Daily Technical Highlights – (SYSCORP, PWROOT)

kiasutrader

Publish date: Tue, 30 Mar 2021, 09:52 AM

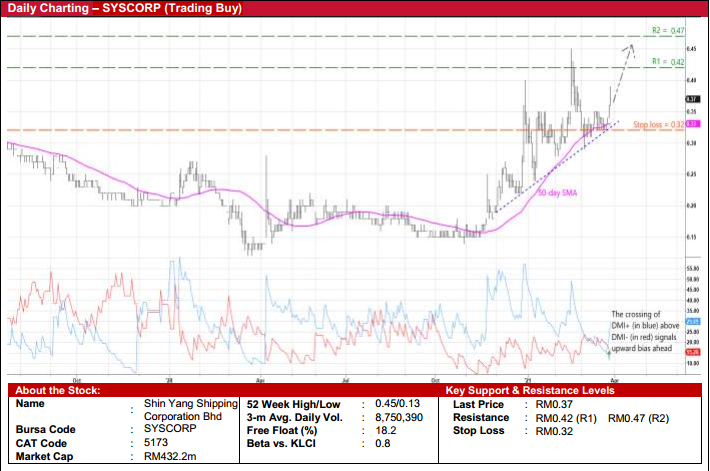

Shin Yang Shipping Corporation Bhd (Trading Buy)

• SYSCORP’s core businesses are shipping, shipbuilding, ship repair and forwarding agency. Its shipping operations cover dry bulk, liquid bulk, containers and coastal, barges and tug and international shipping segments, which are supported by a fleet of 240 vessels with gross revenue tonnage (GRT) of approximately 376,500 tonnages.

• For 2QFY21 ended December 2020, the Group posted net profit of RM3.5m (versus 2QFY20’s net loss of RM23.2m), bringing 1HFY21’s earnings to RM6.5m (compared with 1HFY20’s net loss of RM37.0m) as both the shipping and shipbuilding divisions returned to the black.

• From a charting perspective, the stock has been plotting higher highs and higher lows since mid-November last year. Following a recent bounce-off from the 50-day SMA line, we reckon SYSCORP shares are poised to extend the ascending price pattern.

• A further bullish technical sign has emerged when the DMI Plus crossed over the DMI Minus last Friday.

• Thus, a resumption of buying momentum in the stock – which saw a surge in trading interest over the past two trading days – could then lift the share price to challenge our resistance targets of RM0.42 (R1) and RM0.47 (R2). This translates to upside potentials of 14% and 27%, respectively.

• On the other hand, we have set our stop loss price at RM0.32 (or 14% downside risk).

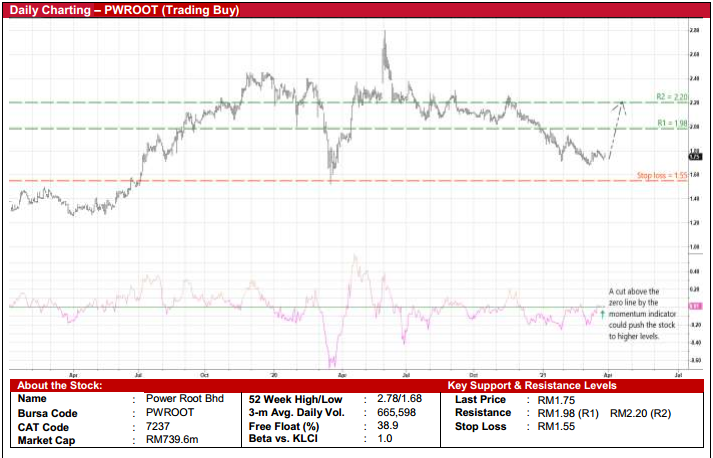

Power Root Bhd (Trading Buy)

• PWROOT is in the beverage business specialising in staple drinks such as coffee, tea, chocolate malt drinks and herbal energy drinks.

• The Group registered net profit of RM26.2m (-32% YoY) in the nine-month period ended December 2020 as its performance came in weaker due to poorer sales (as well as the booking of reversal of impairment loss on trade receivables (RM6.2m) in the previous corresponding period).

• Going forward, consensus is forecasting PWROOT to make net earnings of RM36.9m in FY March 2021 and RM48.3m in FY March 2022, which translates to forward PERs of 20.0x this year and 15.3x next year, respectively.

• With a healthy balance sheet that is backed by net cash holdings of RM89.2m (or 21.1 sen per share) as of end-December last year, the Group is in a position to reward its shareholders with dividend incomes. Based on consensus DPS estimates of 8.6 sen for FY21 and 10.8 sen for FY22, the stock offers attractive prospective dividend yields of 4.9% and 6.2%, respectively.

• On the chart, after slipping from a recent high of RM2.26 in mid-November last year to as low as RM1.68 earlier this month (which is not too far from the March 2020’s trough of RM1.51), PWROOT’s share price may see a technical rebound ahead.

• This comes as the momentum indicator is on the verge of crossing above the zero line with a follow-up increase likely to lift the stock towards our resistance thresholds of RM1.98 (R1; 13% upside potential) and RM2.20 (R2; 26% upside potential).

• Our stop loss price is pegged at RM1.55 (or 11% downside risk from the last traded price of RM1.75).

Source: Kenanga Research - 30 Mar 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

PWROOT2024-11-22

PWROOT2024-11-22

PWROOT2024-11-22

PWROOT2024-11-22

SYGROUP2024-11-21

SYGROUP2024-11-20

SYGROUP2024-11-18

PWROOT2024-11-18

SYGROUP2024-11-18

SYGROUP2024-11-15

PWROOT2024-11-15

SYGROUP2024-11-14

PWROOT2024-11-14

SYGROUP2024-11-13

PWROOT2024-11-13

SYGROUP2024-11-12

PWROOT2024-11-12

SYGROUP2024-11-12

SYGROUPMore articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024