Daily Technical Highlights – (OPCOM, OCK)

kiasutrader

Publish date: Tue, 20 Apr 2021, 09:20 AM

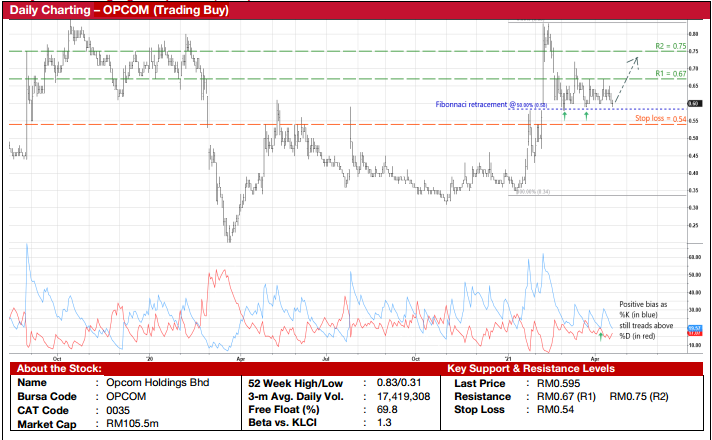

Opcom Holdings Bhd (Trading Buy)

• OPCOM is principally involved in the manufacturing of fibre optic cables and thixotropic gel, as well as the provision of engineering services (mainly for cable installation works).

• The Group is a potential beneficiary of an anticipated increase in demand for fibre optic cables in Malaysia in view of the government’s implementation of JENDELA (the country’s national digital infrastructure plan to provide greater digital connectivity and better quality of broadband experience) and the impending rollout of 5G networks by the telecommunications service industry.

• Whilst OPCOM posted a narrower net loss of RM1.5m in the 9-month period ended December 2020 (versus net loss of RM2.0m in the previous corresponding period), the Group is financially steady with zero debt and cash holdings of RM20.3m (or 11.4 sen per share) as of end of last year. It has also recently completed a private placement exercise (which has raised cash proceeds of RM9.3m) involving the issuance of 16.1m new shares at RM0.575 apiece.

• On the chart, after sliding from a peak of RM0.83 in mid-February this year, the stock has subsequently bounced off the Fibonacci 50% retracement level of RM0.58 (as measured from a trough of RM0.34 in January this year to the high of RM0.83), suggesting that the share price has hit a bottom already. If so, then the existing price of RM0.595 represents a timely entry level for investors to bottom-fish the shares.

• And with the DMI Plus still treading above the DMI Minus following a recent crossover, the positive signal will probably lead OPCOM shares to stage a technical rebound and challenge our resistance targets of RM0.67 (R1; 13% upside potential) and RM0.75 (R2; 26% upside potential) ahead.

• We have pegged our stop loss price at RM0.54 (or 9% downside risk).

OCK Group Bhd (Trading Buy)

• OCK is a proxy to the imminent 5G networks rollout by the telecommunication industry. The Group is in the telecommunication tower business with an existing portfolio of more than 4,200 towers in Malaysia, Myanmar and Vietnam. Its other businesses are in: (i) trading of telco & network products; (ii) green energy & power solutions; and (iii) M&E engineering services.

• After registering net profit of RM25.6m (-9% YoY) in FY December 2020, consensus is projecting the Group to make higher net profit of RM30.6m for FY21 and RM31.8m for FY22. This translates to forward PERs of 17.1x this year and 16.4x next year, respectively.

• From a technical perspective, the stock has plotted higher lows after bouncing up from a low of RM0.385 in the beginning of November last year. The share price is currently hovering somewhere in the middle of an upward sloping price channel with immediate downside support provided by the 50-day SMA line.

• And with the momentum indicator treading above zero and increasing, OCK shares are in a position to shift higher ahead, probably climbing towards our resistance thresholds of RM0.56 (R1; 13% upside potential) and RM0.61 (R2; 23% upside potential).

• Our stop loss price is set at RM0.44 (or 11% downside risk from the last traded price of RM0.495).

Source: Kenanga Research - 20 Apr 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024