Daily technical highlights – (INSAS, YTLPOWR)

kiasutrader

Publish date: Tue, 03 Aug 2021, 09:17 AM

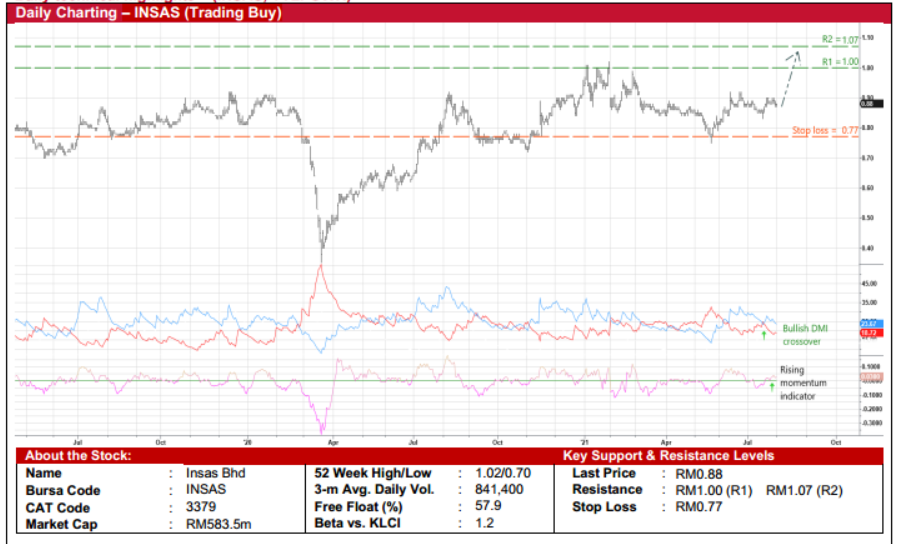

Insas Bhd (Trading Buy)

• As an indirect technology play – via its 14.4% stake in semiconductor service provider Inari Amertron (whose share price hasrisen 26.8% YTD) – INSAS shares (down 6.4% YTD) could play catch up ahead.

• Noticeably too, INSAS’ share of Inari Amertron’s existing market cap (14.4% of RM12.88b) stands at RM1.85b presently,which is slightly more than tripled its own current market valuation of RM583.5m.

• The group also has exposure to the stock market activity (via its wholly-owned stockbroking company M&A Securities) withother businesses in investment holding & trading, retail trading & car rental and property investment & development.

• For the 9-month period ended March 2021, INSAS reported net profit of RM217.3m (from net loss of RM2.4m previously),lifted by a combination of robust operating earnings and exceptional gains from financial assets.

• Valuation-wise, the stock is currently trading at a PBV multiple of 0.30x (based on its book value per share of RM2.96 as ofend-March 2021), which is near its 3-year historical mean.

• On the chart, the stock could attempt to exit an ongoing consolidation pattern following the DMI Plus crossover of the DMIMinus signal and the rising momentum indicator above the zero line.

• Riding on the renewed strength, INSAS’ share price will probably climb to test our immediate resistance target of RM1.00 (R1;14% upside potential). A break above R1 may then lift the stock towards our next resistance threshold of RM1.07 (R2; 22%upside potential).

• We have pegged our stop loss price at RM0.77 (or 12% downside risk).

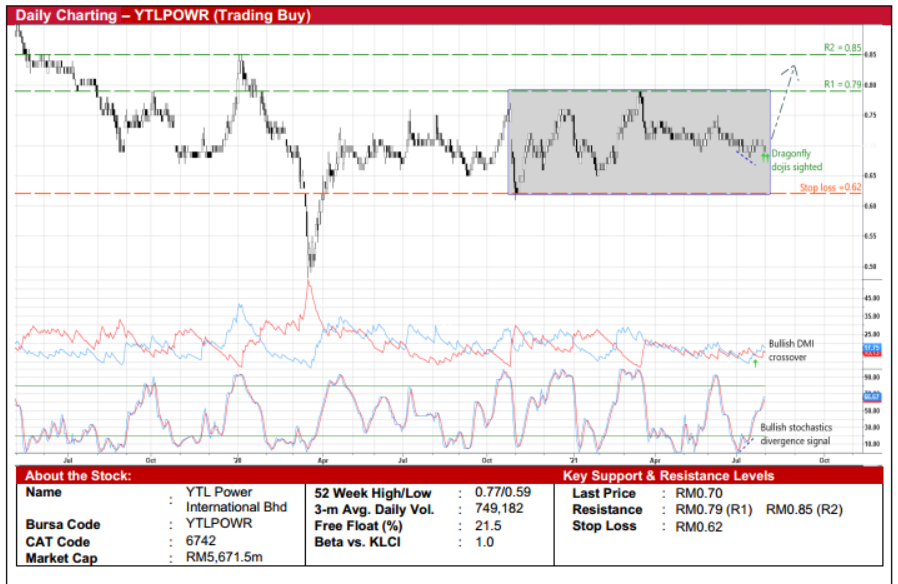

YTL Power International Bhd (Trading Buy)

• After gyrating inside a rectangle box since October last year, YTLPOWR shares could attempt to break out from theconsolidation pattern riding on positive technical momentum.

• On the chart, the stock is expected to plot an upward bias ahead following: (i) the appearance of stochastics divergencepattern (with the %D line forming two rising bottoms in the oversold area while the share price drifted lower), (ii) the DMI Pluscrossing above the DMI Minus, and (iii) the sighting of the bullish dragonfly doji candlesticks in the last two days.

• An anticipated price breakout will likely propel the stock towards our resistance thresholds of RM0.79 (R1; 13% upsidepotential) and RM0.85 (R2; 21% upside potential).

• Our stop loss price is set at RM0.62 (or 11% downside risk from the last traded price of RM0.70).

• From a fundamental viewpoint, as an international multi-utility group (with diversified businesses in power generation, water& sewerage and telecommunications spread across Malaysia, Singapore, the United Kingdom, Indonesia, Australia andJordan), YTLPOWR is in an advantageous position to weather through the ongoing local business disruptions arising from theCovid-19 triggered movement restrictions.

• Reflecting its earnings resilience, the group saw a net profit jump of 65% YoY to RM343.6m for the 9-month period endedMarch 2021 as its bottomline was lifted mainly by stronger contributions from its electricity sales unit in Singapore andnarrower losses from the telecommunications operation.

• Going forward, consensus is forecasting YTLPOWR to register net earnings of RM438.0m for FY June 2021 and RM464.0mfor FY June 2022. This translates to forward PERs of 12.9x this year and 12.2x next year, respectively.

• The stock also offers attractive prospective dividend yield of 6.0% based on consensus FY22 DPS forecast of 4.2 sen.

Source: Kenanga Research - 3 Aug 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Kenanga Research & Investment

Created by kiasutrader | Nov 22, 2024