Daily Technical Highlights – (PRLEXUS, EDGENTA)

kiasutrader

Publish date: Tue, 04 May 2021, 09:15 AM

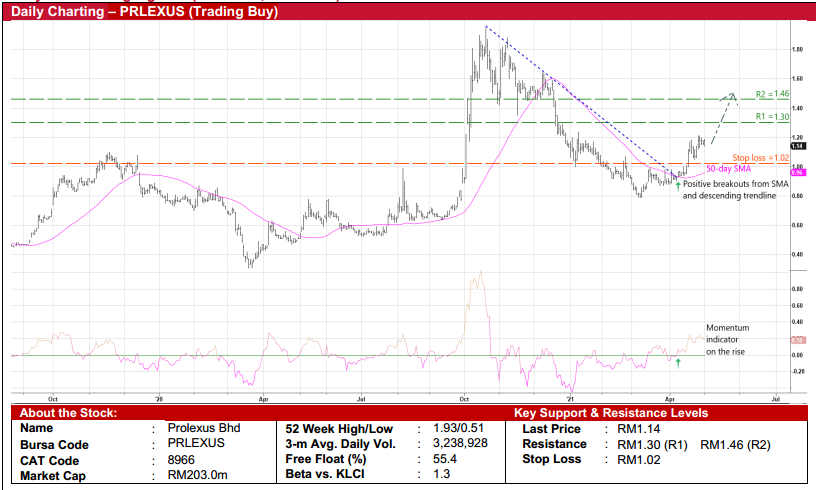

Prolexus Bhd (Trading Buy)

• PRLEXUS shares – which have tumbled from a high of RM1.93 in October last year – are in the midst of staging a technical rebound.

• The stock is expected to chart higher highs following the simultaneous price crossovers of a descending trendline and the 50- day SMA line recently.

• With the momentum indicator still rising after cutting above the zero line, the share price could advance towards our resistance thresholds of RM1.30 (R1) and RM1.46 (R2), which represent upside potentials of 14% and 28%, respectively.

• We have set our stop loss price at RM1.02 (or 11% downside risk from the last traded price of RM1.14).

• In terms of earnings review, PRLEXUS – which is in the business of manufacturing sportswear apparels and reusable fabric face masks – reported net profit of RM8.8m in the quarter ended January 2021 (versus 2QFY20’s net loss of RM0.2m and 1QFY21’s net profit of RM15.2m). This lifted first half earnings to RM24.1m (+1,285% YoY), which has already surpassed its FY July 2020’s net profit of RM17.6m.

• The group is also financially sound with net cash holdings of RM34.6m (translating to 19.4 sen per share) as of end-January 2021.

• In addition, PRLEXUS has recently announced a 1-for-2 bonus issue exercise, which would enhance the trading liquidity and marketability of its shares going forward.

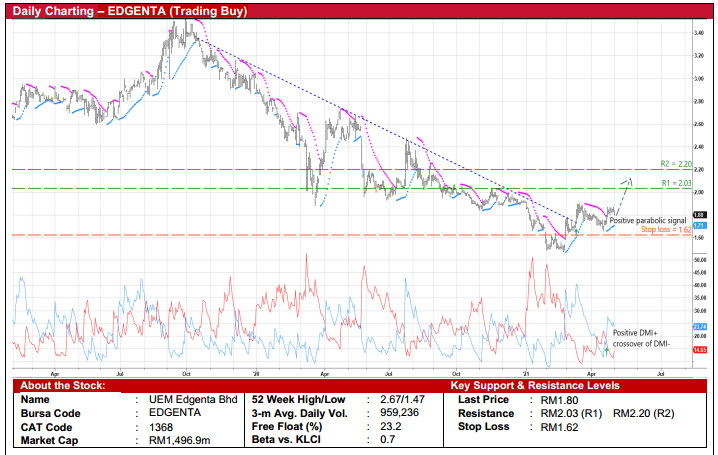

UEM Edgenta Bhd (Trading Buy)

• EDGENTA’s share price might have bottomed already when it bounced up from a trough of RM1.47 in late February this year to overcome a negative sloping trendline that stretches back to mid-October 2019.

• Following which, the stock is expected to ride on an upward momentum as indicated by the parabolic signal and the DMI Plus crossover of DMI Minus.

• With that, the shares will probably advance towards our resistance targets of RM2.03 (R1; 13% upside potential) and RM2.20 (R2; 22% upside potential).

• Our stop loss price is pegged at RM1.62 (representing a downside risk of 10%).

• Fundamentally, EDGENTA’s core business activities are in the provision of: (i) healthcare support (comprising both concession and commercial segments, serving over 300 hospitals in Malaysia, Singapore, Taiwan and India), (ii) property & facility solutions, (iii) infrastructure services (covering expressways and rails), and (iv) asset consultancy.

• After registering net profit of RM13.5m (-93% YoY) in FY December 2020, consensus is forecasting the group’s bottomline to rebound to RM97m in FY21 and RM130m in FY22, which translate to forward PERs of 15.4x and 11.5x, respectively.

• The stock currently offers attractive dividend yields of 4.9%-8.9% based on consensus DPS expectations of 8.9 sen for FY21 and 16.0 sen for FY22, respectively.

• EDGENTA’s ability to pay dividends is also supported by its balance sheet strength that is backed by net cash holdings & shortterm investments amounting to RM206.1m (or 24.8 sen per share) as of end-December last year.

Source: Kenanga Research - 4 May 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 28, 2024