY, the group’s revenue has increased to RM498m (+334% YoY) in FY21, mainly contributed by the robust property sales in its two major townships in Perak. Meanwhile, its earnings has increased in tandem to RM103.3m (+1200% YoY).

• Chart-wise, the stock has continued to tread above its 50-day key SMA. With the shorter-term key SMA still hovering above the longer-term key SMA and the RSI indicator displaying signs of an uptick, we thus expect the bullish momentum to resume.

• With that, our resistance levels are set at RM1.75 (R1; +12% upside potential) and RM1.80 (R2; +15% upside potential).

• Our stop loss is pegged at RM1.40 (-10% downside risk).

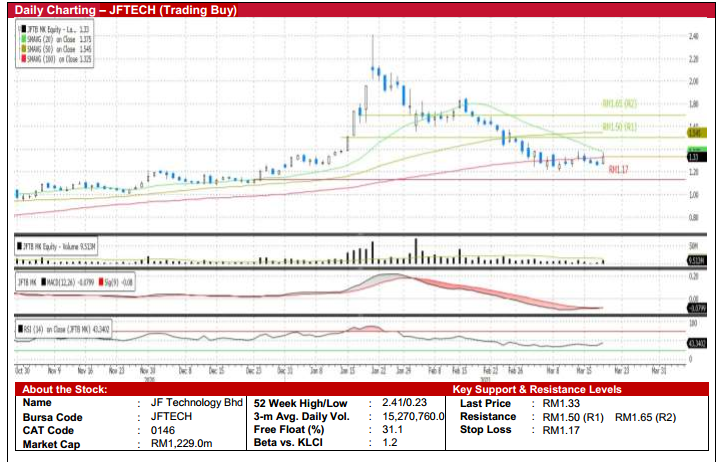

JF Technology Berhad (Trading Buy)

• JFTECH is a manufacturer of high-performance test contacting solutions for global integrated circuit (IC) makers.

• The group is currently working to move up the semiconductor value chain by providing a total turnkey test contacting, interfacing and test program engineering services to semiconductor companies globally. We view this positively as it is expected to enhance the group’s profit margins.

• Meanwhile, its partnership with Hubble Technology Investment Co Ltd to design, develop, manufacture and supply high performance test contactors in China is expected to deliver a new income stream to the group by 3QFY21.

• QoQ, the group’s 2QFY21 revenue increased marginally to RM9.4m (+3.2% QoQ) mainly due to projects completed from its key customers. Meanwhile, the group’s earnings remained relatively unchanged at RM4m during the quarter.

• Chart-wise, after retracing from an all-time high of RM2.406 on 21st January this year, the stock has recently found support near its 100-day SMA. With the RSI indicator breaking out from its near-term trendline, we thus believe the stock could be heading for a trend reversal.

• Our key resistance levels are set at RM1.50 (R1; +13% upside potential) and RM1.65 (R2; +24% upside potential).

• Meanwhile, our stop loss is pegged at RM1.17 (-12% downside risk).

Source: Kenanga Research - 19 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024